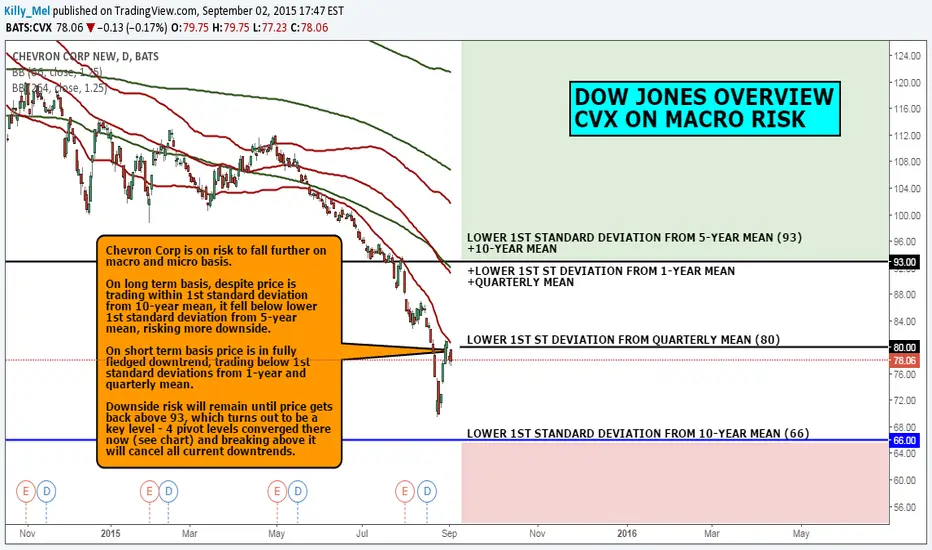

Chevron Corp is on risk to fall further on macro and micro basis.

On long term basis, despite price is trading within 1st standard deviation from 10-year mean, it fell below lower 1st standard deviation from 5-year mean, risking more downside.

On short term basis price is in fully fledged downtrend, trading below 1st standard deviations from 1-year and quarterly mean.

Downside risk will remain until price gets back above 93, which turns out to be a key level - 4 pivot levels converged there now (see chart) and breaking above it will cancel all current downtrends.

On long term basis, despite price is trading within 1st standard deviation from 10-year mean, it fell below lower 1st standard deviation from 5-year mean, risking more downside.

On short term basis price is in fully fledged downtrend, trading below 1st standard deviations from 1-year and quarterly mean.

Downside risk will remain until price gets back above 93, which turns out to be a key level - 4 pivot levels converged there now (see chart) and breaking above it will cancel all current downtrends.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.