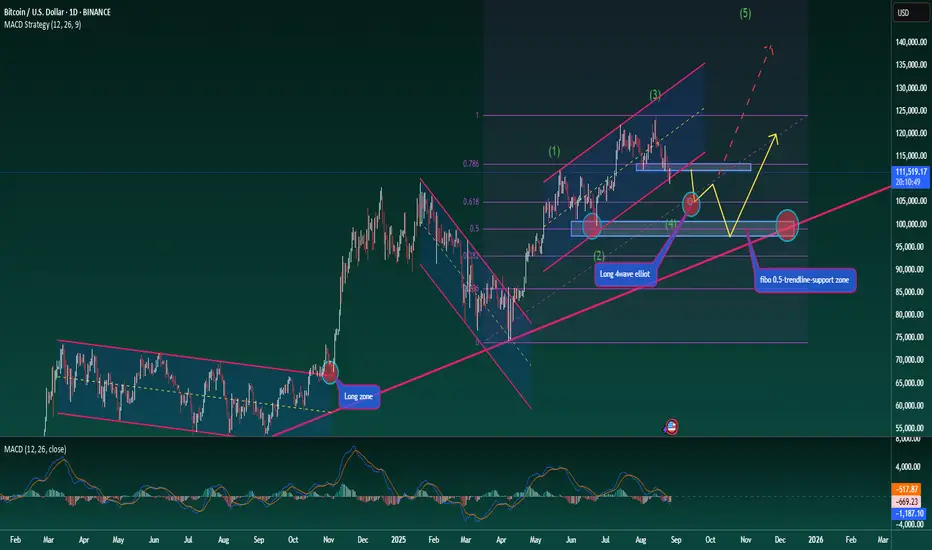

Bitcoin – Long-Term Outlook with Elliott Wave Structure

Hello traders,

Taking a step back for a medium- to long-term perspective on BTC. The broader trend remains bullish, yet for any rally to be sustainable, corrective phases are essential. Right now, BTC is in a corrective move, which aligns with wave 4 of the Elliott Wave structure.

To measure the depth of this correction before wave 5 develops, we can look at the Fibonacci retracement levels. Two zones stand out as significant: 0.618 and 0.5.

At 0.618, support is strong but not yet decisive. If price reacts here and wave 5 unfolds, the Elliott count stays intact and relatively clean.

At 0.5, this is often the ideal retracement level on Fibonacci. The chart also shows this as a major structural support. If it breaks, deeper downside could follow, as the ascending trendline also suggests.

Long-Term Trading Plan

Entry 1: Around the 0.618 retracement at 105k

Entry 2: Around the 0.5 retracement at 99k

This setup forms the basis for a medium-term strategy, but if the second zone (99k) holds strongly, it could well serve as the foundation for a longer-term bullish cycle.

Stay patient, keep risk management at the forefront, and let the structure play out.

What’s your take on BTC’s long-term wave structure? Drop your thoughts in the comments and let’s discuss.

Hello traders,

Taking a step back for a medium- to long-term perspective on BTC. The broader trend remains bullish, yet for any rally to be sustainable, corrective phases are essential. Right now, BTC is in a corrective move, which aligns with wave 4 of the Elliott Wave structure.

To measure the depth of this correction before wave 5 develops, we can look at the Fibonacci retracement levels. Two zones stand out as significant: 0.618 and 0.5.

At 0.618, support is strong but not yet decisive. If price reacts here and wave 5 unfolds, the Elliott count stays intact and relatively clean.

At 0.5, this is often the ideal retracement level on Fibonacci. The chart also shows this as a major structural support. If it breaks, deeper downside could follow, as the ascending trendline also suggests.

Long-Term Trading Plan

Entry 1: Around the 0.618 retracement at 105k

Entry 2: Around the 0.5 retracement at 99k

This setup forms the basis for a medium-term strategy, but if the second zone (99k) holds strongly, it could well serve as the foundation for a longer-term bullish cycle.

Stay patient, keep risk management at the forefront, and let the structure play out.

What’s your take on BTC’s long-term wave structure? Drop your thoughts in the comments and let’s discuss.

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jmo_lLLuUuYwZTI1

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jmo_lLLuUuYwZTI1

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jmo_lLLuUuYwZTI1

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+jmo_lLLuUuYwZTI1

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.