Master the quiet before the move.

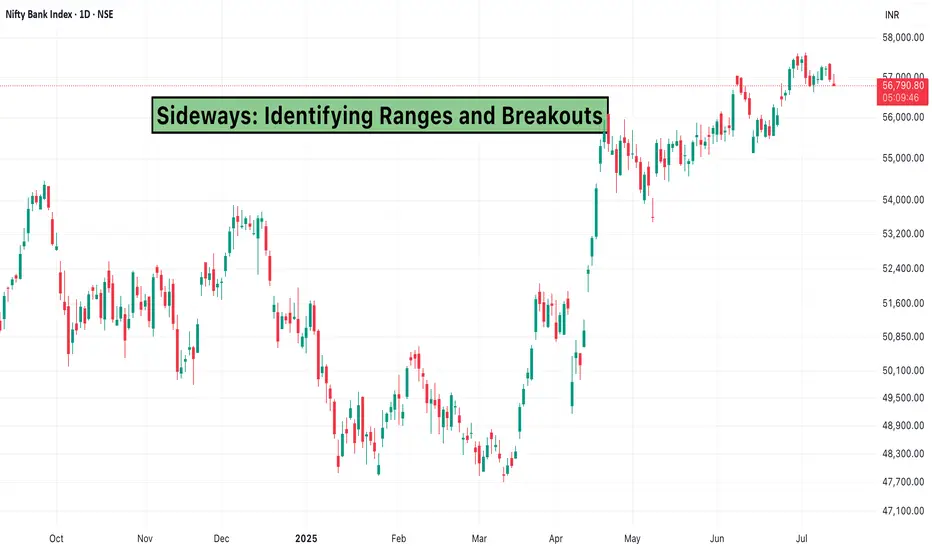

Not every market moves in strong trends. In fact, many stocks spend a lot of time trading sideways moving within a defined range without making a clear move up or down. While this can frustrate trend-following traders, sideways phases actually offer great setups if you know what to look for.

Understanding how to identify sideways markets, define price ranges, and spot breakouts early can help you enter trades with better timing and stronger conviction.

What is a Sideways Market?

A sideways market (also called a consolidation or range-bound market) is when a stock or index trades between horizontal support and resistance levels for an extended period. The price lacks clear direction, and both buyers and sellers seem to be in balance.

During this phase:

Volatility contracts

Indicators flatten out (e.g., Moving Averages)

Breakouts or breakdowns are often short-lived until they aren’t

These quiet zones can build up pressure. When a breakout finally occurs, it often leads to a significant price move.

How to Identify a Range

Look for:

Horizontal support and resistance: Price bounces between two levels without breaking out.

Flat Moving Averages: The 20, 50, or 100-period MA may start to go sideways.

Diminished volume: Volume often tapers off during consolidation.

Failed breakouts: Price may pierce the top or bottom of the range but quickly revert.

Using tools like rectangles or horizontal rays on TradingView helps visualize the range clearly.

Trading the Range vs. Trading the Breakout

You can approach sideways markets in two ways:

Range Trading

Buy near support

Sell near resistance

Use indicators like RSI or Stochastic to confirm overbought/oversold conditions

Range trading works best when the price has respected the zone multiple times and volume is low.

Breakout Trading

Wait for price to close outside the range

Look for increased volume on the breakout

Confirm with indicators like MACD crossover or momentum surge

Breakouts from sideways zones often lead to trending moves especially if the range has held for several days or weeks.

Why Sideways Markets Matter

While many traders wait for big trends, experienced traders know that sideways markets are where setups are built. Whether you’re scalping quick moves inside the range or preparing for a breakout, this phase is rich with opportunities if you’re patient and prepared.

Conclusion

A sideways chart isn’t just “nothing happening” it’s a pause with purpose. Identifying ranges correctly allows you to stay out of noisy trades, time your entries better, and prepare for explosive breakouts.

Not every market moves in strong trends. In fact, many stocks spend a lot of time trading sideways moving within a defined range without making a clear move up or down. While this can frustrate trend-following traders, sideways phases actually offer great setups if you know what to look for.

Understanding how to identify sideways markets, define price ranges, and spot breakouts early can help you enter trades with better timing and stronger conviction.

What is a Sideways Market?

A sideways market (also called a consolidation or range-bound market) is when a stock or index trades between horizontal support and resistance levels for an extended period. The price lacks clear direction, and both buyers and sellers seem to be in balance.

During this phase:

Volatility contracts

Indicators flatten out (e.g., Moving Averages)

Breakouts or breakdowns are often short-lived until they aren’t

These quiet zones can build up pressure. When a breakout finally occurs, it often leads to a significant price move.

How to Identify a Range

Look for:

Horizontal support and resistance: Price bounces between two levels without breaking out.

Flat Moving Averages: The 20, 50, or 100-period MA may start to go sideways.

Diminished volume: Volume often tapers off during consolidation.

Failed breakouts: Price may pierce the top or bottom of the range but quickly revert.

Using tools like rectangles or horizontal rays on TradingView helps visualize the range clearly.

Trading the Range vs. Trading the Breakout

You can approach sideways markets in two ways:

Range Trading

Buy near support

Sell near resistance

Use indicators like RSI or Stochastic to confirm overbought/oversold conditions

Range trading works best when the price has respected the zone multiple times and volume is low.

Breakout Trading

Wait for price to close outside the range

Look for increased volume on the breakout

Confirm with indicators like MACD crossover or momentum surge

Breakouts from sideways zones often lead to trending moves especially if the range has held for several days or weeks.

Why Sideways Markets Matter

While many traders wait for big trends, experienced traders know that sideways markets are where setups are built. Whether you’re scalping quick moves inside the range or preparing for a breakout, this phase is rich with opportunities if you’re patient and prepared.

Conclusion

A sideways chart isn’t just “nothing happening” it’s a pause with purpose. Identifying ranges correctly allows you to stay out of noisy trades, time your entries better, and prepare for explosive breakouts.

Elevate your Trading Experience 🚀

📱 Download Dhan App on iOS and Android and Start Trading.

📱 Download Dhan App on iOS and Android and Start Trading.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

Elevate your Trading Experience 🚀

📱 Download Dhan App on iOS and Android and Start Trading.

📱 Download Dhan App on iOS and Android and Start Trading.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.