📊 Current snapshot

Last quoted price: approx ₹540.75 (as of 11 Nov 2025).

1-week return: ~ +0.09%.

52-week high / low: ~ ₹559.75 / ~ ₹279.80.

🔍 1-Week level view

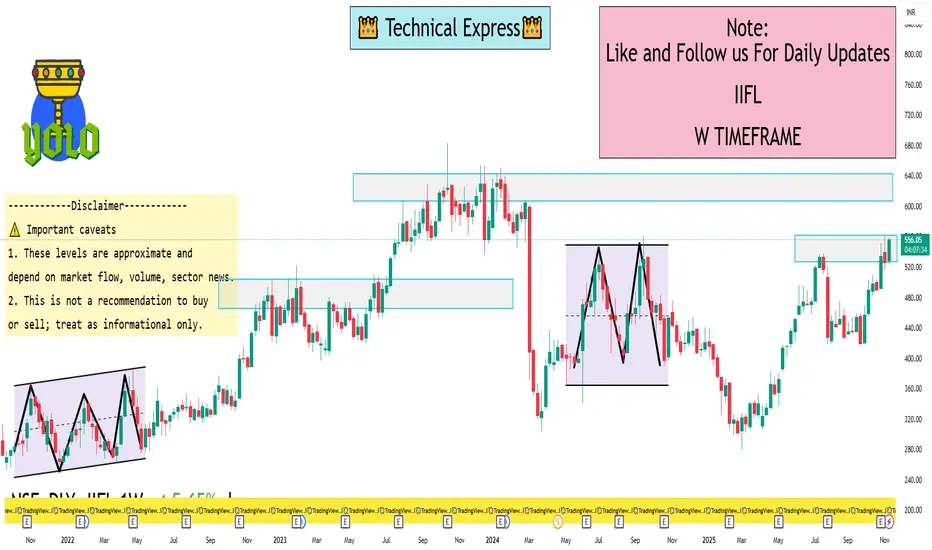

Given the current price and recent behaviour, here are some approximate support/resistance zones for the coming week:

Support zone: around ₹ 520-530. (if price dips, this may be an area where buyers step in)

Resistance zone: around ₹ 555-560. (near the recent high end of the range)

Neutral range: ~₹ 530-550 — staying in this band if no strong momentum emerges.

Upside breakout scenario: if it convincingly breaks above ~₹ 560, the next target may be ~₹ 570-580.

Downside break scenario: if it falls below ~₹ 520, it could test ~₹ 500 or lower in the short term.

⚠️ Important caveats

These levels are approximate and depend on market flow, volume, sector news.

This is not a recommendation to buy or sell; treat as informational only.

NBFC stocks like IIFL can be sensitive to credit/regulation news, which can quickly shift the technicals.

The “1-week” view means the horizon is short; volatility could cause levels to be breached.

Last quoted price: approx ₹540.75 (as of 11 Nov 2025).

1-week return: ~ +0.09%.

52-week high / low: ~ ₹559.75 / ~ ₹279.80.

🔍 1-Week level view

Given the current price and recent behaviour, here are some approximate support/resistance zones for the coming week:

Support zone: around ₹ 520-530. (if price dips, this may be an area where buyers step in)

Resistance zone: around ₹ 555-560. (near the recent high end of the range)

Neutral range: ~₹ 530-550 — staying in this band if no strong momentum emerges.

Upside breakout scenario: if it convincingly breaks above ~₹ 560, the next target may be ~₹ 570-580.

Downside break scenario: if it falls below ~₹ 520, it could test ~₹ 500 or lower in the short term.

⚠️ Important caveats

These levels are approximate and depend on market flow, volume, sector news.

This is not a recommendation to buy or sell; treat as informational only.

NBFC stocks like IIFL can be sensitive to credit/regulation news, which can quickly shift the technicals.

The “1-week” view means the horizon is short; volatility could cause levels to be breached.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.