Chart Overview

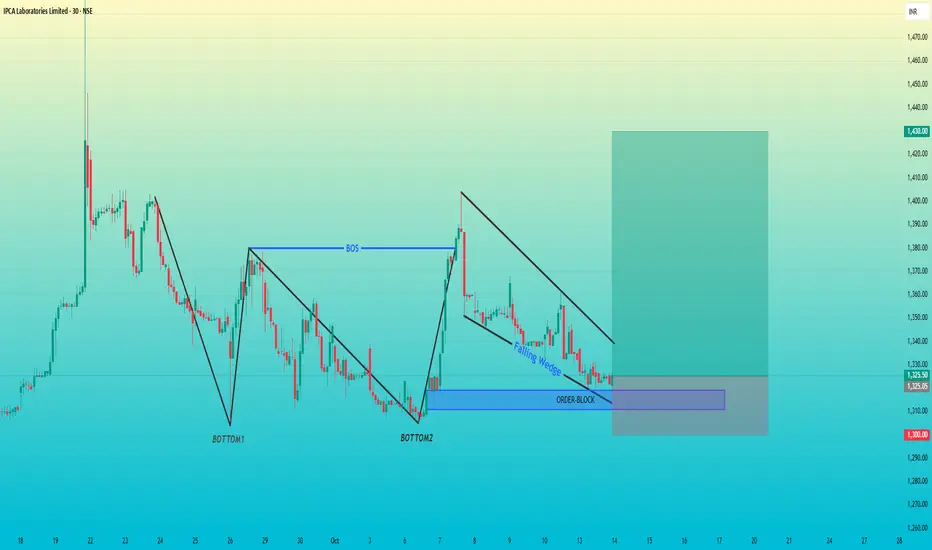

Pattern: Falling Wedge inside a confirmed bullish structure

Structure Break: BOS (Break of Structure) already confirmed

Key Levels:

Order Block Zone: Around ₹1300–₹1310

Current Price: ₹1325

Target Zone: ₹1430

Stop-Loss: Below ₹1300

Technical Breakdown

1. Double Bottom

The formation of Bottom1 and Bottom2 shows a strong demand base.

The BOS (Break of Structure) after Bottom2 confirms that buyers took control.

2. Falling Wedge Pattern

After the BOS, the price is consolidating in a Falling Wedge, which is typically a bullish continuation pattern.

Price respecting the wedge boundaries suggests compression — a breakout to the upside can trigger momentum.

3. Order Block Zone

The blue rectangular area marks a bullish order block from the last strong bullish rally.

Price has retraced back into this OB, creating an ideal entry point if bullish rejection appears.

4. Trade Setup

Entry: Near ₹1320–₹1325

Stop-Loss: Below ₹1300 (OB invalidation)

Target: ₹1430

RR Ratio: ≈ 1:4

Pattern: Falling Wedge inside a confirmed bullish structure

Structure Break: BOS (Break of Structure) already confirmed

Key Levels:

Order Block Zone: Around ₹1300–₹1310

Current Price: ₹1325

Target Zone: ₹1430

Stop-Loss: Below ₹1300

Technical Breakdown

1. Double Bottom

The formation of Bottom1 and Bottom2 shows a strong demand base.

The BOS (Break of Structure) after Bottom2 confirms that buyers took control.

2. Falling Wedge Pattern

After the BOS, the price is consolidating in a Falling Wedge, which is typically a bullish continuation pattern.

Price respecting the wedge boundaries suggests compression — a breakout to the upside can trigger momentum.

3. Order Block Zone

The blue rectangular area marks a bullish order block from the last strong bullish rally.

Price has retraced back into this OB, creating an ideal entry point if bullish rejection appears.

4. Trade Setup

Entry: Near ₹1320–₹1325

Stop-Loss: Below ₹1300 (OB invalidation)

Target: ₹1430

RR Ratio: ≈ 1:4

거래청산: 스탑 닿음

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.