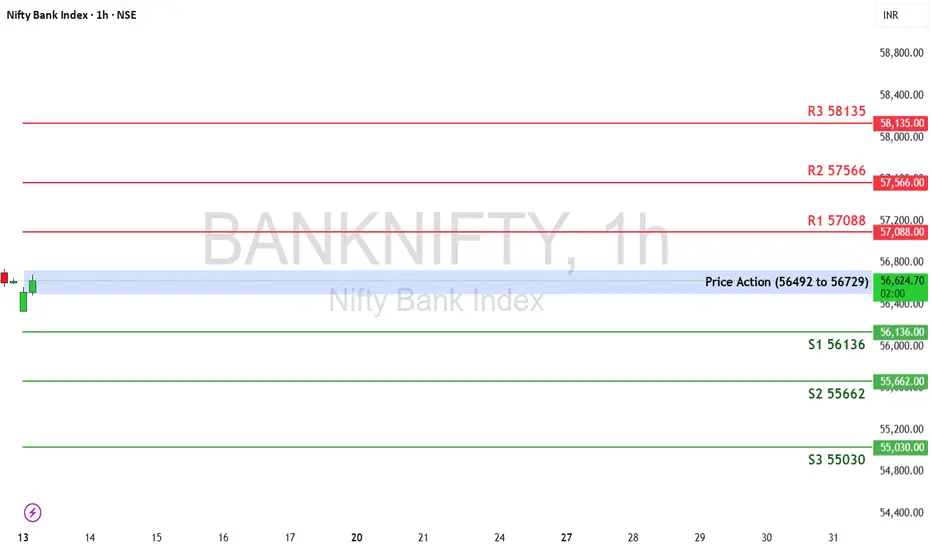

The Bank Nifty ended the week at 56,609.75, gaining +1.84%

🔹 Price Action Pivot Zone:

56,492 – 56,729

This is the crucial price band to watch. A breakout or breakdown from this blue-shaded zone could define this week’s directional bias.

🔻 Support Levels:

S1: 56,136

S2: 55,662

S3: 55,030

🔺 Resistance Levels:

R1: 57,088

R2: 57,566

R3: 58,135

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above the pivot high of 56,729, buyers could push the index toward R1 (57,088). A breakout above this zone may open the path to R2 (57,566) and R3 (58,135).

❌ Bearish Scenario:

A breakdown below the pivot low of 56,492 could trigger profit booking. The index may then retest S1 (56,136), with further weakness extending toward S2 (55,662) and S3 (55,030).

Disclaimer: tinyurl.com/59ypbsrh

🔹 Price Action Pivot Zone:

56,492 – 56,729

This is the crucial price band to watch. A breakout or breakdown from this blue-shaded zone could define this week’s directional bias.

🔻 Support Levels:

S1: 56,136

S2: 55,662

S3: 55,030

🔺 Resistance Levels:

R1: 57,088

R2: 57,566

R3: 58,135

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above the pivot high of 56,729, buyers could push the index toward R1 (57,088). A breakout above this zone may open the path to R2 (57,566) and R3 (58,135).

❌ Bearish Scenario:

A breakdown below the pivot low of 56,492 could trigger profit booking. The index may then retest S1 (56,136), with further weakness extending toward S2 (55,662) and S3 (55,030).

Disclaimer: tinyurl.com/59ypbsrh

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.