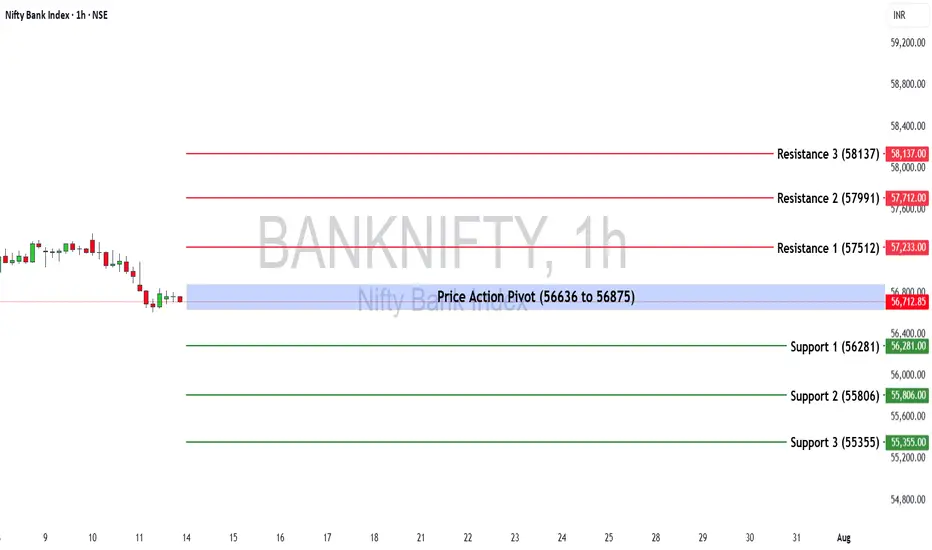

Bank Nifty ended the week at 56,754.70, registering a marginal decline of -0.49%.

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

The critical zone to monitor for potential trend reversals or continuation lies between 56,636 and 56,875.

🔻 Support Levels:

Support 1 (S1): 56,281

Support 2 (S2): 55,806

Support 3 (S3): 55,355

🔺 Resistance Levels:

Resistance 1 (R1): 57,512

Resistance 2 (R2): 57,991

Resistance 3 (R3): 58,137

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above the pivot zone (56,875), it may trigger renewed buying interest, potentially pushing the index toward R1 (57,512) and above.

❌ Bearish Scenario:

A breakdown below the lower end of the pivot zone at 56,636 may attract selling pressure, dragging the index towards S1 (56,281) and further downside levels.

Disclaimer: lnkd.in/gJJDnvn2

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

The critical zone to monitor for potential trend reversals or continuation lies between 56,636 and 56,875.

🔻 Support Levels:

Support 1 (S1): 56,281

Support 2 (S2): 55,806

Support 3 (S3): 55,355

🔺 Resistance Levels:

Resistance 1 (R1): 57,512

Resistance 2 (R2): 57,991

Resistance 3 (R3): 58,137

📈 Market Outlook

✅ Bullish Scenario:

If Bank Nifty sustains above the pivot zone (56,875), it may trigger renewed buying interest, potentially pushing the index toward R1 (57,512) and above.

❌ Bearish Scenario:

A breakdown below the lower end of the pivot zone at 56,636 may attract selling pressure, dragging the index towards S1 (56,281) and further downside levels.

Disclaimer: lnkd.in/gJJDnvn2

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.