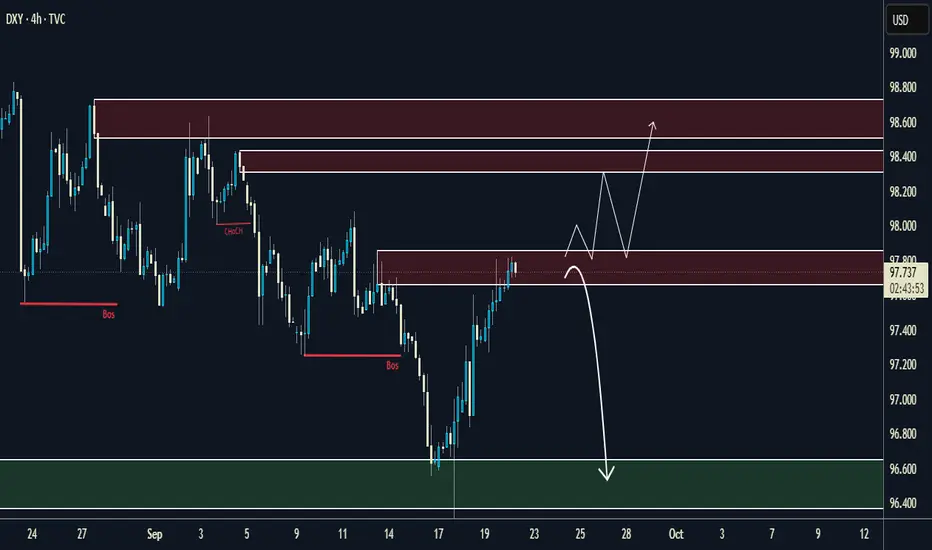

💡 DXY 4H Outlook – Key Levels & Potential Scenarios

Price is currently testing an important supply zone (97.7 – 98.0) after showing a strong recovery. From here, I’m watching two possible outcomes:

🔼 Bullish Scenario

If buyers manage to hold above the 97.7 – 98.0 supply zone, we could see continuation toward the next major resistance between 98.2 – 98.6.

Break & retest of 98.0 would be a strong confirmation for buyers.

🔽 Bearish Scenario

If the 97.7 – 98.0 area rejects strongly, price could reverse back down toward the demand zone (96.4 – 96.6) for liquidity grab.

This zone has previously acted as a strong reaction point.

⚔️ Key Levels to Watch

Resistance: 98.0 | 98.2 | 98.6

Support: 97.4 | 96.6

📊 This setup gives both bulls and bears opportunities depending on how price reacts at these zones.

✅ If you enjoy this type of analysis, make sure to follow me so you don’t miss the next updates.

💼 For those who want account management services (personal or funded accounts), feel free to reach out – I can help you grow consistently with risk management and proven strategies.

Price is currently testing an important supply zone (97.7 – 98.0) after showing a strong recovery. From here, I’m watching two possible outcomes:

🔼 Bullish Scenario

If buyers manage to hold above the 97.7 – 98.0 supply zone, we could see continuation toward the next major resistance between 98.2 – 98.6.

Break & retest of 98.0 would be a strong confirmation for buyers.

🔽 Bearish Scenario

If the 97.7 – 98.0 area rejects strongly, price could reverse back down toward the demand zone (96.4 – 96.6) for liquidity grab.

This zone has previously acted as a strong reaction point.

⚔️ Key Levels to Watch

Resistance: 98.0 | 98.2 | 98.6

Support: 97.4 | 96.6

📊 This setup gives both bulls and bears opportunities depending on how price reacts at these zones.

✅ If you enjoy this type of analysis, make sure to follow me so you don’t miss the next updates.

💼 For those who want account management services (personal or funded accounts), feel free to reach out – I can help you grow consistently with risk management and proven strategies.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.