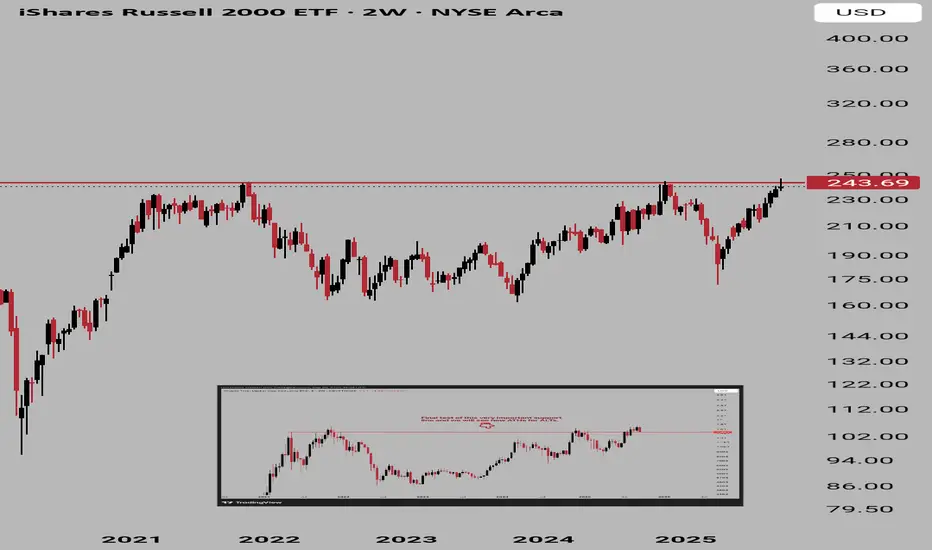

Risk-on vs risk-off assets → Both small-cap stocks (IWM) and altcoins (TOTAL2) are considered high-beta, speculative assets. They respond more aggressively to shifts in liquidity, interest rates, and risk appetite.

Liquidity sensitivity → When liquidity is abundant, both IWM and TOTAL2 rally harder than their large-cap counterparts (S&P 500 / Bitcoin). When liquidity tightens, they sell off harder too.

Market breadth / speculative phase → IWM is a gauge of U.S. market breadth (how smaller companies are doing), while TOTAL2 reflects risk-taking beyond Bitcoin. Both act as “speculative barometers.”

Macro correlation → In tightening cycles (higher rates, strong dollar), both tend to lag. In easing/liquidity cycles, they outperform and move almost in lockstep.

Liquidity sensitivity → When liquidity is abundant, both IWM and TOTAL2 rally harder than their large-cap counterparts (S&P 500 / Bitcoin). When liquidity tightens, they sell off harder too.

Market breadth / speculative phase → IWM is a gauge of U.S. market breadth (how smaller companies are doing), while TOTAL2 reflects risk-taking beyond Bitcoin. Both act as “speculative barometers.”

Macro correlation → In tightening cycles (higher rates, strong dollar), both tend to lag. In easing/liquidity cycles, they outperform and move almost in lockstep.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.