Analysis Date: September 8, 2025

Current Price: $62.25

Market Session: Pre-Market Analysis

Executive Summary

Quarterly Volume Profile Analysis

Institutional Positioning Intelligence

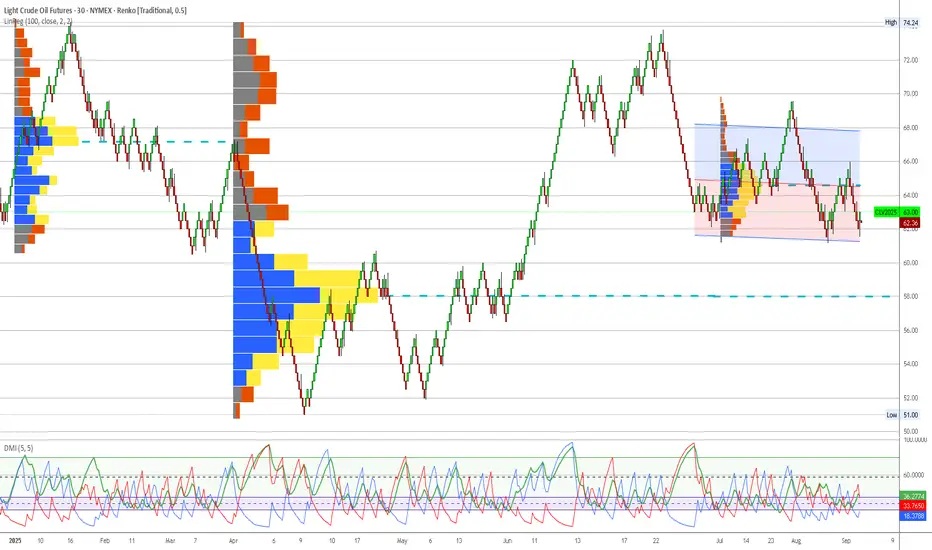

The quarterly volume profile (Q3 2025) reveals critical institutional positioning patterns that provide strategic context for all tactical decisions:

Primary Institutional Accumulation Zone: $62.00-$64.50

Secondary Support Levels:

Resistance Structure Analysis:

Price Structure Context

Historical Pattern Recognition:

The current positioning mirrors successful institutional accumulation patterns observed in previous commodity cycles. The width and intensity of the $62-64 blue volume zone suggests this represents a major strategic positioning by institutional participants, similar to the Natural Gas accumulation pattern that preceded its successful reversal.

Critical Structure Points:

Execution Chart Technical Analysis

Current Technical Configuration

DEMA Analysis - CRITICAL WARNING SIGNAL:

DMI/ADX Assessment:

Stochastic Analysis:

Support and Resistance Levels

Immediate Technical Levels:

Trading Scenarios and Setup Criteria

Scenario 1: Bullish Reversal Setup

Required Conditions for Long Entry:

Entry Protocol:

Profit Targets:

Scenario 2: Bearish Breakdown Setup

Short Entry Conditions:

Short Setup Parameters:

Scenario 3: Range-Bound Consolidation

Sideways Trading Framework:

Risk Management Protocols

Position Sizing Guidelines

Conservative Approach (Recommended):

Stop Loss Hierarchy

Time-Based Risk Controls

Monitoring Requirements:

Market Context and External Factors

Fundamental Considerations

Supply/Demand Dynamics:

Geopolitical Factors:

Seasonal Patterns

September-October Considerations:

Monitoring Checklist and Alert Levels

Daily Monitoring Requirements

Critical Alert Levels

Bullish Alerts:

Bearish Alerts:

Conclusion and Strategic Outlook

Strategic Recommendation: Defensive positioning with readiness to capitalize on either directional resolution. Prioritize capital preservation while maintaining alert status for high-probability setups upon signal alignment.

Next Review: Daily assessment of DEMA configuration and institutional level respect

Document Status: Active monitoring required - conflicted signals demanding careful attention

Important Disclaimer

Current Price: $62.25

Market Session: Pre-Market Analysis

Executive Summary

WTI Crude Oil presents a complex trading scenario with strong institutional support at current levels offset by concerning technical deterioration on the execution timeframe. The quarterly volume profile reveals massive smart money accumulation in the $62-64 zone, yet recent DEMA bearish crossover signals potential near-term weakness. This analysis provides a comprehensive framework for navigating this conflicted setup.

Quarterly Volume Profile Analysis

Institutional Positioning Intelligence

The quarterly volume profile (Q3 2025) reveals critical institutional positioning patterns that provide strategic context for all tactical decisions:

Primary Institutional Accumulation Zone: $62.00-$64.50

- Massive blue volume concentration representing institutional accumulation

- Heaviest volume density occurs at $62.50-$63.50 range

- Current price ($62.25) sits at the lower boundary of this critical zone

- Volume profile width indicates sustained institutional interest over extended period

Secondary Support Levels:

- $60.50-$61.50: Moderate blue volume representing backup institutional support

- $58.00-$59.00: Minimal volume suggesting limited institutional interest

- Below $58.00: Complete volume void indicating institutional evacuation zone

Resistance Structure Analysis:

- $65.00-$66.50: First institutional resistance zone with mixed volume

- $68.00-$70.00: Heavy yellow volume indicating institutional distribution

- $70.00+: Historical distribution zone from Q2 2025 peak

Price Structure Context

Historical Pattern Recognition:

The current positioning mirrors successful institutional accumulation patterns observed in previous commodity cycles. The width and intensity of the $62-64 blue volume zone suggests this represents a major strategic positioning by institutional participants, similar to the Natural Gas accumulation pattern that preceded its successful reversal.

Critical Structure Points:

- Institutional Floor: $62.00 represents the absolute lower boundary of smart money positioning

- Volume Point of Control: $63.25 shows peak institutional activity

- Breakout Level: $64.50 marks the upper boundary requiring institutional continuation

- Void Zone: $58-60 represents dangerous territory with minimal institutional backing

Execution Chart Technical Analysis

Current Technical Configuration

DEMA Analysis - CRITICAL WARNING SIGNAL:

- Black Line (Fast DEMA 12): Currently at $62.25

- Orange Line (Slow DEMA 20): Currently at $62.50

- Configuration: Bearish crossover confirmed (black below orange)

- Trend Bias: Technical momentum now bearish despite institutional support

DMI/ADX Assessment:

- ADX Level: 40+ indicating strong directional movement

- +DI vs -DI: -DI gaining dominance over +DI

- Momentum Direction: Confirming the DEMA bearish bias

- Trend Strength: High ADX suggests this technical shift has conviction

Stochastic Analysis:

- Tactical Stochastic (5,3,3): Oversold territory providing potential bounce signal

- Strategic Stochastic (50,3,3): Still showing bearish momentum

- Divergence: Mixed signals between timeframes creating uncertainty

Support and Resistance Levels

Immediate Technical Levels:

- Current Resistance: $62.75 (DEMA 20 orange line)

- Key Resistance: $63.25 (institutional volume POC)

- Major Resistance: $64.00 (upper institutional boundary)

- Immediate Support: $61.75 (recent swing low)

- Critical Support: $61.25 (institutional floor approach)

- Emergency Support: $60.50 (secondary institutional zone)

Trading Scenarios and Setup Criteria

Scenario 1: Bullish Reversal Setup

Required Conditions for Long Entry:

- DEMA recrossover: Black line must cross back above orange line

- DMI confirmation: +DI must regain dominance over -DI

- ADX maintenance: Strong directional reading above 25-30

- Volume respect: Price must hold above $62.00 institutional floor

- Stochastic alignment: Both tactical and strategic stochastics showing bullish divergence

Entry Protocol:

- Primary Entry: $62.50-$63.00 upon DEMA bullish recrossover

- Secondary Entry: $62.00-$62.25 if institutional floor holds with technical improvement

- Position Sizing: 2% account risk maximum given conflicted signals

- Stop Loss: Below $61.50 (institutional support violation)

Profit Targets:

- Target 1: $65.00 (first institutional resistance) - Take 50% profits

- Target 2: $67.00 (major resistance zone) - Take 25% profits

- Target 3: $68.50-$70.00 (distribution zone) - Trail remaining 25%

Scenario 2: Bearish Breakdown Setup

Short Entry Conditions:

- DEMA bearish continuation: Black line accelerating below orange line

- Volume violation: Price breaking below $62.00 institutional floor

- DMI confirmation: -DI expanding lead over +DI

- ADX persistence: Maintaining strong directional bias

Short Setup Parameters:

- Entry Range: $61.50-$61.75 on institutional support breakdown

- Stop Loss: Above $62.75 (failed breakdown)

- Targets: $60.00, $58.50, $57.00 (volume void zones)

- Risk Management: Tight stops given counter-institutional positioning

Scenario 3: Range-Bound Consolidation

Sideways Trading Framework:

- Range Definition: $62.00-$64.50 (institutional accumulation zone)

- Long Zone: $62.00-$62.50 (lower boundary)

- Short Zone: $63.75-$64.50 (upper boundary)

- Stop Distance: 0.5-0.75 points ($500-$750 per contract)

- Profit Target: Opposite range boundary

Risk Management Protocols

Position Sizing Guidelines

Conservative Approach (Recommended):

- Maximum Risk: 1.5% of account (reduced from standard 2% due to technical/institutional conflict)

- Contract Calculation: Account Size × 0.015 ÷ (Stop Distance × $10)

- Example: $100,000 account with $0.75 stop = 200 contracts maximum

Stop Loss Hierarchy

- Tactical Stop: $61.75 (execution chart support)

- Strategic Stop: $61.50 (institutional boundary approach)

- Emergency Stop: $60.75 (institutional floor violation)

Time-Based Risk Controls

Monitoring Requirements:

- Daily: DEMA relationship and institutional level respect

- 4-Hour: DMI momentum shifts and ADX strength

- Hourly: Stochastic divergence patterns

- Exit Timeline: 10 trading days maximum if no clear resolution

Market Context and External Factors

Fundamental Considerations

Supply/Demand Dynamics:

- OPEC+ production decisions impacting supply outlook

- US Strategic Petroleum Reserve policies

- China demand recovery prospects

- Refinery maintenance season effects (September-October)

Geopolitical Factors:

- Middle East tension levels affecting risk premiums

- US-Iran relations impacting supply disruption concerns

- Russia-Ukraine conflict ongoing effects on global energy flows

Seasonal Patterns

September-October Considerations:

- End of summer driving season typically bearish for demand

- Hurricane season potential for supply disruptions

- Heating oil demand preparation potentially supportive

- Refinery turnaround season creating temporary supply tightness

Monitoring Checklist and Alert Levels

Daily Monitoring Requirements

- DEMA Status: Track black vs orange line relationship

- Institutional Respect: Confirm price behavior at $62.00 floor

- Volume Analysis: Monitor any changes in accumulation patterns

- External Events: EIA inventory reports, Fed policy statements

- Correlation Analysis: Monitor relationship with dollar strength and equity markets

Critical Alert Levels

Bullish Alerts:

- DEMA bullish recrossover above $62.50

- Strong bounce from $62.00 institutional floor

- +DI reclaiming dominance over -DI

- Break above $64.50 with volume confirmation

Bearish Alerts:

- Break below $62.00 institutional floor

- DEMA gap expansion (black line diverging from orange)

- Volume breakdown below secondary support at $60.50

- ADX above 50 with strong -DI dominance

Conclusion and Strategic Outlook

WTI Crude Oil presents a classic conflict between institutional positioning and technical momentum. The quarterly volume profile provides unambiguous evidence of major institutional accumulation at current levels, yet execution chart technical deterioration cannot be ignored. This scenario requires heightened vigilance and reduced position sizing until technical and institutional signals realign. The institutional floor at $62.00 represents the critical decision point - respect of this level with technical improvement offers exceptional risk/reward opportunities, while violation signals potential deeper correction despite smart money positioning.

Strategic Recommendation: Defensive positioning with readiness to capitalize on either directional resolution. Prioritize capital preservation while maintaining alert status for high-probability setups upon signal alignment.

Next Review: Daily assessment of DEMA configuration and institutional level respect

Document Status: Active monitoring required - conflicted signals demanding careful attention

Important Disclaimer

Risk Warning and Educational Purpose Statement

This analysis is provided for educational and informational purposes only and does not constitute financial advice, investment recommendations, or trading signals. All trading and investment decisions are solely the responsibility of the individual trader or investor.

Key Risk Considerations:

- Futures trading involves substantial risk of loss and is not suitable for all investors

- Past performance does not guarantee future results

- Market conditions can change rapidly, invalidating any analysis

- Leverage can amplify both profits and losses significantly

- Individual financial circumstances and risk tolerance vary greatly

Professional Guidance: Before making any trading decisions, consult with qualified financial advisors, conduct your own research, and ensure you fully understand the risks involved. Only trade with capital you can afford to lose.

Methodology Limitations: Volume profile analysis and technical indicators are tools for market assessment but are not infallible predictors of future price movement. Market dynamics include numerous variables that cannot be fully captured in any single analytical framework.

The views and analysis presented represent one interpretation of market data and should be considered alongside other forms of analysis and individual judgment.

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.