CHF/JPY – 1 Hour Technical & Fundamental Analysis

Fundamental Overview:

The Swiss National Bank (SNB) continues to benefit from Switzerland’s strong external balance, fiscal discipline, and safe-haven appeal — all of which support the Swiss Franc (CHF).

Meanwhile, the Bank of Japan (BoJ) remains relatively dovish, keeping the Japanese Yen (JPY) on the defensive. This ongoing policy divergence makes CHF/JPY structurally biased to the upside over the medium term.

Technical Outlook (1H):

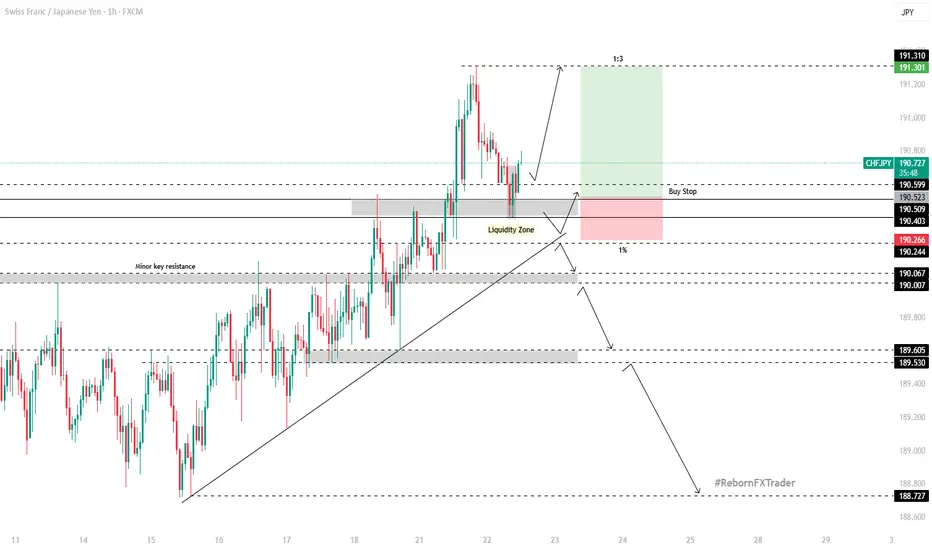

On the technical side, CHF/JPY recently broke above a key resistance level around 190.000, confirming a strong bullish structure within an ascending channel.

The pair continues to print higher highs and higher lows, maintaining bullish momentum until a clear break of structure (BOS) is seen.

The latest BOS occurred around 190.400, where buyers stepped in, signaling renewed upward interest.

Our trading plan:

🎯 Entry (Buy Stop): 190.500 (above BOS)

🛑 Stop-Loss: 190.250 (below liquidity zone)

💰 Take Profit: 191.300 (next key resistance zone)

We anticipate a liquidity grab below the liquidity zone before the next upward move.

Once a bullish confirmation candle (e.g., bullish engulfing) forms near that area on lower timeframes, it could provide a valid entry signal.

Alternative Scenario:

If price breaks below the previous key resistance, which now acts as support, we could see a short-term pullback or decline.

Additionally, if the BoJ signals a surprise hawkish shift, Yen strength could temporarily reverse the bullish bias.

⚠️ Disclaimer:

This analysis is provided for educational and informational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Always conduct your own research and manage your risk appropriately.

Fundamental Overview:

The Swiss National Bank (SNB) continues to benefit from Switzerland’s strong external balance, fiscal discipline, and safe-haven appeal — all of which support the Swiss Franc (CHF).

Meanwhile, the Bank of Japan (BoJ) remains relatively dovish, keeping the Japanese Yen (JPY) on the defensive. This ongoing policy divergence makes CHF/JPY structurally biased to the upside over the medium term.

Technical Outlook (1H):

On the technical side, CHF/JPY recently broke above a key resistance level around 190.000, confirming a strong bullish structure within an ascending channel.

The pair continues to print higher highs and higher lows, maintaining bullish momentum until a clear break of structure (BOS) is seen.

The latest BOS occurred around 190.400, where buyers stepped in, signaling renewed upward interest.

Our trading plan:

🎯 Entry (Buy Stop): 190.500 (above BOS)

🛑 Stop-Loss: 190.250 (below liquidity zone)

💰 Take Profit: 191.300 (next key resistance zone)

We anticipate a liquidity grab below the liquidity zone before the next upward move.

Once a bullish confirmation candle (e.g., bullish engulfing) forms near that area on lower timeframes, it could provide a valid entry signal.

Alternative Scenario:

If price breaks below the previous key resistance, which now acts as support, we could see a short-term pullback or decline.

Additionally, if the BoJ signals a surprise hawkish shift, Yen strength could temporarily reverse the bullish bias.

⚠️ Disclaimer:

This analysis is provided for educational and informational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Always conduct your own research and manage your risk appropriately.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.