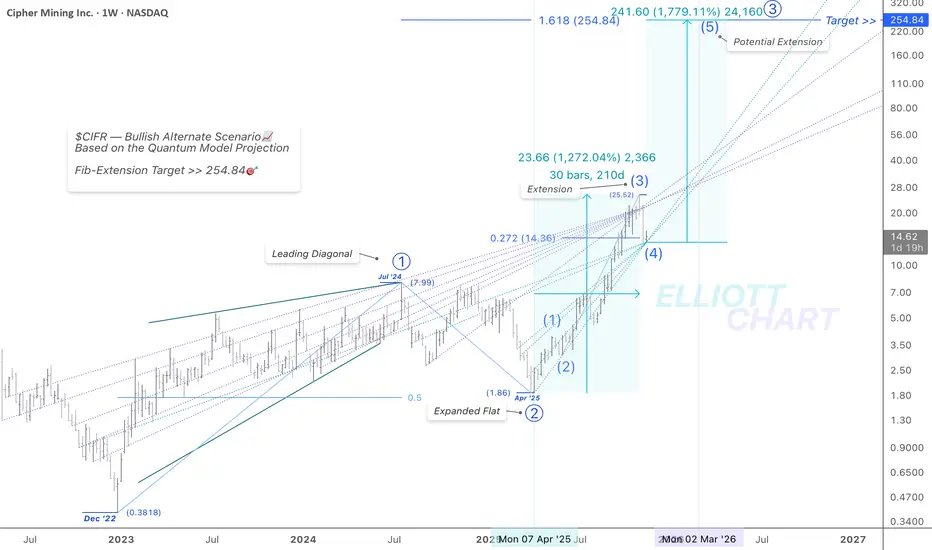

Bullish Alternative — Weekly

As outlined earlier (Nov. 15), Intermediate Wave (4) retraced sharply into the $14.36 target last week and is now resting at the apex of the support equivalence lines.

While there is still room for Intermediate Wave (4) to further evolve into a Flat or Triangle correction, an eventual extension into Intermediate Wave (5) within Primary Wave ⓷ projects toward $254🎯. This aligns with the zone defined by the divergent equivalence lines, marking the 1.618 Fibonacci extension of the Leading Diagonal that formed Primary Wave ⓵ — a structurally bullish formation.

🔖 In my Quantum Models methodology, the equivalence lines function as structural elements, anchoring the model’s internal geometry and framing the progression of alternate paths.

#MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #TradingView #Investing #CIFR #DataCenters #BitcoinMining #HPC #CryptoMining #CipherMining #BTC #Bitcoin #BTCUSD

#HighPerformanceComputing

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.