Reasoning

- The stock has corrected significantly (from its highs) and is seen by some analysts to be forming technical reversal signs.

- A support zone around ₹1,178 is considered strong; it has held recently after pulling back.

- A breakout above ₹1,420 is seen as critical by some for pushing toward higher targets.

- On the fundamentals side, KPIT is seen as well-positioned in the automotive / mobility / electric / AI / embedded software space, which is expected to drive growth.

- Margins, revenue growth near term are mixed: in latest quarter, revenue grew ~12-13% YoY, but net profit was down due to factors like currency fluctuations.

Risk Factors / What Could Go Wrong - Failing to break above critical resistance levels (e.g. ~₹1,420) could lead to renewed downside pressure.

- If macro / global automotive demand weakens, or input costs (salary, software, etc.) rise sharply, margin compression is possible.

- Currency volatility already showed some impact.

- Execution risk: Integration of new technologies (EV, connected/autonomous, AI) requires investment; delays or competition may hurt.

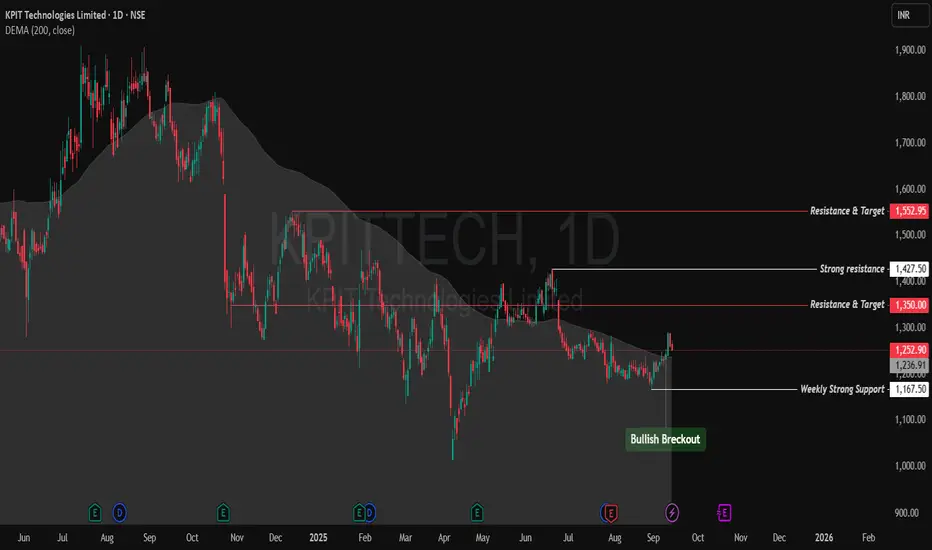

KPITTECH Technical Projection

Key Levels - Immediate Support: ₹1,180-₹1,200 (recent strong base; multiple analysts highlighted ~₹1,178 as key).

- Secondary Support: ₹1,100 (if correction deepens).

- Immediate Resistance: ₹1,350 (short-term hurdle).

- Major Resistance: ₹1,420 (critical breakout zone; above this, big momentum expected).

- Medium-term Target Resistance: ₹1,500-₹1,550.

1. Bullish Case (most likely, if sustains above ₹1,200 & breaks ₹1,420): - Short term (2-4 weeks): ₹1,350-₹1,400

- Medium term (2-3 months): ₹1,500-₹1,550

- Long term (6-12 months): ₹1,600-₹1,650+ (aligns with high analyst targets)

2. Neutral / Range-bound: - If price trades between ₹1,200 and ₹1,350, it may consolidate before the next breakout.

- Swing traders can buy near support and book profit near ₹1,350.

3. Bearish Case (if closes below ₹1,180): - Downside to ₹1,100-₹1,120 is possible.

- Break below ₹1,100 could extend correction toward ₹1,050.

Trading Approach - Entry Zone: ₹1,220-₹1,250 (if it sustains above ₹1,200 support).

- Stop-Loss (SL): ₹1,175 (below major support).

- Target (Short term): ₹1,350, then trail SL to ₹1,250 for higher targets.

- Risk/Reward: ~1:2 or better if played for ₹1,500+

Disclaimer:lnkd.in/gJJDnvn2

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.