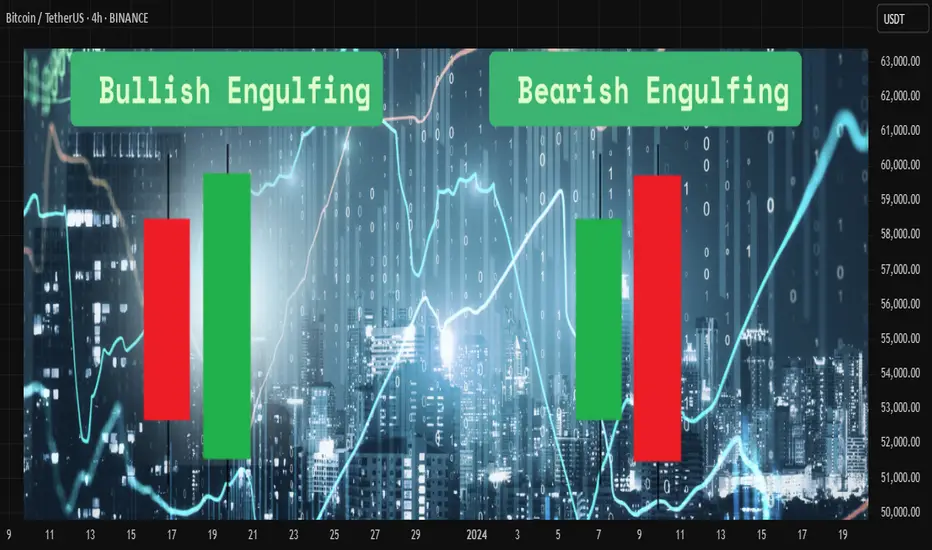

the engulfing candlestick pattern is a powerful price action signal used by traders to identify potential reversals in the market. it consists of two candles:

🟢 bullish engulfing

* occurs during a downtrend

* the first candle is bearish (red)

* the second candle is bullish (green) and completely engulfs the body of the first candle

* it signals a potential reversal to the upside

🔴 bearish engulfing

* occurs during an uptrend

* the first candle is bullish (green)

* the second candle is bearish (red) and completely engulfs the body of the first candle

* it signals a potential reversal to the downside

📍 key points to remember

* the second candle must fully engulf the body (not just the wicks) of the first candle

* higher volume during the engulfing candle increases its reliability

* it works best when combined with support and resistance levels or trendlines

💡 confirmation

always wait for confirmation before entering a trade. for bullish engulfing, a break above the high of the engulfing candle is ideal. for bearish engulfing, a break below the low adds strength to the signal.

📈 How to use it ?

many traders use this pattern as part of their entry or exit strategy. combining engulfing patterns with indicators like rsi, moving averages, or trend filters can improve accuracy.

⚠️ risk management

like any pattern, engulfing candles are not 100% accurate. always use proper risk management and stop-loss placement to protect your capital.

Disclaimer :

This Video is not financial advice, it's for educational purposes only highlighting the power of coding( pine script) in TradingView, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

🟢 bullish engulfing

* occurs during a downtrend

* the first candle is bearish (red)

* the second candle is bullish (green) and completely engulfs the body of the first candle

* it signals a potential reversal to the upside

🔴 bearish engulfing

* occurs during an uptrend

* the first candle is bullish (green)

* the second candle is bearish (red) and completely engulfs the body of the first candle

* it signals a potential reversal to the downside

📍 key points to remember

* the second candle must fully engulf the body (not just the wicks) of the first candle

* higher volume during the engulfing candle increases its reliability

* it works best when combined with support and resistance levels or trendlines

💡 confirmation

always wait for confirmation before entering a trade. for bullish engulfing, a break above the high of the engulfing candle is ideal. for bearish engulfing, a break below the low adds strength to the signal.

📈 How to use it ?

many traders use this pattern as part of their entry or exit strategy. combining engulfing patterns with indicators like rsi, moving averages, or trend filters can improve accuracy.

⚠️ risk management

like any pattern, engulfing candles are not 100% accurate. always use proper risk management and stop-loss placement to protect your capital.

Disclaimer :

This Video is not financial advice, it's for educational purposes only highlighting the power of coding( pine script) in TradingView, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

Shivam mandai

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

Shivam mandai

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.