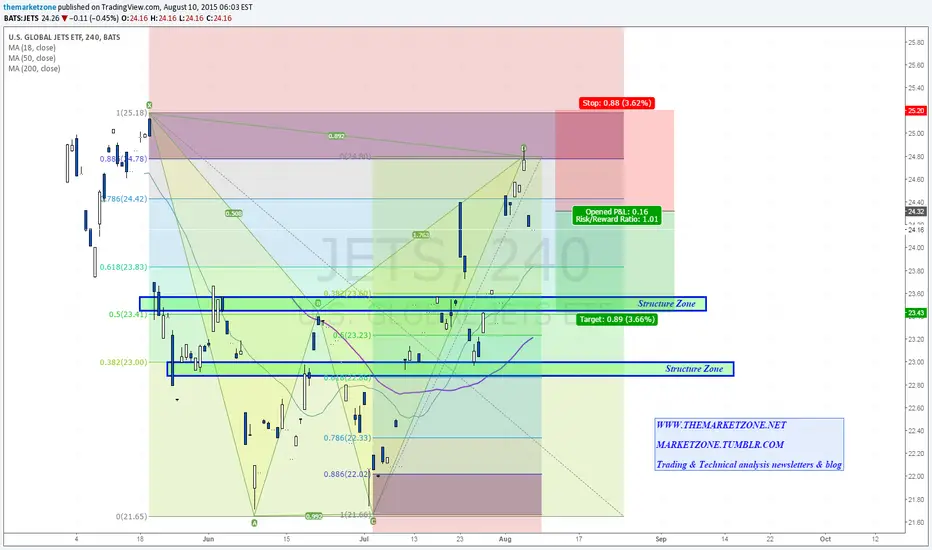

With the drop in oil prices,  JETS, the new ETF that holds airline companies like Delta (

JETS, the new ETF that holds airline companies like Delta ( DAL), American Airlines (

DAL), American Airlines ( AAL) and southwest airlines company (

AAL) and southwest airlines company ( LUV) had a very nice rally during the month of July.

LUV) had a very nice rally during the month of July.

The ETF rallied all the way up to the 88.6 Fib level to complete a bearish Bat pattern and declined from there.

ETF rallied all the way up to the 88.6 Fib level to complete a bearish Bat pattern and declined from there.

The pattern's targets are 23.5$ and 23$ which also come with daily support zones.

The current price level offer about 1:1 R/R ration for the short position with stop loss above X and 23.5$ as initial target zone.

This might work with the bullish scenario I posted earlier for oil

The

The pattern's targets are 23.5$ and 23$ which also come with daily support zones.

The current price level offer about 1:1 R/R ration for the short position with stop loss above X and 23.5$ as initial target zone.

This might work with the bullish scenario I posted earlier for oil

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.