I’m still an Elliott Wave noob, so the drawing on my chart is purely theoretical. It’s based on personal speculation — not financial advice.

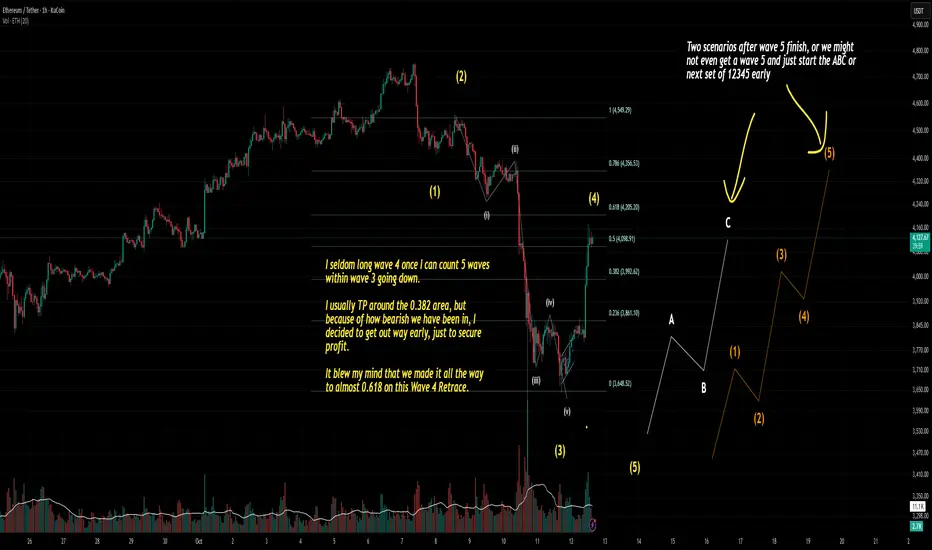

Right now, I’m working under the assumption that we’re either in a corrective Wave A heading down, or in Wave 2 of a larger structure on a higher timeframe.

Last night, I counted five waves down within Wave 3 and started to notice signs of support. So instead of riding it out for a retrace back to the usual 0.382 Fib, I decided to long Wave 4 early and took profit once it hit an amount I was comfortable with.

Given how sharp the recent drop was, I was worried this might be one of those weak sub-Wave 4 retracements. I honestly doubted we’d even make it to 0.382, and even if we did, I expected it to take another 12–24 hours.

This morning, ETH shot up another $200 to $4000 right after I TP’d. I won’t lie — I definitely felt some ROMO (regret of missing out). An hour later, I checked again and saw it nearly tagged the 0.618 Fib. I was shocked at how fast it recovered.

But I reminded myself: don’t FOMO in and end up stuck in a long while Wave 5 is setting up to go down. I’ve learned that less profit is better than no profit. So I’m sticking to my plan and moving on.

My outlook from here:

I’m expecting Wave 5 to start between now and the London session open. Then, during the U.S. session, we might see another impulsive 1-2-3-4-5 leg up or begin corrective Wave B (if we really are in corrective Wave A down).

Good luck, everyone. Stay disciplined and trade your plan.

Right now, I’m working under the assumption that we’re either in a corrective Wave A heading down, or in Wave 2 of a larger structure on a higher timeframe.

Last night, I counted five waves down within Wave 3 and started to notice signs of support. So instead of riding it out for a retrace back to the usual 0.382 Fib, I decided to long Wave 4 early and took profit once it hit an amount I was comfortable with.

Given how sharp the recent drop was, I was worried this might be one of those weak sub-Wave 4 retracements. I honestly doubted we’d even make it to 0.382, and even if we did, I expected it to take another 12–24 hours.

This morning, ETH shot up another $200 to $4000 right after I TP’d. I won’t lie — I definitely felt some ROMO (regret of missing out). An hour later, I checked again and saw it nearly tagged the 0.618 Fib. I was shocked at how fast it recovered.

But I reminded myself: don’t FOMO in and end up stuck in a long while Wave 5 is setting up to go down. I’ve learned that less profit is better than no profit. So I’m sticking to my plan and moving on.

My outlook from here:

I’m expecting Wave 5 to start between now and the London session open. Then, during the U.S. session, we might see another impulsive 1-2-3-4-5 leg up or begin corrective Wave B (if we really are in corrective Wave A down).

Good luck, everyone. Stay disciplined and trade your plan.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.