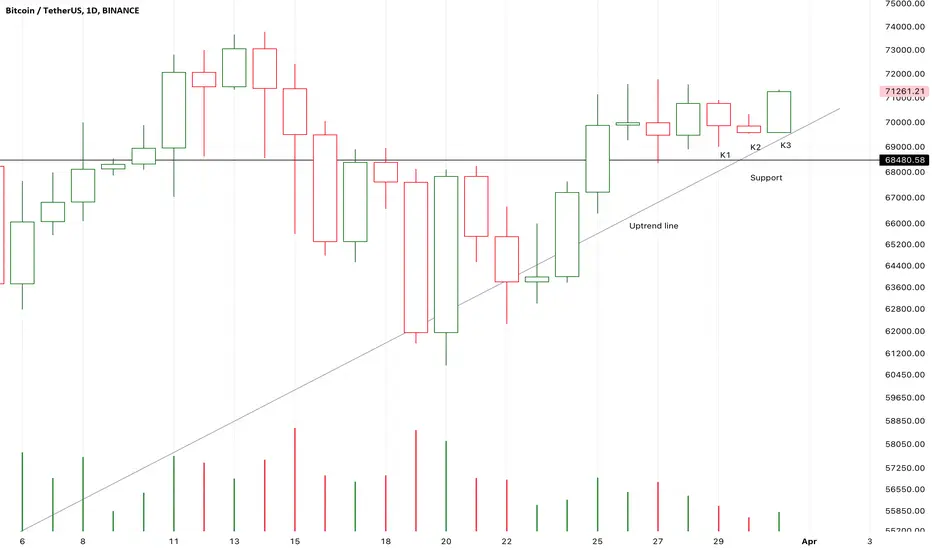

K3 is breaking up the dead corner.

The market chose a direction to climb up.

From K1 to K3, it is a strong bullish morning star pattern.

It is likely that K3 will close upon K1.

So, it still worth to buy in.

The historic highest price 69K and the nearest uptrend line is the potential support.

It is still worth to hold for a long time.

The market is healthy.

노트

K6 couldn’t close below K5 under a sharply increased volume,

It verified that the support is effective.

If K7 break up K6,

It still worth to buy in.

On the other hand,

K5 and K6 is also a bearish dark cloud cover pattern.

If the following candles couldn’t close below K2 to verify it,

K6 will be a final test to the support,

And the supply pressure will be exhausted here.

I think there is nothing to worry here.

Perhaps I was wrong,

I hope so,

And it will be a good lesson for me.

노트

My previous analysis was totally wrong.

It is really a big loss for me.

I can do nothing here but waiting for more signals.

K2 break down and close below K1,

It verified a short-term downtrend.

If the following candles keep dropping to close below the support,

The risk will sharply increase.

If the following candles could stay here and consolidate for days,

The bearish momentum will be interrupted.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.