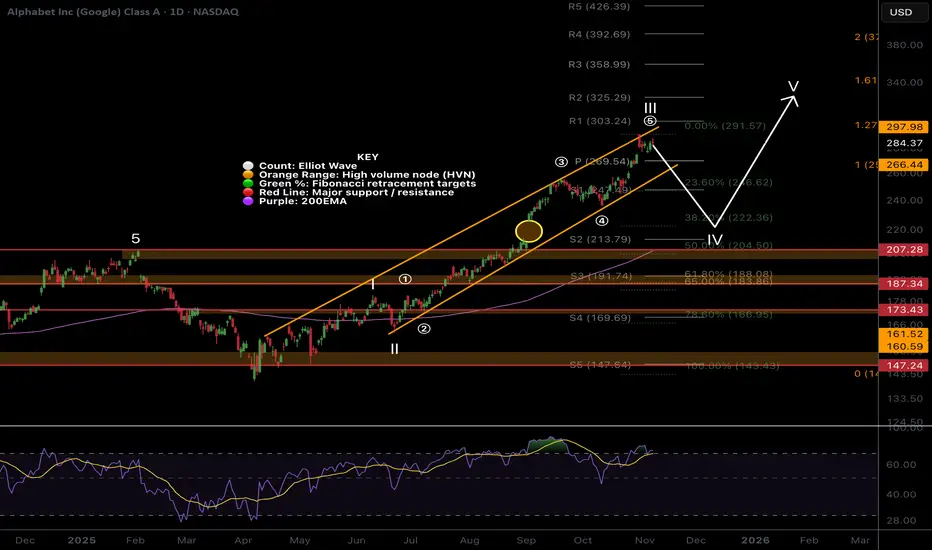

Wave III continues but price looks exhausted and may trap late investors causing them to capitulate lower later.

Wave (5) of III is likely to complete with a throw-over of the upper channel boundary. Wave IV has an expected retracement target of the 0.382, $222, filling the gap left and meeting the daily 200EMA.

Daily RSI has printed bearish divergence from overbought.

Continued upside hasa target of the R3 pivot, $358.

Wave (5) of III is likely to complete with a throw-over of the upper channel boundary. Wave IV has an expected retracement target of the 0.382, $222, filling the gap left and meeting the daily 200EMA.

Daily RSI has printed bearish divergence from overbought.

Continued upside hasa target of the R3 pivot, $358.

PhD Cand: Investing & Sentiment , MSc Financial Econ

Trader 8 years, Investor 15 years

The Sentiment Investor - Market Psychology: thesentimentinvestor.substack.com

Trade Planning, Strategies & Signals: Earn & Learn: tradesignals.substack.com

Trader 8 years, Investor 15 years

The Sentiment Investor - Market Psychology: thesentimentinvestor.substack.com

Trade Planning, Strategies & Signals: Earn & Learn: tradesignals.substack.com

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

PhD Cand: Investing & Sentiment , MSc Financial Econ

Trader 8 years, Investor 15 years

The Sentiment Investor - Market Psychology: thesentimentinvestor.substack.com

Trade Planning, Strategies & Signals: Earn & Learn: tradesignals.substack.com

Trader 8 years, Investor 15 years

The Sentiment Investor - Market Psychology: thesentimentinvestor.substack.com

Trade Planning, Strategies & Signals: Earn & Learn: tradesignals.substack.com

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.