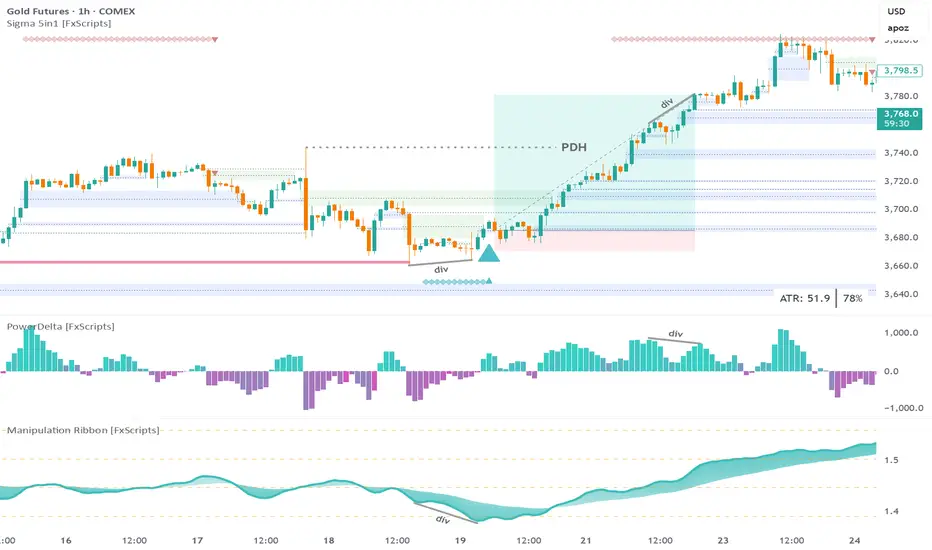

Step 1: wait for a sweep of daily liquidity

Note: the sweep must be confirmed for any of the other confluences to be valid

Step 2: wait for a bullish marker to be drawn by the Reversal Print indicator

Tip: set an alert if you don’t want to spend all day staring at the chart

Step 3: look for a divergence with either the PowerDelta Oscillator or, in this case, the Manipulation Ribbon

Info: the Manipulation Ribbon detects areas of price manipulation by Market Makers vs areas where it is trading in a natural, price-driven state

Step 4: the entry is a tap of the most recent confirmed FVG

FYI: all the drawings on the main chart are created by the Sigma 5-in-1 indicator

SL: low of first candle that forms the entry FVG

Tip: for a more conservative approach the recent swing low could also be used

TP: bearish divergence with the PowerDelta Oscillator

Note: gold was at an all-time high so anything beyond the Previous Day High (PDH) posed a risk however for a more conservative approach you could exit half your position at the PDH

Note: the sweep must be confirmed for any of the other confluences to be valid

Step 2: wait for a bullish marker to be drawn by the Reversal Print indicator

Tip: set an alert if you don’t want to spend all day staring at the chart

Step 3: look for a divergence with either the PowerDelta Oscillator or, in this case, the Manipulation Ribbon

Info: the Manipulation Ribbon detects areas of price manipulation by Market Makers vs areas where it is trading in a natural, price-driven state

Step 4: the entry is a tap of the most recent confirmed FVG

FYI: all the drawings on the main chart are created by the Sigma 5-in-1 indicator

SL: low of first candle that forms the entry FVG

Tip: for a more conservative approach the recent swing low could also be used

TP: bearish divergence with the PowerDelta Oscillator

Note: gold was at an all-time high so anything beyond the Previous Day High (PDH) posed a risk however for a more conservative approach you could exit half your position at the PDH

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.