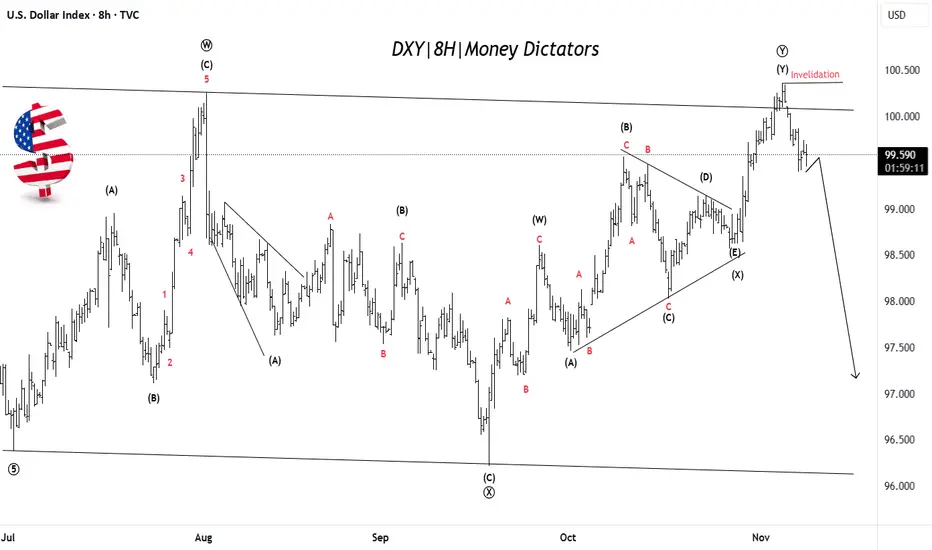

DXY has completed a complex corrective W–X–Y pattern, with the final leg (Y) recently topping near the 100.50 zone. Price has failed to break above the invalidation level, suggesting the uptrend is losing strength. This signals that the dollar may have finished its corrective phase and could now start a fresh bearish wave targeting lower zones near 97–98. The overall structure indicates that momentum is shifting from bullish to bearish. In simple terms: rally is likely over → downside move toward new lows expected next.

Stay tuned!

Money_Dictators

Thank you :)

Stay tuned!

Money_Dictators

Thank you :)

To eliminate these delays and give priority access to serious traders, we’ve launched an exclusive Premium EDU + Wave Count Group.

💰 Annual Fee: $115

BUY NOW: t.me/moneydictators/148

Lifetime Free - t.me/moneydictators

💰 Annual Fee: $115

BUY NOW: t.me/moneydictators/148

Lifetime Free - t.me/moneydictators

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

To eliminate these delays and give priority access to serious traders, we’ve launched an exclusive Premium EDU + Wave Count Group.

💰 Annual Fee: $115

BUY NOW: t.me/moneydictators/148

Lifetime Free - t.me/moneydictators

💰 Annual Fee: $115

BUY NOW: t.me/moneydictators/148

Lifetime Free - t.me/moneydictators

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.