🔎 Overview

____________________________________________________________

🛠 How to Use

____________________________________________________________

📊 Chart Explanation

____________________________________________________________

🔎 Observations & Conclusion

____________________________________________________________

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

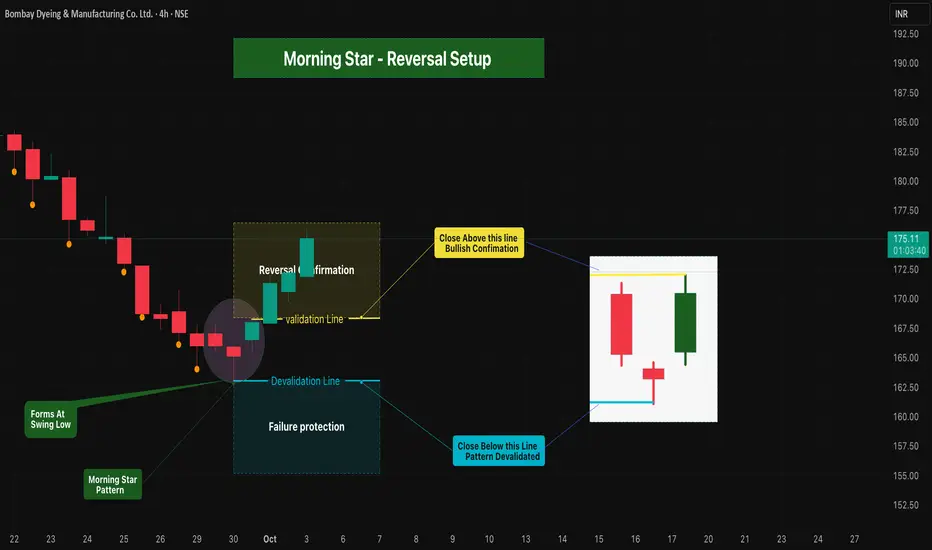

The Morning Star is a three-candle bullish reversal pattern that forms at a swing low after a downtrend.

• 1st Candle → Long bearish red candle (sellers in control).

• 2nd Candle → Small-bodied / Doji candle (indecision).

• 3rd Candle → Strong bullish green candle closing above the midpoint of the 1st red candle (buyers take control).

This structure signals a possible bullish reversal with clear validation & devalidation rule

____________________________________________________________

🛠 How to Use

• Validation Line → High of bullish candle = breakout confirmation level.

• Devalidation Line → Low of Doji candle = failure protection.

• Entry Rule → Candle close above Validation Line = Bullish Confirmation.

• Failure Rule → Candle close below Devalidation Line (before validation) = Pattern invalidated.

• Forms at swing low

• Protects against false signals & ensures structured risk management.

____________________________________________________________

📊 Chart Explanation

• Symbol →BOMDYEING Bombay Dyeing & Manufacturing Co. Ltd.

• Timeframe → 4H

• Pattern Confirmation → Morning Star identified & validated.

• Validation Level → 168.24

• Devalidation Level → 163.00

• On 1 Oct 2025, price closed above validation level, confirming the bullish reversel

____________________________________________________________

🔎 Observations & Conclusion

The Morning Star provides a reliable bullish reversal framework..

With validation & devalidation levels, it filters false signals and enables disciplined risk-reward setups

____________________________________________________________

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.