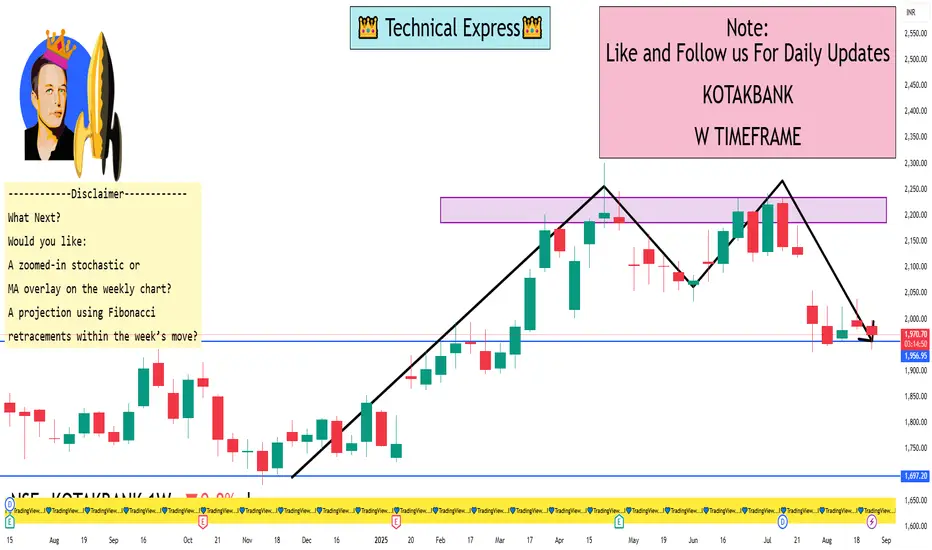

Weekly Technical Levels & Analysis

Pivot-Based Levels (from TopStockResearch)

Weekly Support Zones (Standard pivots):

S1: ₹1,964.87

S2: ₹1,943.13

S3: ₹1,906.07

Weekly Resistance Zones:

R1: ₹2,001.93

R2: ₹2,060.73

R3: ₹2,082.47

These pivot levels often act as short-term barriers and support and can help anticipate price behavior within the current weekly range.

Elliott Wave Analysis (from FXStreet)

The stock appears to be beginning Wave 3 in an Elliott Wave count—typically the strongest impulse phase.

The invalidating level for this bullish count is pegged at ₹1,681. As long as the price stays above this, the bullish structure remains valid.

This suggests strong upward potential in the medium term.

Pivot-Based Levels (from TopStockResearch)

Weekly Support Zones (Standard pivots):

S1: ₹1,964.87

S2: ₹1,943.13

S3: ₹1,906.07

Weekly Resistance Zones:

R1: ₹2,001.93

R2: ₹2,060.73

R3: ₹2,082.47

These pivot levels often act as short-term barriers and support and can help anticipate price behavior within the current weekly range.

Elliott Wave Analysis (from FXStreet)

The stock appears to be beginning Wave 3 in an Elliott Wave count—typically the strongest impulse phase.

The invalidating level for this bullish count is pegged at ₹1,681. As long as the price stays above this, the bullish structure remains valid.

This suggests strong upward potential in the medium term.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.