https://www.tradingview.com/x/7RaOhDL2/

Gold prices retreated slightly on Friday as investors took profits ahead of the monthly and weekly close, ultimately closing down 0.54%. Next week is typically the week for non-farm payroll data releases, but with the US government shutdown entering its second month, the data is likely to be absent again. Investors will focus on speeches by Federal Reserve officials next week.

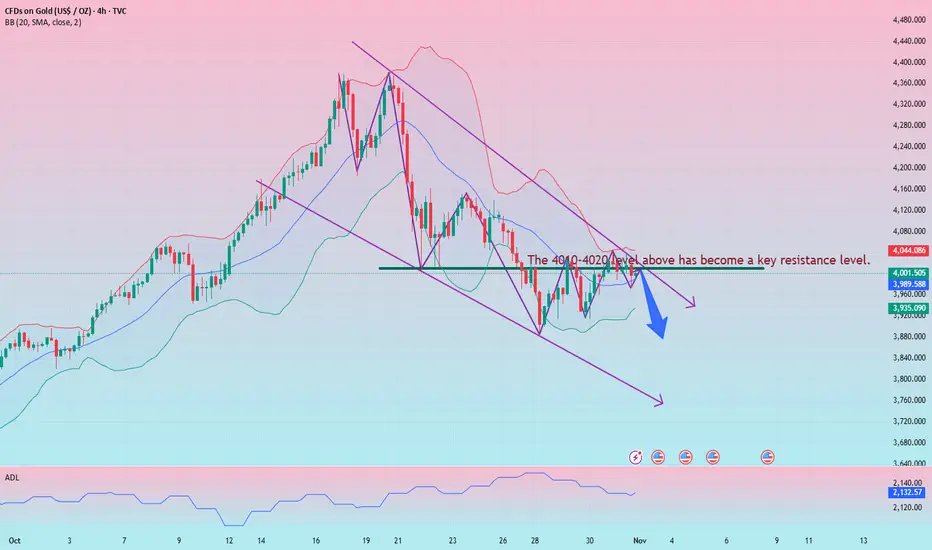

Gold prices fell on Friday, rising in Asian trading before retreating, fluctuating in European trading, and continuing to decline in US trading, closing with a small bearish candle. October's closing price formed a shooting star pattern with a bullish upper shadow; the longer the upper shadow, the more unfavorable it is for the bulls, and the probability of further declines in November is high. Fundamentally, the reopening of the US government, easing US-China relations, and the Federal Reserve's pause in rate cuts in December will all negatively impact gold prices. Therefore, the strategy for November is still to sell on rallies and look for a pullback. In the short term, judging from Friday's closing price, the 4030-4040 resistance level is effective, and a pullback is expected on Monday. The 4010-4020 level will become a key resistance level. If this resistance level is not broken, the outlook is bearish; conversely, if this resistance level is broken, a rebound is expected, and the 4030-4040 resistance level will become invalid.

Gold prices retreated slightly on Friday as investors took profits ahead of the monthly and weekly close, ultimately closing down 0.54%. Next week is typically the week for non-farm payroll data releases, but with the US government shutdown entering its second month, the data is likely to be absent again. Investors will focus on speeches by Federal Reserve officials next week.

Gold prices fell on Friday, rising in Asian trading before retreating, fluctuating in European trading, and continuing to decline in US trading, closing with a small bearish candle. October's closing price formed a shooting star pattern with a bullish upper shadow; the longer the upper shadow, the more unfavorable it is for the bulls, and the probability of further declines in November is high. Fundamentally, the reopening of the US government, easing US-China relations, and the Federal Reserve's pause in rate cuts in December will all negatively impact gold prices. Therefore, the strategy for November is still to sell on rallies and look for a pullback. In the short term, judging from Friday's closing price, the 4030-4040 resistance level is effective, and a pullback is expected on Monday. The 4010-4020 level will become a key resistance level. If this resistance level is not broken, the outlook is bearish; conversely, if this resistance level is broken, a rebound is expected, and the 4030-4040 resistance level will become invalid.

액티브 트레이드

Prepare for the opening of the market거래청산: 타겟 닿음

Please be prepared.Hey, everyone. I'm Yulia, a girl from Russia working as an analyst in New York, USA. I've been doing this job for 13 years. I have professional financial knowledge. I hope you like me.

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

Hey, everyone. I'm Yulia, a girl from Russia working as an analyst in New York, USA. I've been doing this job for 13 years. I have professional financial knowledge. I hope you like me.

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.