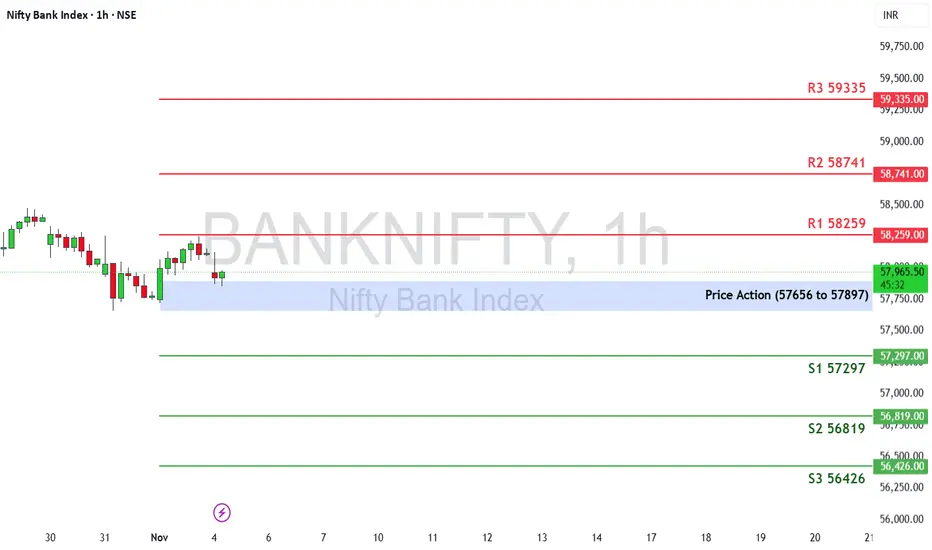

The Nifty Bank Index last week ended at 57,776.35, posting a modest +0.13% gain. The index showed signs of indecision near the recent high, indicating that the market is pausing after a strong bullish run in October.

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

57,656 to 57,897 – This blue-shaded range marks the key decision area. Sustaining above this zone may invite renewed buying interest, while a close below could lead to mild profit booking.

🔻 Support Levels:

S1: 57,297

S2: 56,819

S3: 56,426

🔺 Resistance Levels:

R1: 58,259

R2: 58,741

R3: 59,335

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above 57,897, a move toward R1 (58,259) can be expected. Sustained strength above this level may open the path toward R2 (58,741) and R3 (59,335) in the near term.

❌ Bearish Scenario:

If the index falls below 57,656, short-term weakness may drag it toward S1 (57,297), followed by S2 (56,819) and S3 (56,426). A weekly close below 57,200 could signal the beginning of a corrective phase.

Disclaimer: lnkd.in/ge86Wx-X

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

57,656 to 57,897 – This blue-shaded range marks the key decision area. Sustaining above this zone may invite renewed buying interest, while a close below could lead to mild profit booking.

🔻 Support Levels:

S1: 57,297

S2: 56,819

S3: 56,426

🔺 Resistance Levels:

R1: 58,259

R2: 58,741

R3: 59,335

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above 57,897, a move toward R1 (58,259) can be expected. Sustained strength above this level may open the path toward R2 (58,741) and R3 (59,335) in the near term.

❌ Bearish Scenario:

If the index falls below 57,656, short-term weakness may drag it toward S1 (57,297), followed by S2 (56,819) and S3 (56,426). A weekly close below 57,200 could signal the beginning of a corrective phase.

Disclaimer: lnkd.in/ge86Wx-X

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.