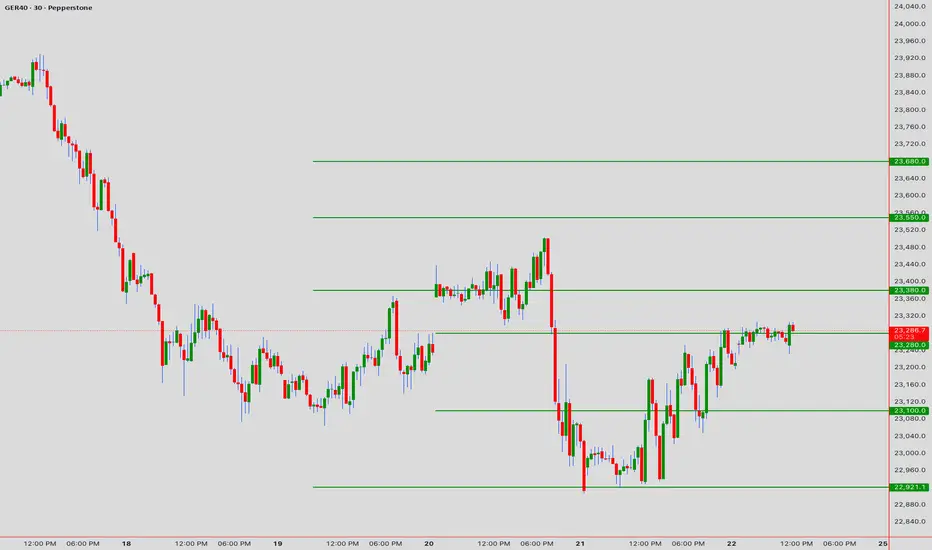

Asset: GER40 (DAX Index)

Current Price: 23,290.00

Date: November 24, 2025

Market Sentiment: The German index is trading at stratospheric levels, testing the 23,300 psychological ceiling. Institutional algorithms are fighting for control between a breakout continuation and a mean-reversion correction.

📊 Technical Indicators & Momentum Analysis

- Trend Structure: The primary trend is STRONGLY BULLISH 🐂 on the Daily timeframe. However, the 1H chart shows a "Rising Wedge" formation, often a precursor to a bearish reversal.

- Relative Strength Index (RSI): Currently at 68.0. We are approaching overbought territory. A bearish divergence is visible between price highs and RSI peaks, signaling waning momentum.

- Bollinger Bands: Price is testing the Upper Band deviation. A failure to close above 23,310 could trigger a snap-back to the 20-period SMA (Mid-Band).

📐 Fibonacci & Harmonic Patterns

- Fibonacci Extension: The current rally has hit the 1.272 extension of the previous correction. The next major resistance aligns with the 1.414 extension at 23,350.

- Harmonic Pattern: A Bearish Butterfly Pattern is nearing completion. The Potential Reversal Zone (PRZ) is calculated between 23,320 and 23,350.

🛡️ Support and Resistance Levels

- Resistance 1: 23,320 (Harmonic PRZ)

- Resistance 2: 23,400 (Psychological Round Number)

- Support 1: 23,220 (Previous High / Support Flip)

- Support 2: 23,150 (0.382 Fib Retracement)

🎯 Strategic Trade Setups

Scenario A: The Reversal (Short)

Valid if price rejects the 23,320 zone with a bearish pin bar.

- Entry: Below 23,280

- Target 1: 23,220

- Target 2: 23,150

- Stop Loss: 23,360

Scenario B: Breakout Continuation (Long)

If price closes above 23,350 on strong volume.

- Entry: Retest of 23,350

- Target: 23,450

- Stop Loss: 23,300

⚠️ Summary: Caution is advised. The confluence of the Bearish Butterfly pattern and RSI divergence suggests a high probability of a pullback from the 23,320 region. We favor Scenario A for the intraday session. 📉🇩🇪

I am nothing @shunya.trade

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

I am nothing @shunya.trade

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.