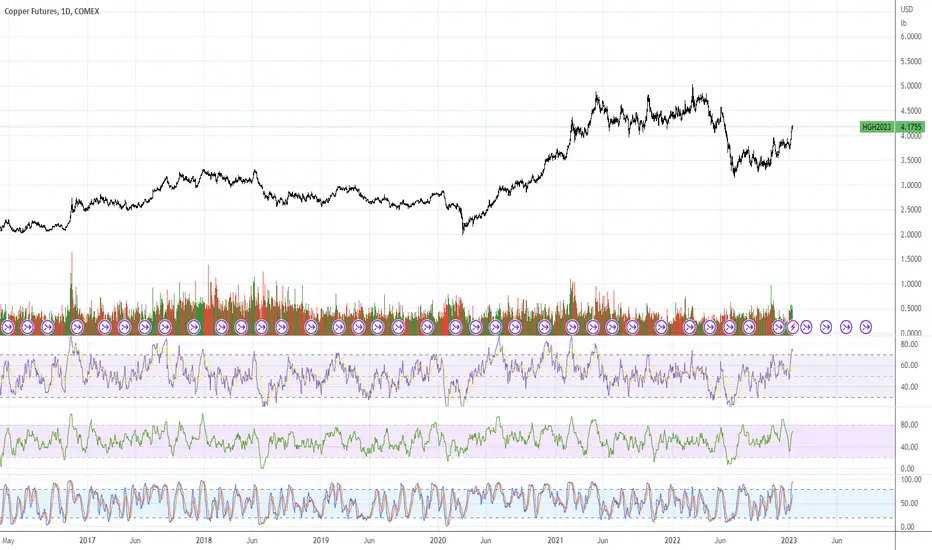

Commodity traders are pumping everything, gold, oil, copper, cattle, hogs, everything I checked.

If they continue to do so, it will force the Fed to go .5% regardless of CPI. A Fed member speaks every day next week, at least one of them will probably say something.

Not as bullish as I was earlier today. Besides, CPI of 6.5% is still above 2% target.

They can't undo QE because they're under water on all of their MBS, so they're slowly letting them expire. I think interest rates will have to remain high until their balance sheet goes down. Take a look at this chart (and now you know why I keep calling Powell stupid):

federalreserve.gov/monetarypolicy/bst_recenttrends.htm

If they continue to do so, it will force the Fed to go .5% regardless of CPI. A Fed member speaks every day next week, at least one of them will probably say something.

Not as bullish as I was earlier today. Besides, CPI of 6.5% is still above 2% target.

They can't undo QE because they're under water on all of their MBS, so they're slowly letting them expire. I think interest rates will have to remain high until their balance sheet goes down. Take a look at this chart (and now you know why I keep calling Powell stupid):

federalreserve.gov/monetarypolicy/bst_recenttrends.htm

노트

Funny thing occurred to me....Market celebrates easing inflation by pumping commodity futures, lol. Talk about self defeating.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.