Diving right in.

We have had a HUGE reaction to the massive selloff, even though I was somewhat off on the bottom in my previous TA (I predicted $140-$150 bottom), I did say that we would make it back up to retest the range we just fell out of.

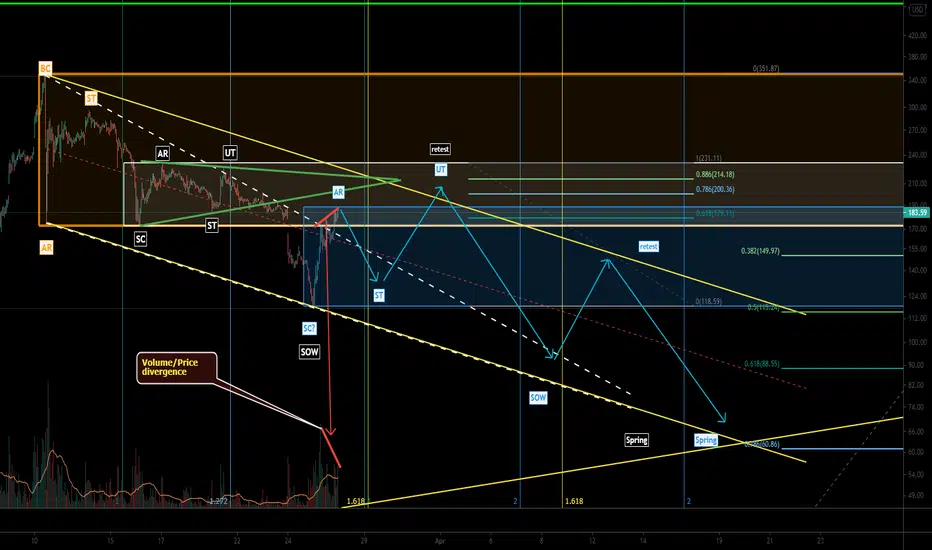

So right now, the way I see it is that there is a strong chance we have topped out on the Automatic Reaction phase of yet ANOTHER accumulation trading range that is forming. There are some decent indicators that this is (or close to this price) is AR. We have volume diverging, we are making higher highs on lower volume which is a typical indicator of an imminent reversal... So I kind of like the idea that AR has been had. The third stage of any Wyckoff model is the range retest (ST - secondary test). This tests the range for sellers before making a strong move up into upthrust... Upthrust will probably not be too strong, this is when I see us hitting that $200 I've been yammering about that you should short from.

Once again, bullish legs in bearish trends are not the most profitable and they are riskier. If you bought at $140-$150, you're in profit now, just be forewarned that it will retest the trading range before you see the $200 upthrust high.

Otherwise the forecast is (so far) going pretty good. I still think at this point that we will end up dipping below $100 based on how the accumulation cycles are adding up.

We have had a HUGE reaction to the massive selloff, even though I was somewhat off on the bottom in my previous TA (I predicted $140-$150 bottom), I did say that we would make it back up to retest the range we just fell out of.

So right now, the way I see it is that there is a strong chance we have topped out on the Automatic Reaction phase of yet ANOTHER accumulation trading range that is forming. There are some decent indicators that this is (or close to this price) is AR. We have volume diverging, we are making higher highs on lower volume which is a typical indicator of an imminent reversal... So I kind of like the idea that AR has been had. The third stage of any Wyckoff model is the range retest (ST - secondary test). This tests the range for sellers before making a strong move up into upthrust... Upthrust will probably not be too strong, this is when I see us hitting that $200 I've been yammering about that you should short from.

Once again, bullish legs in bearish trends are not the most profitable and they are riskier. If you bought at $140-$150, you're in profit now, just be forewarned that it will retest the trading range before you see the $200 upthrust high.

Otherwise the forecast is (so far) going pretty good. I still think at this point that we will end up dipping below $100 based on how the accumulation cycles are adding up.

노트

Edit: The blue accumulation trading range is based on our current price (or close to it) being the automatic reaction면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.