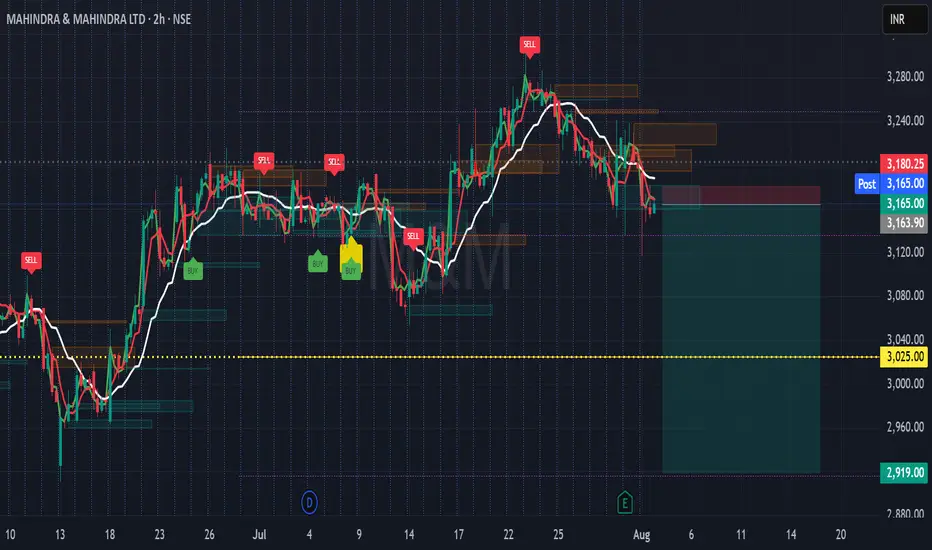

This 2H chart on Mahindra & Mahindra Ltd. reflects a structure-aware short opportunity, based on price rejection from a key resistance zone and alignment with Leola Lens SignalPro logic.

🔎 Technical Structure Highlights:

🔴 SELL signal confirmed as price failed to sustain above recent supply clusters.

🟤 Multiple rejection blocks visible near ₹3,180 — now acting as resistance.

⚪ Price broke below the adaptive white base trendline, turning it into overhead pressure.

🟡 Prior yellow caution marker (trend shift risk) proved meaningful as momentum faded.

🟥 Defined invalidation level above ₹3,180.25.

🟢 Bearish targets align with previous demand zones near ₹3,025 and ₹2,919.

📌 Context Note:

Trend has shifted from congestion to downside acceleration. A clean break of recent structure suggests caution for longs. Watch for volatility around upcoming earnings.

📚 This is a technical case study — for educational use only.

Always trade with risk controls and your own judgment.

#M&M #Mahindra #NSEStocks #PriceAction #ShortSetup #StructureTrading #TechnicalAnalysis #SignalPro

🔎 Technical Structure Highlights:

🔴 SELL signal confirmed as price failed to sustain above recent supply clusters.

🟤 Multiple rejection blocks visible near ₹3,180 — now acting as resistance.

⚪ Price broke below the adaptive white base trendline, turning it into overhead pressure.

🟡 Prior yellow caution marker (trend shift risk) proved meaningful as momentum faded.

🟥 Defined invalidation level above ₹3,180.25.

🟢 Bearish targets align with previous demand zones near ₹3,025 and ₹2,919.

📌 Context Note:

Trend has shifted from congestion to downside acceleration. A clean break of recent structure suggests caution for longs. Watch for volatility around upcoming earnings.

📚 This is a technical case study — for educational use only.

Always trade with risk controls and your own judgment.

#M&M #Mahindra #NSEStocks #PriceAction #ShortSetup #StructureTrading #TechnicalAnalysis #SignalPro

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.