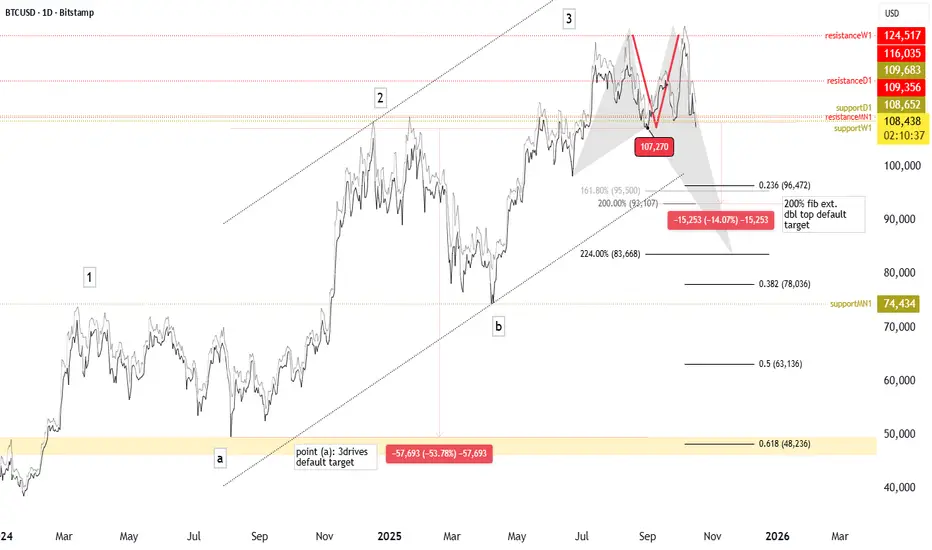

Bitcoin’s continues to capture the attention as it unfolds into a potentially critical technical formation. The chart suggests that a 3 Drives Pattern — a classic reversal structure — is taking shape, suggesting that the current bullish cycle may be approaching exhaustion. If this pattern completes, the projected move could lead Bitcoin down toward the $50,000 region, implying a 50% price correction from current levels.

This pattern is strengthened by bearish divergences on the Relative Strength Index (RSI), which reveal a gradual weakening of buying momentum even as prices have continued to set new highs. Such divergence often precedes significant retracements, signaling that the underlying strength of the uptrend may be fading.

A clearer confirmation of short-term weakness emerges through a double top formation, with its neckline currently being tested around $107,270. A confirmed breakdown below this level would favor a correction of roughly 14%, targeting the $93,000 zone.

This move could mark the early stage of a broader bearish sequence consistent with the 3 Drives Pattern, potentially setting the tone for a larger downside continuation.

The convergence of these multiple signals — the 3 Drives Pattern, the double top, and the RSI divergence — collectively reinforces the notion that bullish momentum is fading and that the market may be transitioning into a reversal phase.

Happy Trading,

André

Harmonic Patterns | Market Analyst | Forex Analytix | Porto, Portugal

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

Harmonic Patterns | Market Analyst | Forex Analytix | Porto, Portugal

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.