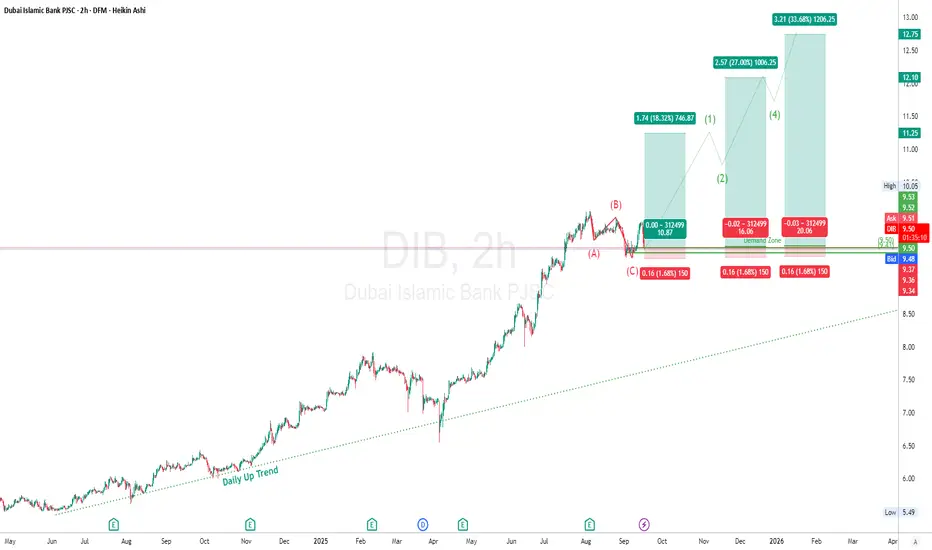

DIB has been in a solid daily uptrend since mid-2024, respecting the rising trendline.

Recently, price completed an ABC corrective structure, pulling back from 12.10 highs → 9.50s.

It is now sitting at the demand zone (9.35–9.50), with signs of buyers stepping back in.

Trend & Structure

Macro Trend: Bullish (higher highs/lows intact).

Current Phase: End of Wave (C) correction.

Next Cycle Projection: Elliott Wave 1–5 up, with 12.75+ targets in sight.

Supply & Demand

Demand Zone (Strong Support): 9.35 – 9.50 (already tested).

Next Resistance Levels (Supply):

11.25

12.10 (previous high)

12.75 (projected Wave 5 target)

Elliott Wave Outlook

Completed: (A)-(B)-(C) correction.

Next: Bullish cycle projected → Wave (1) → (2) → (3) → (4) → (5) toward 12.75.

Measured projections:

Wave (1): 10.87 (+18%)

Wave (3): 12.10 (+27%)

Wave (5): 12.75 (+33%)

💰 Trade Idea

Entry Zone: 9.50 – 9.55 (demand zone bounce).

Stop Loss: 9.35 (below demand).

Take Profit Levels:

TP1: 10.87 (Wave 1)

TP2: 12.10 (Wave 3)

TP3: 12.75 (Wave 5)

🎯 Risk/Reward :

To TP1 = ~1:7

To TP2 = ~1:12

To TP3 = ~1:18+

⚖ Risk Management

Max risk per trade = 1–2% of portfolio.

Move SL to Break-Even (BE) once TP1 is hit.

Scale out 30% at TP1, 30% at TP2, hold rest for TP3.

"In trading, the key is not being right, but having an edge and sticking to it." – Paul Tudor Jones

⚠️ Disclaimer

This is not financial advice. For educational purposes only. Always DYOR before trading.

By Dubai Traders Hub

Follow us on X , YouTube, and Join our Telegram Channel

Follow us on X , YouTube, and Join our Telegram Channel

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

By Dubai Traders Hub

Follow us on X , YouTube, and Join our Telegram Channel

Follow us on X , YouTube, and Join our Telegram Channel

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.