Playing the Short-Term Setups with Clear Risk/Reward

Is BTC going to rally or are we living the end of a cycle? Would love to read your opinion in comments :)

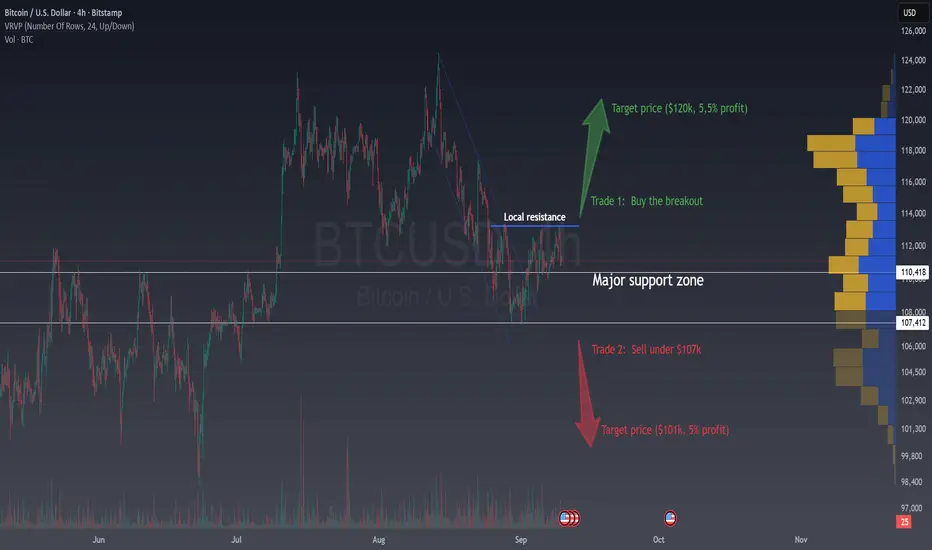

I’ve mentioned before how crucial the $107k level is in the bigger picture, and I still stand by it.

https://www.tradingview.com/chart/BTC.D/zkoCqnYQ-The-Bitcoin-cycle-is-over/

It’s a major support zone and losing it could open the door for deeper corrections, as stated in the previous idea.

But as traders, we don’t need to predict the future months ahead. What makes me smile is finding clear, short-term opportunities with solid margins.

Right now, price is testing a local resistance.

🚀 If we get a clean breakout, I’m looking to go long, aiming for about +5.5% upside with just 1.5% risk (stop loss). That’s the kind of asymmetric setup I love.

📉 On the flip side, if Bitcoin slips below $107k, instead of panicking, I’ll look for the fast and easy short trade.

The idea is to capture a quick 5% downside move with again a tight 1.5% stop loss, knowing that volatility and rebounds in these zones make hard to hold a long term bearish position.

👉 I’m not here to predict the “final direction” for the long term.

I like to focus on trading with safety, confidence, and wide profit margins in the short term. That’s where my consistency is built.

Is BTC going to rally or are we living the end of a cycle? Would love to read your opinion in comments :)

I’ve mentioned before how crucial the $107k level is in the bigger picture, and I still stand by it.

https://www.tradingview.com/chart/BTC.D/zkoCqnYQ-The-Bitcoin-cycle-is-over/

It’s a major support zone and losing it could open the door for deeper corrections, as stated in the previous idea.

But as traders, we don’t need to predict the future months ahead. What makes me smile is finding clear, short-term opportunities with solid margins.

Right now, price is testing a local resistance.

🚀 If we get a clean breakout, I’m looking to go long, aiming for about +5.5% upside with just 1.5% risk (stop loss). That’s the kind of asymmetric setup I love.

📉 On the flip side, if Bitcoin slips below $107k, instead of panicking, I’ll look for the fast and easy short trade.

The idea is to capture a quick 5% downside move with again a tight 1.5% stop loss, knowing that volatility and rebounds in these zones make hard to hold a long term bearish position.

👉 I’m not here to predict the “final direction” for the long term.

I like to focus on trading with safety, confidence, and wide profit margins in the short term. That’s where my consistency is built.

액티브 트레이드

The breakout was aggressive. I’ve closed 50% of the position with a +2% gain, leaving the other 50% to either reach a +5.5% target or hit the stop loss at +1.4%. In other words, I’m in a risk-free trade now. In one case, I will do 2% + 5,5% (avg almost 4%) or 2% - 1,4% (averaging +0,3%). ⚡ Trading is not about luck or patience. Is about skills and knowledge. ⚡

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

⚡ Trading is not about luck or patience. Is about skills and knowledge. ⚡

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.