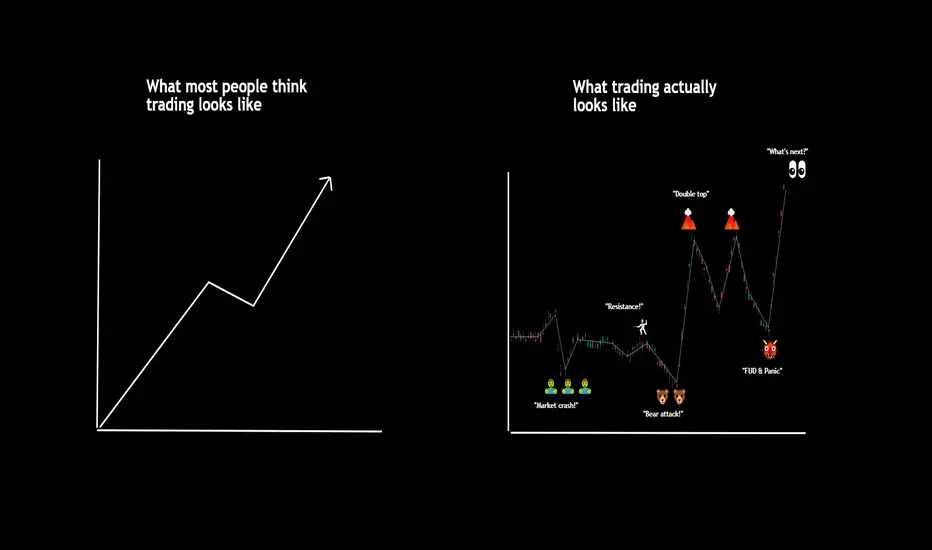

Trading & investing is not easy. If it were, everyone would be rich.

One of the most difficult moments for all traders, and especially investors, is when markets are abnormally bearish, trending downward or in a direction that goes against their positions. Adding to that difficulty is when volatility is rising and when uncertainty is high. These events have occurred throughout market history and should be expected. Every trader or investor should remember a simple truth: markets will go against you at some point. Be prepared.

Learning to trade or invest in bearish and volatile markets requires great skill, experience, and composure. The last 12 months have demonstrated that. Stocks, bonds, forex, crypto, and futures have seen heightened volatility over the last 12 months. So what should we do? What now?

Let's revisit the basics - the skills, traits, and mindset that are required to survive these moments.

1. Plan ahead 🗺

Plan your trade, trade your plan. Every trade, and every investment, should have an underlying plan. Write out the basic questions before you buy or sell. For example, what is your desired entry price? What is your desired exit price? What is your stop loss? How much money are you risking? Why are you making this trade or investment in the first place? In times of volatility, these questions matter more than ever. Get back to the basics.

2. Don't rush 🧘♂️

Volatility, and especially market panic, cause people to make quick reactions. The pressure, the fast price action, often forces people to act without a moment to revisit their original plan. Don't do this! Take your time. Stay composed and deal with the hand you have been dealt.

3. Be patient with entries 🎯

Many traders & investors speak of buying dips, but this phrase does explain the steps required. You don't buy dips without a plan. You plan out your strategy, you wait for the perfect entry, and you let the market come to you. When the market is in a downtrend, and volatility is high, it is paramount that you remain patient, waiting for the perfect entry. Use limit orders wisely.

4. Know your timeframe ⏰

Are you trading for one day? One month? Or 5 years? These basic questions will remind you of what you're trying to accomplish and how rushed or patient you should really be. They will also remind you about the chart you should be looking at, whether you should be zoomed in to a 30-minute chart or zoomed out to a weekly chart, showing years of price history.

5. Have an exit strategy 🚨

An exit strategy means that no matter what happens, you know where your stop loss is and you know where your profit target is. No matter what happens, up or down or sideways, you have an exit plan. Do not leave any entry or exit up to chance. Create your exit strategy before you place the trade and follow it.

6. Tighten position size 💪

Added volatility and uncertainty need to be factored into your game plan before it begins in the first place. However, many new investors and traders forget to do this. If that's you, it's time to adjust your strategy, and your plan, for larger trading ranges, and volatility. The year-long trends that defined a previous market are now less valid.

7. Zoom out for historical context 🔎

Zoom out on your charts. Then keep zooming out. And now zoom out some more. Circle the latest candle, line, or price movement and let it serve as a reminder about where the price is today vs. where it came from. There's a saying: when in doubt, zoom out. Do not get lost in the moment, looking only at the day or week, but instead go research the entire history of price. Learn about what has happened in the past.

8. Cash is a position 💸

Want to dollar cost average into a trade? Want to buy more? Want to trade more? You need cash to do that. There is comfort in being able to participate in the volatility whenever you want. Cash is a position and guarantees this.

9. Avoid panic, FUD, and FOMO 😳

When emotions are running high, some of the biggest psychological mistakes can occur. FUD stands for fear, uncertainty, and doom. FOMO stands for fear of missing out. These are two common emotions in crashing markets. On one hand, everyone thinks the end is near and then on the other hand every little up move is the next bull run. Do not let these emotions take you.

10. Take a break 😀

Sometimes it helps to step away. Log out, close your apps, get outside and get some exercise. Come back to the markets when you're ready. Your mind will also be well rested now.

We hope you enjoyed this post and we hope it helps you as you navigate the markets.

Please feel free to write any additional tips or pieces of advice in the comments section below!

See you all next week. 🙂

– Team TradingView

Do check us out on Instagram and YouTube for more awesome content! 💘

One of the most difficult moments for all traders, and especially investors, is when markets are abnormally bearish, trending downward or in a direction that goes against their positions. Adding to that difficulty is when volatility is rising and when uncertainty is high. These events have occurred throughout market history and should be expected. Every trader or investor should remember a simple truth: markets will go against you at some point. Be prepared.

Learning to trade or invest in bearish and volatile markets requires great skill, experience, and composure. The last 12 months have demonstrated that. Stocks, bonds, forex, crypto, and futures have seen heightened volatility over the last 12 months. So what should we do? What now?

Let's revisit the basics - the skills, traits, and mindset that are required to survive these moments.

1. Plan ahead 🗺

Plan your trade, trade your plan. Every trade, and every investment, should have an underlying plan. Write out the basic questions before you buy or sell. For example, what is your desired entry price? What is your desired exit price? What is your stop loss? How much money are you risking? Why are you making this trade or investment in the first place? In times of volatility, these questions matter more than ever. Get back to the basics.

2. Don't rush 🧘♂️

Volatility, and especially market panic, cause people to make quick reactions. The pressure, the fast price action, often forces people to act without a moment to revisit their original plan. Don't do this! Take your time. Stay composed and deal with the hand you have been dealt.

3. Be patient with entries 🎯

Many traders & investors speak of buying dips, but this phrase does explain the steps required. You don't buy dips without a plan. You plan out your strategy, you wait for the perfect entry, and you let the market come to you. When the market is in a downtrend, and volatility is high, it is paramount that you remain patient, waiting for the perfect entry. Use limit orders wisely.

4. Know your timeframe ⏰

Are you trading for one day? One month? Or 5 years? These basic questions will remind you of what you're trying to accomplish and how rushed or patient you should really be. They will also remind you about the chart you should be looking at, whether you should be zoomed in to a 30-minute chart or zoomed out to a weekly chart, showing years of price history.

5. Have an exit strategy 🚨

An exit strategy means that no matter what happens, you know where your stop loss is and you know where your profit target is. No matter what happens, up or down or sideways, you have an exit plan. Do not leave any entry or exit up to chance. Create your exit strategy before you place the trade and follow it.

6. Tighten position size 💪

Added volatility and uncertainty need to be factored into your game plan before it begins in the first place. However, many new investors and traders forget to do this. If that's you, it's time to adjust your strategy, and your plan, for larger trading ranges, and volatility. The year-long trends that defined a previous market are now less valid.

7. Zoom out for historical context 🔎

Zoom out on your charts. Then keep zooming out. And now zoom out some more. Circle the latest candle, line, or price movement and let it serve as a reminder about where the price is today vs. where it came from. There's a saying: when in doubt, zoom out. Do not get lost in the moment, looking only at the day or week, but instead go research the entire history of price. Learn about what has happened in the past.

8. Cash is a position 💸

Want to dollar cost average into a trade? Want to buy more? Want to trade more? You need cash to do that. There is comfort in being able to participate in the volatility whenever you want. Cash is a position and guarantees this.

9. Avoid panic, FUD, and FOMO 😳

When emotions are running high, some of the biggest psychological mistakes can occur. FUD stands for fear, uncertainty, and doom. FOMO stands for fear of missing out. These are two common emotions in crashing markets. On one hand, everyone thinks the end is near and then on the other hand every little up move is the next bull run. Do not let these emotions take you.

10. Take a break 😀

Sometimes it helps to step away. Log out, close your apps, get outside and get some exercise. Come back to the markets when you're ready. Your mind will also be well rested now.

We hope you enjoyed this post and we hope it helps you as you navigate the markets.

Please feel free to write any additional tips or pieces of advice in the comments section below!

See you all next week. 🙂

– Team TradingView

Do check us out on Instagram and YouTube for more awesome content! 💘

Share TradingView with a friend:

tradingview.com/share-your-love/

Check out all #tradingviewtips

tradingview.com/ideas/tradingviewtips/?type=education

New Tools and Features:

tradingview.com/blog/en/

tradingview.com/share-your-love/

Check out all #tradingviewtips

tradingview.com/ideas/tradingviewtips/?type=education

New Tools and Features:

tradingview.com/blog/en/

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

Share TradingView with a friend:

tradingview.com/share-your-love/

Check out all #tradingviewtips

tradingview.com/ideas/tradingviewtips/?type=education

New Tools and Features:

tradingview.com/blog/en/

tradingview.com/share-your-love/

Check out all #tradingviewtips

tradingview.com/ideas/tradingviewtips/?type=education

New Tools and Features:

tradingview.com/blog/en/

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.