Combining H1 and 5-Minute Charts for Tomorrow’s Trading Plan

Based on the technical analysis of both the H1 and 5-minute charts, the following conclusions and trading strategies can be drawn:

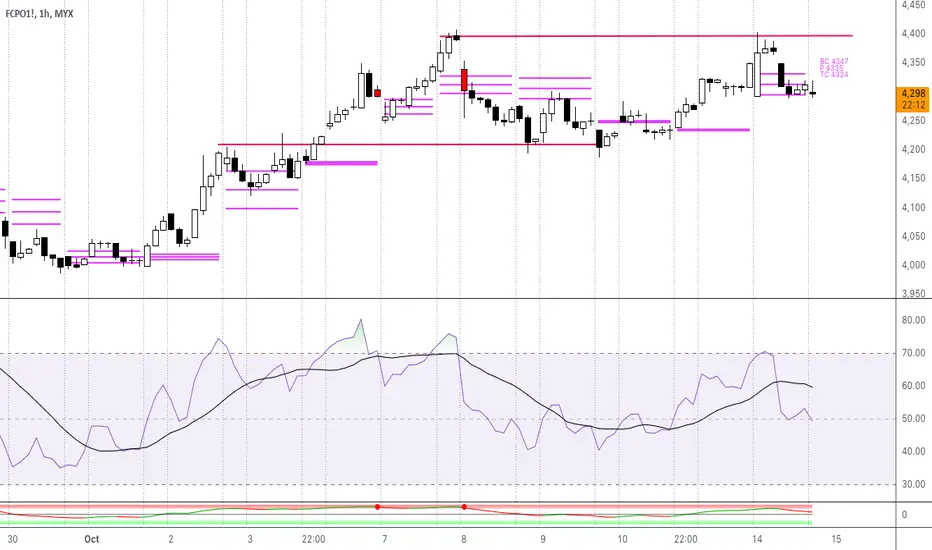

Watch for a Breakout Above 4,400 (H1):

A confirmed breakout above the 4,400 resistance level on the H1 chart could provide an opportunity for long positions, targeting 4,450 and possibly higher. The key is to wait for a strong bullish confirmation with accompanying volume.

4,240 Support Holds the Key (H1):

Should the price fail to hold 4,240 on the H1 chart, a significant downside move could occur. Look for short opportunities with potential targets around 4,200 and possibly 4,160.

Intraday Focus on 4,320 - 4,300 Zone (5-Minute Chart):

On the 5-minute chart, the market is showing signs of exhaustion. If the 4,300 support holds in early trading tomorrow, a quick bounce toward 4,320 is likely. However, if 4,300 is broken, look for a potential move lower.

RSI and Momentum Indicators:

Keep an eye on the RSI for any signs of divergence or overbought/oversold conditions, as these could provide early warning signs for reversals.

Based on the technical analysis of both the H1 and 5-minute charts, the following conclusions and trading strategies can be drawn:

Watch for a Breakout Above 4,400 (H1):

A confirmed breakout above the 4,400 resistance level on the H1 chart could provide an opportunity for long positions, targeting 4,450 and possibly higher. The key is to wait for a strong bullish confirmation with accompanying volume.

4,240 Support Holds the Key (H1):

Should the price fail to hold 4,240 on the H1 chart, a significant downside move could occur. Look for short opportunities with potential targets around 4,200 and possibly 4,160.

Intraday Focus on 4,320 - 4,300 Zone (5-Minute Chart):

On the 5-minute chart, the market is showing signs of exhaustion. If the 4,300 support holds in early trading tomorrow, a quick bounce toward 4,320 is likely. However, if 4,300 is broken, look for a potential move lower.

RSI and Momentum Indicators:

Keep an eye on the RSI for any signs of divergence or overbought/oversold conditions, as these could provide early warning signs for reversals.

노트

See full analysis from masterfcpotrading.com/daily-analysis/14-october-2024/면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.