🟡 GOLD – Breakout Play Setting Up

🔎 Bias: Bullish

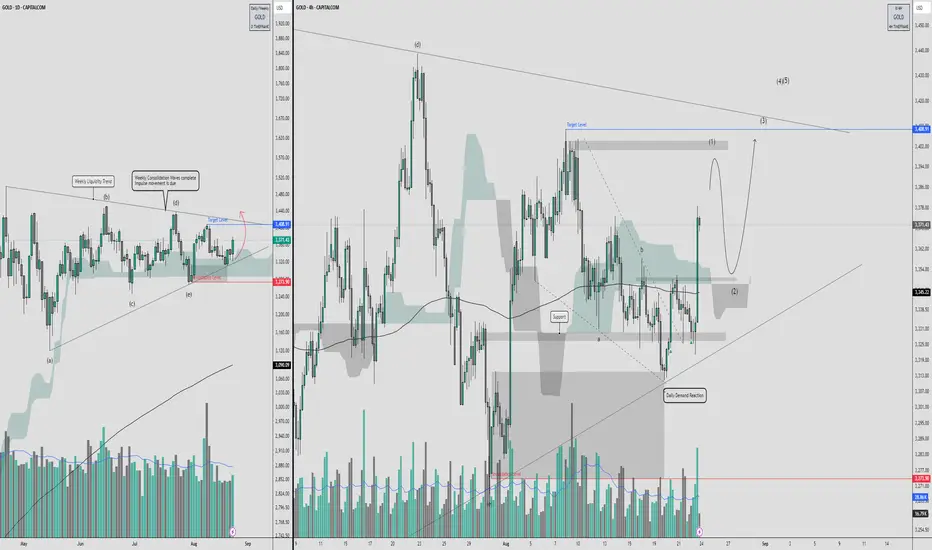

Gold is breaking out of a long consolidation phase. Weekly consolidation waves have completed, meaning an impulsive move is due. The liquidity trend is pointing higher, and demand zones are holding strongly.

📊 Technical Breakdown

Weekly/Daily View (Left Chart):

Price has been trapped in a weekly wedge structure, respecting both liquidity highs and lows.

Wave cycle (a–e) completed, with bullish pressure building.

Key Demand Zone: 3273 – 3330 held firm, rejecting sell pressure.

Target Zone: 3408 (major liquidity target), aligning with wedge resistance.

4H View (Right Chart):

Clear demand reaction after tapping into daily demand block.

Strong impulsive move upward (Wave (1)), expecting a pullback (Wave (2)) to retest structure/support before continuation.

Next projected leg higher towards 3400+, where liquidity and supply converge.

🎯 Trade Plan

Entry Zone: 3330 – 3360 (wait for retracement confirmation)

Target 1: 3408 (liquidity level)

Target 2: 3450 (upper supply wick)

Invalidation: Below 3273 (loss of demand structure)

📌 Summary

Gold is shifting from consolidation into impulse. With demand holding and liquidity resting above, bulls are in control. Watching for a healthy pullback to load into longs targeting 3408+.

🔎 Bias: Bullish

Gold is breaking out of a long consolidation phase. Weekly consolidation waves have completed, meaning an impulsive move is due. The liquidity trend is pointing higher, and demand zones are holding strongly.

📊 Technical Breakdown

Weekly/Daily View (Left Chart):

Price has been trapped in a weekly wedge structure, respecting both liquidity highs and lows.

Wave cycle (a–e) completed, with bullish pressure building.

Key Demand Zone: 3273 – 3330 held firm, rejecting sell pressure.

Target Zone: 3408 (major liquidity target), aligning with wedge resistance.

4H View (Right Chart):

Clear demand reaction after tapping into daily demand block.

Strong impulsive move upward (Wave (1)), expecting a pullback (Wave (2)) to retest structure/support before continuation.

Next projected leg higher towards 3400+, where liquidity and supply converge.

🎯 Trade Plan

Entry Zone: 3330 – 3360 (wait for retracement confirmation)

Target 1: 3408 (liquidity level)

Target 2: 3450 (upper supply wick)

Invalidation: Below 3273 (loss of demand structure)

📌 Summary

Gold is shifting from consolidation into impulse. With demand holding and liquidity resting above, bulls are in control. Watching for a healthy pullback to load into longs targeting 3408+.

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.