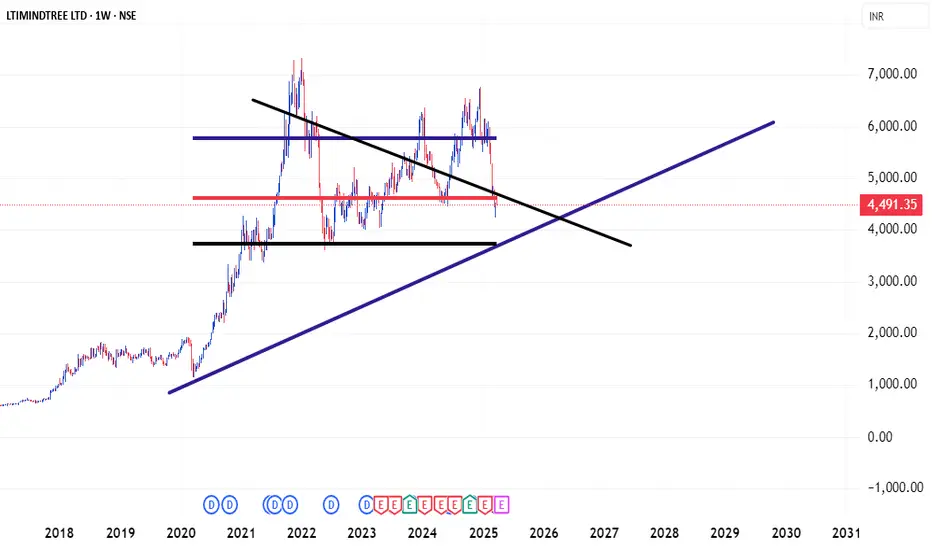

LTIM On Volume Profile And How To Use In Trading & Investing Journey

Volume Profile is a **technical analysis tool** that shows the **traded volume** of an asset at different price levels over a specific period. Unlike traditional volume indicators (which display volume over time), Volume Profile helps traders understand **where the most buying and selling activity occurred at different price levels**.

### **Key Components of Volume Profile:**

1. **Point of Control (POC):**

- The price level where the highest volume of trades occurred.

- Acts as a strong support or resistance level.

2. **Value Area (VA):**

- The price range where **70% of the total volume** was traded.

- Consists of:

- **Value Area High (VAH):** Upper boundary of the value area (resistance).

- **Value Area Low (VAL):** Lower boundary of the value area (support).

3. **High Volume Nodes (HVN):**

- Areas with high trading activity.

- Indicates strong interest and potential price stability.

4. **Low Volume Nodes (LVN):**

- Areas with little trading activity.

- Suggests price levels where the market moved quickly without much consolidation.

### **Why Use Volume Profile?**

- **Identifies strong support and resistance levels.**

- **Finds areas of high liquidity (POC) where price tends to consolidate.**

- **Spot breakouts and reversals by analyzing volume distribution.**

- **Helps traders make informed entry and exit decisions.**

### **How to Use Volume Profile in Trading?**

1. **Trend Confirmation:** If price moves above the POC with strong volume, it suggests an uptrend. If it moves below, a downtrend.

2. **Breakout Trading:** A breakout above VAH or below VAL with strong volume can indicate trend continuation.

3. **Reversal Signals:** If price moves to LVN, it might reverse as there is low liquidity in that zone.

Volume Profile is a **technical analysis tool** that shows the **traded volume** of an asset at different price levels over a specific period. Unlike traditional volume indicators (which display volume over time), Volume Profile helps traders understand **where the most buying and selling activity occurred at different price levels**.

### **Key Components of Volume Profile:**

1. **Point of Control (POC):**

- The price level where the highest volume of trades occurred.

- Acts as a strong support or resistance level.

2. **Value Area (VA):**

- The price range where **70% of the total volume** was traded.

- Consists of:

- **Value Area High (VAH):** Upper boundary of the value area (resistance).

- **Value Area Low (VAL):** Lower boundary of the value area (support).

3. **High Volume Nodes (HVN):**

- Areas with high trading activity.

- Indicates strong interest and potential price stability.

4. **Low Volume Nodes (LVN):**

- Areas with little trading activity.

- Suggests price levels where the market moved quickly without much consolidation.

### **Why Use Volume Profile?**

- **Identifies strong support and resistance levels.**

- **Finds areas of high liquidity (POC) where price tends to consolidate.**

- **Spot breakouts and reversals by analyzing volume distribution.**

- **Helps traders make informed entry and exit decisions.**

### **How to Use Volume Profile in Trading?**

1. **Trend Confirmation:** If price moves above the POC with strong volume, it suggests an uptrend. If it moves below, a downtrend.

2. **Breakout Trading:** A breakout above VAH or below VAL with strong volume can indicate trend continuation.

3. **Reversal Signals:** If price moves to LVN, it might reverse as there is low liquidity in that zone.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.