Hello👋 dear traders. I am Pejman👦, and today I want to explain the types of markets📈 with another story from TradingView🎢.

Maybe you love the world of animation👶 like me, and I'm trying to make the trading world as beautiful and colorful as the animation👶 world🌍. So let's dive into another Tradingview🎢 land story.

Once upon a time⏳, in Hundred Acre Wood, Christopher Robin decides to go to Stocktopia to live with other traders and try to learn trading skills📉.

Since Winnie the Pooh🧸 likes Christopher Robin very much, he and his friends decided to go with him and move to the city🌆 of Stocktopia.

They all knew that the path might be long and complicated😢, so they decided to compare different Types of Markets📈 and talk about markets📈 along the way🛣.

Do you know the Wise Owl 🦉? He always has many experiences of everything and explains them loudly.

On the other hand, he had a lot of experience in technical analysis and said: When I was a beginner, I was baffled😟 and even lost a lot of money🤑 because I didn't have a good perception of the market📈.

When my buy orders were filled, the stock would face a crash💥. And when I was selling, green candles📊 jumped one after the other. Annoying!😡

I only found out why when I went to Stocktopia and realized that the market📈 has its own types.

Trends are essential in the market📈, and you need to learn to recognize trends. For training, first, I had to know what technical analysis📊 and its benefits are.

There was a moment something caught my eyes👁 when I was surfing🏄♂️ on a website called “Tradingview,” and I opened the post to see what technical analysis is.👇

During my trading, I learned three types of markets📈. Bullish🟢, Bearish🔴 & Range market📈.

Tiger🐯: Whoo Whoo Whoooooo! I liked the name of the Bullish trend🟢. Can we start from that first? What is a Bullish trend🟢?

The Wise Owl🦉 showed Tiger🐯 a chart from the book that was with him and said:

Dear Tiger🐯, to find a Bullish🟢 market📈, you must first draw a trendline like a dynamic support trend line.

Do you remember dynamic support and resistance lines? If you don't know these lines, it is better to read the story of Princess👸 Snow❄️White Chart and Trader Dwarfs before hearing the story of the market📈 types.👇

By the way, the Bullish🟢 market📈 is very similar to Tiger🐯. In the Bullish 🟢trend, buyers are happy and positive emotions are seen in the market📈 atmosphere.

There are more buyers than sellers. That is, buyers hope for the growth of a stock.

In the Bullish trend🟢, you must be fast, so that you don’t lose opportunities.

As you can see in the chart, the price inflates more like a balloon🎈. It goes Higher High (HH)every time and forms a Higher Low(HL)🗻 than the previous one.

But no Bullish trend🟢 is permanent.

The market📈 will experience a crash eventually. So you have to be smart because shopping will only sometimes be profitable. You will get bloody candles if you wait to buy them in time.

The Wise Owl 🦉 continued: The Bullish market📈 has conditions that I will explain based on my experience:

This type of trend is called a Bullish market📈 because when the bulls🟢 want to attack, they raise their horns from the bottom to the top. And the buyers increase the stock higher and higher by buying.

Christopher Robin asked: What if Higher High(HH) doesn’t touch the previous High🗻?

The Wise Owl🦉 said: This is a sign of a strong Bullish trend🟢. If you see such an event, prepare your dollars for shopping. Does anyone have any other questions?

Eeyore said: What is the trend of Bearish🔴? Why is it named like this?

Wise Owl🦉: How interesting that Eeyore himself asked this question because the Bearish trend🔴 is exactly like Eeyore. Ivor John has some negative feelings about him.

Shareholders also feel disappointment😩 and fear😱 in the trend. Because of this, the number of buyers decreases, and the number of sellers increases.

Candles turn red like roses🌹; the more sellers there are, the bigger this red flower garden🏡 will be.

Highs and Lows🗻 form one after the other lower⬇️ and lower⬇️.

In a downward trend🔻, if you are in a one-sided market📈, you should sell your shares, but if the market📈 is two-sided, you can present yourself for a sell/short position.

In this trend, negative emotions may dominate the market📈, but sellers will be happy.

Like the upward trend, the downward trend also has its conditions. Can you guess them before I say them?

Po said: Ah, in the growth trend, each High🗻 should be formed lower⬇️ than the previous High(LH)🗻, and each Low should be formed below the previous one(LL).

On the other hand, if the price falls below a Low in the downward trend, it is better not to return above that Low.

The Wise Owl🦉: It was great, Pooh🧸. Now let's take a look at this Bearish trend🔴 chart.

As you can see, there is no news of going up(HH)🔺 in downward trends🔻. Instead, we see Lower Lows(LL) and Lower Highs(LH).

But the market📈 is only sometimes bullish🟢 or consistently bearish🔴. Does anyone remember the name of the third type of market📈 that I mentioned?

Piglet answered with a bit of stress: Ummm, I think it was Range Market📈.

Wise Owl🦉: Hohohoho, you are right, Piglet. But don't be afraid and don't stress because this market📈 has no particular trend.

If you looked at the chart and could not find an upward🔺 or downward trend🔻, the sea market📈 is tame, and no waves move the candles up🔺 or down🔻.

The number of buyers and sellers in the Range market📈 is almost equal. In the market📈, Range traders are like piglets.

A group of them have hope for stocks and buy with confidence, and another group is still afraid, like piglets, and thinks that the value of their shares may decrease. So they sell it.

Neither bears🔴 or bulls🟢 win in the Range market📈 because they need more trading volume to pull the market📈 in the same direction and form a strong up🔺 or down🔻 movement.

In the market📈, the price range is involved in two Ranges: buy or demand Range and sell or supply Range.

The support zone pushes the price upwards🔺 in the buying Range, but the resistance one does not allow the price to advance.

Therefore, the price is passed between these Ranges like a yo-yo until one of the parties enters more volume and breaks this price compression. The head will run away from one side when the price is done.

As you can see in the picture, finally, the sellers ran away from the price :) And the bears🔴 won over the bulls🟢.

Rabbit: I have heard that most financial markets are Range, and it’s more difficult to trade in this type of market. By the way, I don't want to rush, but I guess it's time to tell us the use of all this information.

The Wise Owl🦉 laughed and replied: "Hey, you didn't rush. Now that you are familiar with different types of markets📈, it is time to learn how to trade in these markets📈."

You must first draw trendlines in trending markets📈 to get a general view of the chosen stock📈. Then you can take a position in the direction of the trend.

Be sure to remember that you’re entering at the right points. Take your time, because waiting is a flower that doesn’t grow in everyone's garden.

The owl🦉 opened a new page and showed a downward trend🔻, which later turned into an upward trend🔺. Owl🦉 continued:

As you can see from the chart below, the price is caught under the bears' claws, and the market📈 is bearish🔴. It has formed Lower Lows(LL) and Lower Highs(LH).

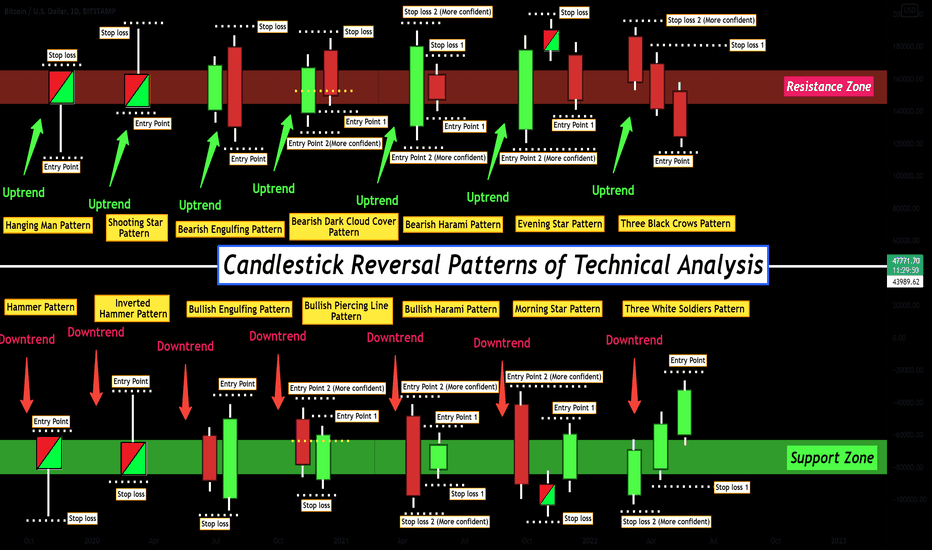

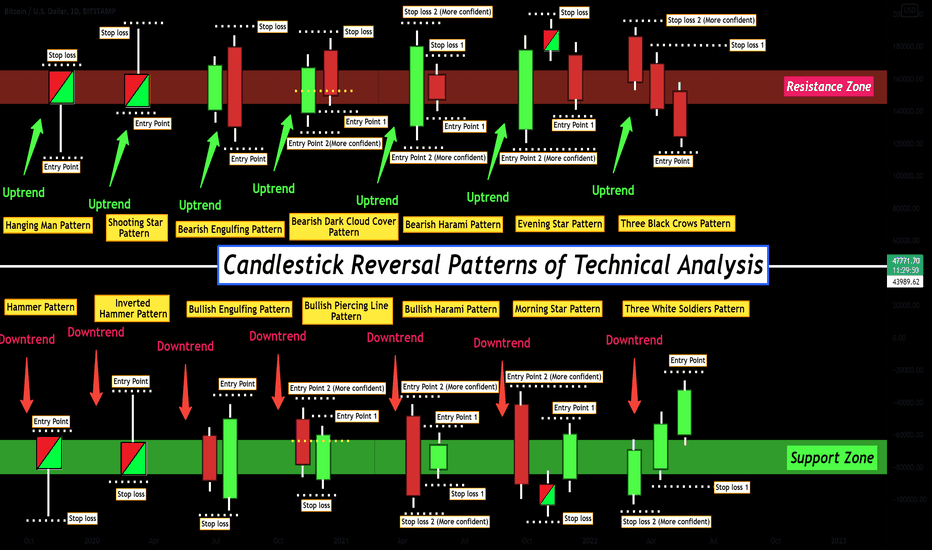

But after the Bullish engulfing candlestick pattern, the trend changed and turned into a Bullish🟢 market📈.

If you want to learn about candlesticks and how to trade with them, you can go to the following post because I have collected how to trade with all candlestick patterns in this post.👇

As you know, the more the price collides with a trendline📈, the more valid the trendline will be. So these lines📈 will become valuable, like support or resistance lines📉.

In this example, we learned how effective candlesticks could be in identifying or finding the end of trends.

Now it's the turn of the Range market📈, and it is possible to trade in this market📈 considering the volatility of the trend.

In the Range market📈, as I said, the price is like a small fish🐠 stuck in a fast Eeyore.

The flow of water💧 and the flow of buyers and sellers move this fish🐠 into the Eeyore bed🛌.

As a trader, if you want to catch fish🐠 from this water, you must wait until it approaches one of the Eeyore beds🛌.

Up🔺 or down🔻 bed, i.e., support line or resistance line. You can buy when you see the price on the support line, and when you see it on the resistance line, it is time to sell.

Rabbit said: Haha. That is very easy. Buy low and sell high.

The wise owl laughed😂 and said: You are exactly right. Trading in this market📈 may seem simple, but this fish🐠 can escape anytime.

Trading in Range Market📈 is like eating a sandwich🥪. If you press your sandwich🥪 too much, the fillings of the sandwich🥪 maybe spilled out from the top or bottom.

Everyone heard the sound of Po's stomach and laughed😂. Po said: We have been walking for a long time, and I also ate my honey🍯 on the way. How much is left?

Christopher Robin looked around with his camera📸 and said we're finally there. I can see the lights💡 of Trading Wave🌊 Land🎡.

The Wise Owl🦉 continued: Now, knowing the types of markets📈, you can learn more than technical analysis in this land.

All of them went to the land of Trading Wave🌊, happy😊 that they got good information along the way🛣 by heaRange about the experiences of the wise owl.

If you want to learn how to trade well like the people of this land🎡, practice today's tips and join me every week because I have many stories to tell about this market📈.

This land🎡 is full of traders who lost their capital💸 and became disappointed😔 without carefulness and practice. If you don't want to be one of them, remember to manage your capital💸 and training.

I hope you are always healthy and prosperous😎.

Maybe you love the world of animation👶 like me, and I'm trying to make the trading world as beautiful and colorful as the animation👶 world🌍. So let's dive into another Tradingview🎢 land story.

Once upon a time⏳, in Hundred Acre Wood, Christopher Robin decides to go to Stocktopia to live with other traders and try to learn trading skills📉.

Since Winnie the Pooh🧸 likes Christopher Robin very much, he and his friends decided to go with him and move to the city🌆 of Stocktopia.

They all knew that the path might be long and complicated😢, so they decided to compare different Types of Markets📈 and talk about markets📈 along the way🛣.

Do you know the Wise Owl 🦉? He always has many experiences of everything and explains them loudly.

On the other hand, he had a lot of experience in technical analysis and said: When I was a beginner, I was baffled😟 and even lost a lot of money🤑 because I didn't have a good perception of the market📈.

When my buy orders were filled, the stock would face a crash💥. And when I was selling, green candles📊 jumped one after the other. Annoying!😡

I only found out why when I went to Stocktopia and realized that the market📈 has its own types.

Trends are essential in the market📈, and you need to learn to recognize trends. For training, first, I had to know what technical analysis📊 and its benefits are.

There was a moment something caught my eyes👁 when I was surfing🏄♂️ on a website called “Tradingview,” and I opened the post to see what technical analysis is.👇

During my trading, I learned three types of markets📈. Bullish🟢, Bearish🔴 & Range market📈.

Tiger🐯: Whoo Whoo Whoooooo! I liked the name of the Bullish trend🟢. Can we start from that first? What is a Bullish trend🟢?

The Wise Owl🦉 showed Tiger🐯 a chart from the book that was with him and said:

Dear Tiger🐯, to find a Bullish🟢 market📈, you must first draw a trendline like a dynamic support trend line.

Do you remember dynamic support and resistance lines? If you don't know these lines, it is better to read the story of Princess👸 Snow❄️White Chart and Trader Dwarfs before hearing the story of the market📈 types.👇

By the way, the Bullish🟢 market📈 is very similar to Tiger🐯. In the Bullish 🟢trend, buyers are happy and positive emotions are seen in the market📈 atmosphere.

There are more buyers than sellers. That is, buyers hope for the growth of a stock.

In the Bullish trend🟢, you must be fast, so that you don’t lose opportunities.

As you can see in the chart, the price inflates more like a balloon🎈. It goes Higher High (HH)every time and forms a Higher Low(HL)🗻 than the previous one.

But no Bullish trend🟢 is permanent.

The market📈 will experience a crash eventually. So you have to be smart because shopping will only sometimes be profitable. You will get bloody candles if you wait to buy them in time.

The Wise Owl 🦉 continued: The Bullish market📈 has conditions that I will explain based on my experience:

- Each Low should be at least one step higher than the previous one and make a Higher Low(HL) like the Tiger🐯.

- Usually, each High🗻 is formed one step Higher High(HH) than the previous one.

- Preferably, when the price rises above a High🗻, it is better not to return below it.

This type of trend is called a Bullish market📈 because when the bulls🟢 want to attack, they raise their horns from the bottom to the top. And the buyers increase the stock higher and higher by buying.

Christopher Robin asked: What if Higher High(HH) doesn’t touch the previous High🗻?

The Wise Owl🦉 said: This is a sign of a strong Bullish trend🟢. If you see such an event, prepare your dollars for shopping. Does anyone have any other questions?

Eeyore said: What is the trend of Bearish🔴? Why is it named like this?

Wise Owl🦉: How interesting that Eeyore himself asked this question because the Bearish trend🔴 is exactly like Eeyore. Ivor John has some negative feelings about him.

Shareholders also feel disappointment😩 and fear😱 in the trend. Because of this, the number of buyers decreases, and the number of sellers increases.

Candles turn red like roses🌹; the more sellers there are, the bigger this red flower garden🏡 will be.

Highs and Lows🗻 form one after the other lower⬇️ and lower⬇️.

In a downward trend🔻, if you are in a one-sided market📈, you should sell your shares, but if the market📈 is two-sided, you can present yourself for a sell/short position.

In this trend, negative emotions may dominate the market📈, but sellers will be happy.

Like the upward trend, the downward trend also has its conditions. Can you guess them before I say them?

Po said: Ah, in the growth trend, each High🗻 should be formed lower⬇️ than the previous High(LH)🗻, and each Low should be formed below the previous one(LL).

On the other hand, if the price falls below a Low in the downward trend, it is better not to return above that Low.

The Wise Owl🦉: It was great, Pooh🧸. Now let's take a look at this Bearish trend🔴 chart.

As you can see, there is no news of going up(HH)🔺 in downward trends🔻. Instead, we see Lower Lows(LL) and Lower Highs(LH).

But the market📈 is only sometimes bullish🟢 or consistently bearish🔴. Does anyone remember the name of the third type of market📈 that I mentioned?

Piglet answered with a bit of stress: Ummm, I think it was Range Market📈.

Wise Owl🦉: Hohohoho, you are right, Piglet. But don't be afraid and don't stress because this market📈 has no particular trend.

If you looked at the chart and could not find an upward🔺 or downward trend🔻, the sea market📈 is tame, and no waves move the candles up🔺 or down🔻.

The number of buyers and sellers in the Range market📈 is almost equal. In the market📈, Range traders are like piglets.

A group of them have hope for stocks and buy with confidence, and another group is still afraid, like piglets, and thinks that the value of their shares may decrease. So they sell it.

Neither bears🔴 or bulls🟢 win in the Range market📈 because they need more trading volume to pull the market📈 in the same direction and form a strong up🔺 or down🔻 movement.

In the market📈, the price range is involved in two Ranges: buy or demand Range and sell or supply Range.

The support zone pushes the price upwards🔺 in the buying Range, but the resistance one does not allow the price to advance.

Therefore, the price is passed between these Ranges like a yo-yo until one of the parties enters more volume and breaks this price compression. The head will run away from one side when the price is done.

As you can see in the picture, finally, the sellers ran away from the price :) And the bears🔴 won over the bulls🟢.

Rabbit: I have heard that most financial markets are Range, and it’s more difficult to trade in this type of market. By the way, I don't want to rush, but I guess it's time to tell us the use of all this information.

The Wise Owl🦉 laughed and replied: "Hey, you didn't rush. Now that you are familiar with different types of markets📈, it is time to learn how to trade in these markets📈."

You must first draw trendlines in trending markets📈 to get a general view of the chosen stock📈. Then you can take a position in the direction of the trend.

Be sure to remember that you’re entering at the right points. Take your time, because waiting is a flower that doesn’t grow in everyone's garden.

The owl🦉 opened a new page and showed a downward trend🔻, which later turned into an upward trend🔺. Owl🦉 continued:

As you can see from the chart below, the price is caught under the bears' claws, and the market📈 is bearish🔴. It has formed Lower Lows(LL) and Lower Highs(LH).

But after the Bullish engulfing candlestick pattern, the trend changed and turned into a Bullish🟢 market📈.

If you want to learn about candlesticks and how to trade with them, you can go to the following post because I have collected how to trade with all candlestick patterns in this post.👇

As you know, the more the price collides with a trendline📈, the more valid the trendline will be. So these lines📈 will become valuable, like support or resistance lines📉.

In this example, we learned how effective candlesticks could be in identifying or finding the end of trends.

Now it's the turn of the Range market📈, and it is possible to trade in this market📈 considering the volatility of the trend.

In the Range market📈, as I said, the price is like a small fish🐠 stuck in a fast Eeyore.

The flow of water💧 and the flow of buyers and sellers move this fish🐠 into the Eeyore bed🛌.

As a trader, if you want to catch fish🐠 from this water, you must wait until it approaches one of the Eeyore beds🛌.

Up🔺 or down🔻 bed, i.e., support line or resistance line. You can buy when you see the price on the support line, and when you see it on the resistance line, it is time to sell.

Rabbit said: Haha. That is very easy. Buy low and sell high.

The wise owl laughed😂 and said: You are exactly right. Trading in this market📈 may seem simple, but this fish🐠 can escape anytime.

Trading in Range Market📈 is like eating a sandwich🥪. If you press your sandwich🥪 too much, the fillings of the sandwich🥪 maybe spilled out from the top or bottom.

Everyone heard the sound of Po's stomach and laughed😂. Po said: We have been walking for a long time, and I also ate my honey🍯 on the way. How much is left?

Christopher Robin looked around with his camera📸 and said we're finally there. I can see the lights💡 of Trading Wave🌊 Land🎡.

The Wise Owl🦉 continued: Now, knowing the types of markets📈, you can learn more than technical analysis in this land.

All of them went to the land of Trading Wave🌊, happy😊 that they got good information along the way🛣 by heaRange about the experiences of the wise owl.

If you want to learn how to trade well like the people of this land🎡, practice today's tips and join me every week because I have many stories to tell about this market📈.

This land🎡 is full of traders who lost their capital💸 and became disappointed😔 without carefulness and practice. If you don't want to be one of them, remember to manage your capital💸 and training.

I hope you are always healthy and prosperous😎.

노트

Did you read a new story (new lesson)?🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.