__________________________________________________________________________________

Market Overview

__________________________________________________________________________________

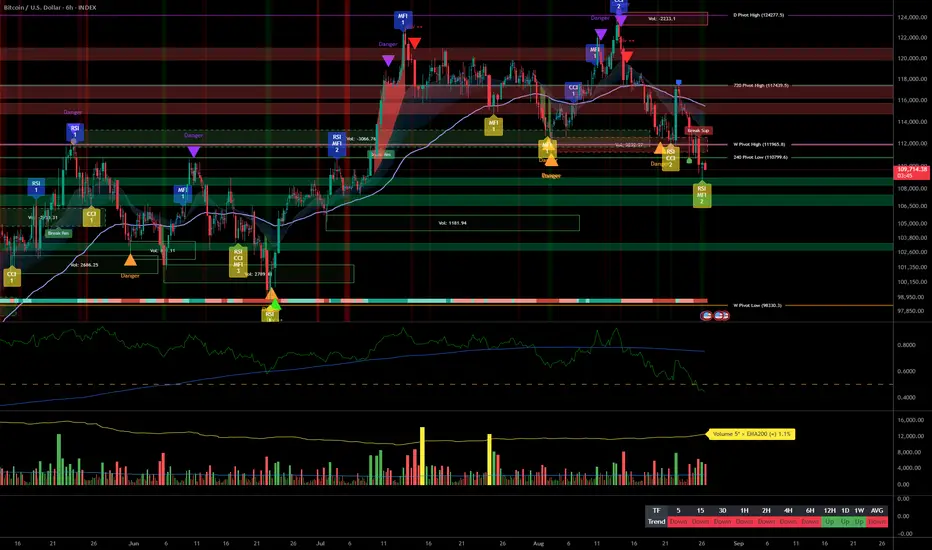

BTC remains in a controlled pullback after the 124,277 rejection, compressing above 109k and gravitating toward the 107,100 HTF pivot. Sellers keep the upper hand, but a technical bounce can emerge if key supports hold.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Below 111k, sellers drive the tape; favor “sell the rip” while keeping a tactical long only on clean reactions at support.

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Most timeframes lean bearish, with 4H/2H contrarian hints at a major HTF support.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro turns more easing‑friendly yet data‑dependent, while institutional BTC demand persists despite deleveraging.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

Market sits in controlled range‑down, anchored by a key HTF pivot.

– Trend: Bearish/cautious below 111k, bounce potential if 107.1k holds.

– Top setup: “Sell the rip” at 110.6–111.0k; “Buy the dip” only on a clean 107.1k reaction and reclaim > 110.6k.

– Macro: Easing bias (Fed/RBA) helps a reclaim, but US data and trade tensions can cap risk.

Stay disciplined: trade confirmations and respect invalidations.

Market Overview

__________________________________________________________________________________

BTC remains in a controlled pullback after the 124,277 rejection, compressing above 109k and gravitating toward the 107,100 HTF pivot. Sellers keep the upper hand, but a technical bounce can emerge if key supports hold.

- Momentum: Bearish 📉 with lower highs/lows; selling pressure dominates below 111k.

- Key levels:

– Resistances (HTF/LTF): 110.6–111.0k • 111.9k (W) • 114–115k (D)

– Supports (HTF): 109.0–109.3k • 107,100 (240 PL) • 103,000 (former demand) - Volumes: Moderate on 2H–6H, Normal on 1D → no capitulation; likely low‑range chop/wicks.

- Multi-timeframe signals: LTF (15m–2H) trending down; 4H/2H show local bullish divergence (ISPD = BUY) near 107.1k; overall trend bias still Down.

- Risk On / Risk Off Indicator: SELL (sell bias) — confirms the bearish momentum; a move to NEUTRE ACHAT would better support a bounce.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Below 111k, sellers drive the tape; favor “sell the rip” while keeping a tactical long only on clean reactions at support.

- Global bias: Mildly bearish below 111.0k; main invalidation on a 4H close > 111.0k.

- Opportunities:

– Fade the 110.6–111.0k bounce with a tight stop; target 109.6k then 109.0k.

– Tactical long on a strong 107.1k reaction (wick rejection + 2H/4H reclaim > 110.6k), target 111.9k.

– Continuation short if 4H/D closes below 107.1k toward 103k. - Risk zones / invalidations:

– A firm break below 107.1k invalidates longs and opens 103k, then 96.3k.

– A confirmed reclaim above 111.9k invalidates most shorts and opens 114–115k. - Macro catalysts (Twitter, Perplexity, news):

– Powell signaling a possible September cut but data‑dependent → solid prints help reclaim 110.6k+.

– US data (Durable Goods, Consumer Confidence) → negative surprises raise odds of a 107.1k break.

– Trade tensions (tariffs/supply‑chain) → risk premium, can cap rebounds. - Action plan:

– Long Plan (tactical): Entry 109.2k and 107.3–107.1k / Stop < 106.8k / TP1 110.6k, TP2 111.9k, TP3 114–115k / R:R ~2.0–2.5R.

– Short Plan (fade or breakdown): Entry 110.6–111.0k OR after 4H close < 107.1k / Stop > 111.2k (fade) or >108.2k (break) / TP1 109.6k (fade) or 103k (break), TP2 109.0k or 99–98k / R:R ~1.8–2.5R.

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Most timeframes lean bearish, with 4H/2H contrarian hints at a major HTF support.

- 1D/12H/6H: Lower highs/lows under 111k; magnet toward 107.1k; 114–115k only after a firm reclaim > 111.0k.

- 4H/2H: Bullish divergence (ISPD = BUY) around 108.8–109.3k/107.1k; only buy if 110.6k is reclaimed, then 111.9k tests.

- 1H/30m/15m: Trend favors sell‑the‑rip; fade 110.4–111.0k; watch liquidity sweeps sub‑109k to 108.6k; need a volume regime shift to reverse.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro turns more easing‑friendly yet data‑dependent, while institutional BTC demand persists despite deleveraging.

- Macro events: Powell hints at a possible September cut (data‑dependent); RBA minutes tilt dovish; trade tensions (tariffs/undersea supply) → tactically supportive for risk unless inflation/geopolitics flip risk‑off.

- Bitcoin analysis: US spot ETF inflows (+$219M on Aug 25) signal resilient institutional demand; players like MicroStrategy near ~3% of supply → steady float absorption.

- On-chain data: CEX reserves ~3.27M BTC with recent net outflows; ~1,703 BTC moved from Coinbase Institutional to custody → accumulation bias, but high derivatives OI = squeeze‑prone.

- Expected impact: If easing narrative and inflows persist, reclaiming 110.6k/111.0k becomes more likely; risk‑off shocks raise the odds of a 107.1k break.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

Market sits in controlled range‑down, anchored by a key HTF pivot.

– Trend: Bearish/cautious below 111k, bounce potential if 107.1k holds.

– Top setup: “Sell the rip” at 110.6–111.0k; “Buy the dip” only on a clean 107.1k reaction and reclaim > 110.6k.

– Macro: Easing bias (Fed/RBA) helps a reclaim, but US data and trade tensions can cap risk.

Stay disciplined: trade confirmations and respect invalidations.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.