Hello Traders

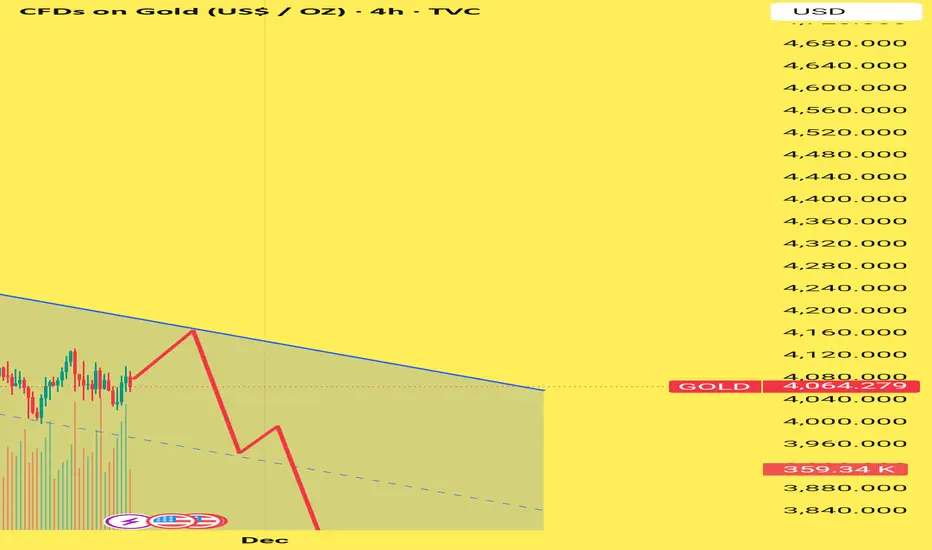

Gold on the 4H timeframe continues to respect a clear descending channel, with price moving steadily between the upper resistance trendline and the lower support boundary.

At the moment, price is trading near the mid-range of the channel, showing limited bullish momentum but still respecting the broader downtrend structure.

Key Highlights:

🔹 Upper Channel Resistance:

Price is approaching a major trendline where sellers have consistently reacted throughout October and November. A rejection from this zone keeps the bearish structure intact.

🔹 Mid-Channel Reaction:

The dashed median line continues to act as a dynamic pivot. Current price movement suggests temporary consolidation before a larger directional move.

🔹 Bearish Scenario (Most aligned with structure):

If price rejects the upper trendline again, a move toward the lower channel support remains possible. This level has historically provided strong reactions.

🔹 Lower Channel Support:

A drop toward this zone would complete the next leg inside the channel, maintaining the overall descending pattern.

Market Structure Insight:

The overall flow remains bearish as long as Gold trades inside this channel. The chart illustrates potential movement but does not represent any financial advice—simply an analysis of market structure based on visible trend behavior.

Gold on the 4H timeframe continues to respect a clear descending channel, with price moving steadily between the upper resistance trendline and the lower support boundary.

At the moment, price is trading near the mid-range of the channel, showing limited bullish momentum but still respecting the broader downtrend structure.

Key Highlights:

🔹 Upper Channel Resistance:

Price is approaching a major trendline where sellers have consistently reacted throughout October and November. A rejection from this zone keeps the bearish structure intact.

🔹 Mid-Channel Reaction:

The dashed median line continues to act as a dynamic pivot. Current price movement suggests temporary consolidation before a larger directional move.

🔹 Bearish Scenario (Most aligned with structure):

If price rejects the upper trendline again, a move toward the lower channel support remains possible. This level has historically provided strong reactions.

🔹 Lower Channel Support:

A drop toward this zone would complete the next leg inside the channel, maintaining the overall descending pattern.

Market Structure Insight:

The overall flow remains bearish as long as Gold trades inside this channel. The chart illustrates potential movement but does not represent any financial advice—simply an analysis of market structure based on visible trend behavior.

⚡ Premium Trader | Forex & Gold Analyst

Consistency. Accuracy. Results.

Click the link and join us t.me/Fx_Agency_World3

Consistency. Accuracy. Results.

Click the link and join us t.me/Fx_Agency_World3

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

⚡ Premium Trader | Forex & Gold Analyst

Consistency. Accuracy. Results.

Click the link and join us t.me/Fx_Agency_World3

Consistency. Accuracy. Results.

Click the link and join us t.me/Fx_Agency_World3

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.