Quick Recap: Last week Expected Ranges levels in action

What is Expected Range Volatility (ER)?

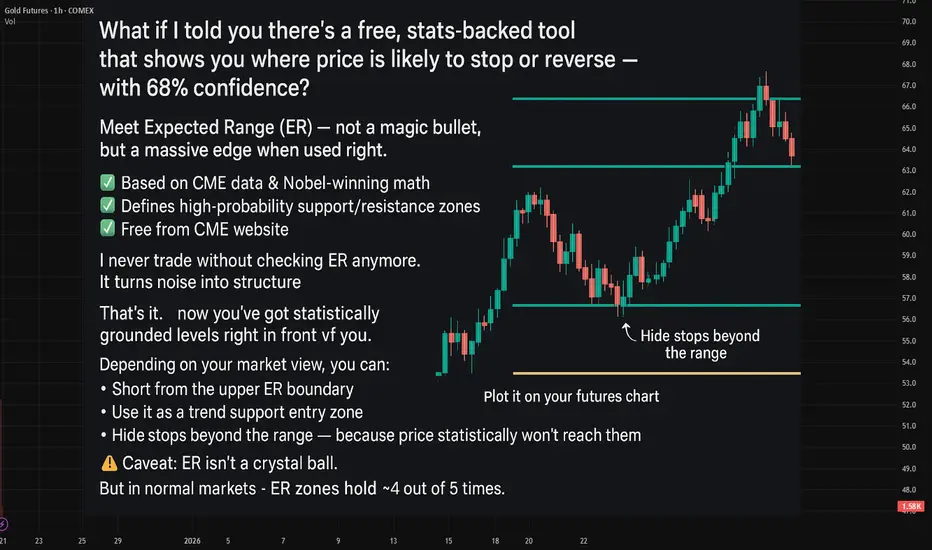

The Expected Range (ER) is a framework that helps traders understand how much an asset is likely to move within a specific timeframe. Based on CME market data and Nobel Prize-winning calculations, price movements within the expected volatility corridor have a 68%-95% probability of staying within those boundaries.

Crude Oil - 6 reactions to levels🔥

EUR - 4 reactions to levels

BTC - 3 reactions

GOLD - 1 reaction to levels

It's really an amazing tool to enhance your market entry💲

!!!- It doesn't guarantee trades every day.

!! it's better to combine it when working with the trend and when there's a clear sideways movement.

What is Expected Range Volatility (ER)?

The Expected Range (ER) is a framework that helps traders understand how much an asset is likely to move within a specific timeframe. Based on CME market data and Nobel Prize-winning calculations, price movements within the expected volatility corridor have a 68%-95% probability of staying within those boundaries.

Crude Oil - 6 reactions to levels🔥

EUR - 4 reactions to levels

BTC - 3 reactions

GOLD - 1 reaction to levels

It's really an amazing tool to enhance your market entry💲

!!!- It doesn't guarantee trades every day.

!! it's better to combine it when working with the trend and when there's a clear sideways movement.

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.