🧭 Overall Structure

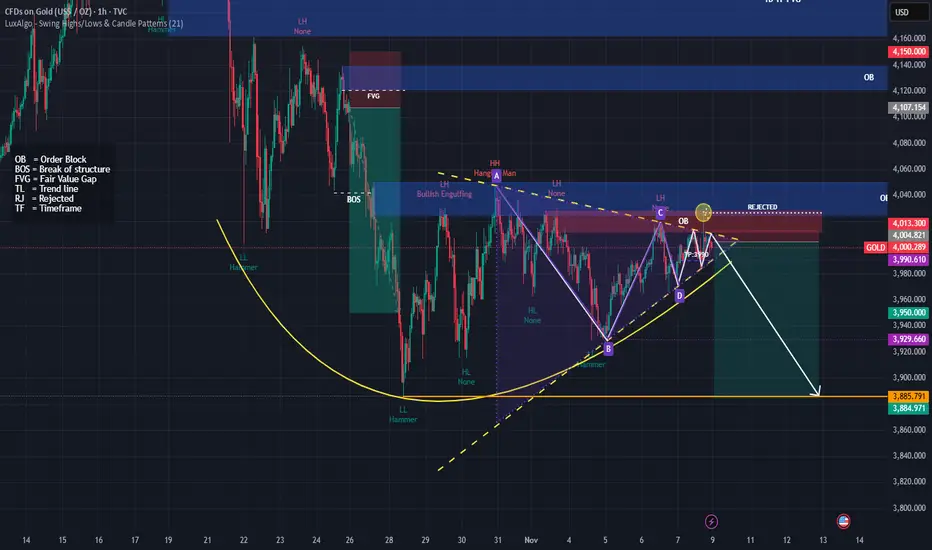

The chart shows a potential bearish setup.

I have drawn a descending pattern (A-B-C-D) with rejection from an Order Block (OB) around $4,013–$4,020.

The white arrow projects a downward move toward 3,885.

🔍 Key Technical Elements

1. Order Blocks (OB)

Upper OB (~4,150–4,120): Higher timeframe supply zone; strong resistance if price rallies.

Current OB (~4,013–4,040): Recently rejected here — price reacted and failed to make a new higher high → confirms seller pressure.

2. Break of Structure (BOS)

A previous BOS occurred to the downside, suggesting bearish momentum took control after a temporary bullish leg.

3. Trend Lines (Yellow Dashed)

The upper TL connects lower highs → consistent downtrend.

The lower TL (support) was recently tested and might break soon — signaling bearish continuation.

4. Pattern

A–B–C–D harmonic-like pattern completed near the order block, often signaling a sell opportunity when it aligns with rejection zones.

Price formed a lower high (LH) at point C and another at D → confirms trend weakness.

5. Candlestick Rejection

“Rejected” and “Hammer” labels near point D and OB zone show failed bullish attempts → adds confluence for short.

🎯 Bearish Targets

TP1: 3,950 (nearest support)

TP2: 3,930 (previous low)

TP3 (Major): 3,885 (strong historical support zone)

⚠️ Invalidation

If price closes above 4,040–4,060 (OB zone), bearish setup invalidates.

That would mean liquidity grab and possible push toward 4,100–4,150 OB.

🧩 Summary

Bias Entry Zone Confirmation Targets Invalidation

Bearish 4,010–4,020 OB zone Rejection + lower high 3,950 → 3,930 → 3,885 Close above 4,060

The chart shows a potential bearish setup.

I have drawn a descending pattern (A-B-C-D) with rejection from an Order Block (OB) around $4,013–$4,020.

The white arrow projects a downward move toward 3,885.

🔍 Key Technical Elements

1. Order Blocks (OB)

Upper OB (~4,150–4,120): Higher timeframe supply zone; strong resistance if price rallies.

Current OB (~4,013–4,040): Recently rejected here — price reacted and failed to make a new higher high → confirms seller pressure.

2. Break of Structure (BOS)

A previous BOS occurred to the downside, suggesting bearish momentum took control after a temporary bullish leg.

3. Trend Lines (Yellow Dashed)

The upper TL connects lower highs → consistent downtrend.

The lower TL (support) was recently tested and might break soon — signaling bearish continuation.

4. Pattern

A–B–C–D harmonic-like pattern completed near the order block, often signaling a sell opportunity when it aligns with rejection zones.

Price formed a lower high (LH) at point C and another at D → confirms trend weakness.

5. Candlestick Rejection

“Rejected” and “Hammer” labels near point D and OB zone show failed bullish attempts → adds confluence for short.

🎯 Bearish Targets

TP1: 3,950 (nearest support)

TP2: 3,930 (previous low)

TP3 (Major): 3,885 (strong historical support zone)

⚠️ Invalidation

If price closes above 4,040–4,060 (OB zone), bearish setup invalidates.

That would mean liquidity grab and possible push toward 4,100–4,150 OB.

🧩 Summary

Bias Entry Zone Confirmation Targets Invalidation

Bearish 4,010–4,020 OB zone Rejection + lower high 3,950 → 3,930 → 3,885 Close above 4,060

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.