Overall trends continue to develop within the macro structures outlined in previous weekly reviews. Some assets (BNB, SOL, HYPE) are already in new uptrends, while others are only starting to form the first impulsive moves within broader bullish structures.

In the coming days, I expect local downside pressure to complete the ongoing September corrections, followed by a continuation of the uptrend toward target resistance zones. Another wave of Autumn consolidation is likely to follow afterward.

From a macro perspective, as long as prices hold above their key support zones, I continue to view the September lows as important macro higher-lows. Below these levels, most coins (possibly with the exception of ETH) are unlikely to fall and should instead continue forming higher lows ahead of a more sustainable rally into Q4.

⸻

BNBUSDT

BNBUSDT

Chart:

Support: 1000–930

Resistance: 1135–1150

⸻

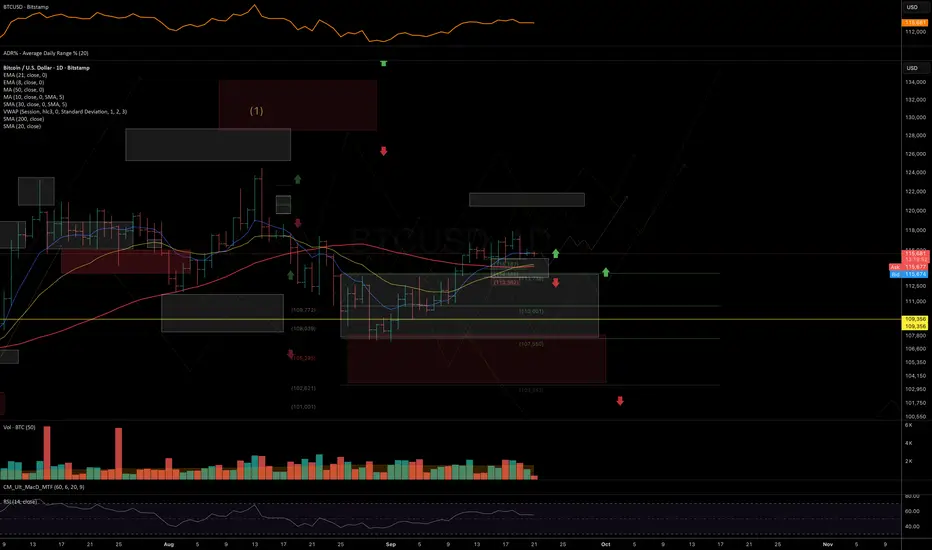

BTCUSDT

BTCUSDT

Chart:

Support: 115–113.3K

Resistance: 120–122K

⸻

XRPUSDT

XRPUSDT

Chart:

Support: 2.97–2.91 / 2.85

Resistance: 3.30–3.40

⸻

ETHUSDT

ETHUSDT

Chart:

Support: 3380

Resistance: 5060–5235

⸻

SOLUSDT

SOLUSDT

Chart:

Support: 230–223

Resistance: 285–310

⸻

$HYPEHUSDT

Chart:

Support: 52.5–51

Resistance: 67–73

Feel free to comment which coins and assets you’re most interested in, and I’ll prepare a separate review on them.

Thank you for your attention, and wishing you a successful week ahead!

In the coming days, I expect local downside pressure to complete the ongoing September corrections, followed by a continuation of the uptrend toward target resistance zones. Another wave of Autumn consolidation is likely to follow afterward.

From a macro perspective, as long as prices hold above their key support zones, I continue to view the September lows as important macro higher-lows. Below these levels, most coins (possibly with the exception of ETH) are unlikely to fall and should instead continue forming higher lows ahead of a more sustainable rally into Q4.

⸻

Chart:

Support: 1000–930

Resistance: 1135–1150

⸻

Chart:

Support: 115–113.3K

Resistance: 120–122K

⸻

Chart:

Support: 2.97–2.91 / 2.85

Resistance: 3.30–3.40

⸻

Chart:

Support: 3380

Resistance: 5060–5235

⸻

Chart:

Support: 230–223

Resistance: 285–310

⸻

$HYPEHUSDT

Chart:

Support: 52.5–51

Resistance: 67–73

Feel free to comment which coins and assets you’re most interested in, and I’ll prepare a separate review on them.

Thank you for your attention, and wishing you a successful week ahead!

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.