-  NVDA export ban lifted for China will be beneficial for

NVDA export ban lifted for China will be beneficial for  NVDA for sure but main advantages would be for

NVDA for sure but main advantages would be for  BABA as they can get the shovels from the shop as well so that they can compete in Gold Rush and compete with

BABA as they can get the shovels from the shop as well so that they can compete in Gold Rush and compete with  GOOGL ,

GOOGL ,  META and other private companies like Open AI and Anthropic.

META and other private companies like Open AI and Anthropic.

- There are good universities in China and BABA is regional big tech in China which gets great talent. I'm confident that

BABA is regional big tech in China which gets great talent. I'm confident that  BABA would be able to compete with

BABA would be able to compete with  META &

META &  GOOGL in building LLMs even better with this export ban lift.

GOOGL in building LLMs even better with this export ban lift.

- Long BABA and short/avoid

BABA and short/avoid  META ( overvalued )

META ( overvalued )

- There are good universities in China and

- Long

노트

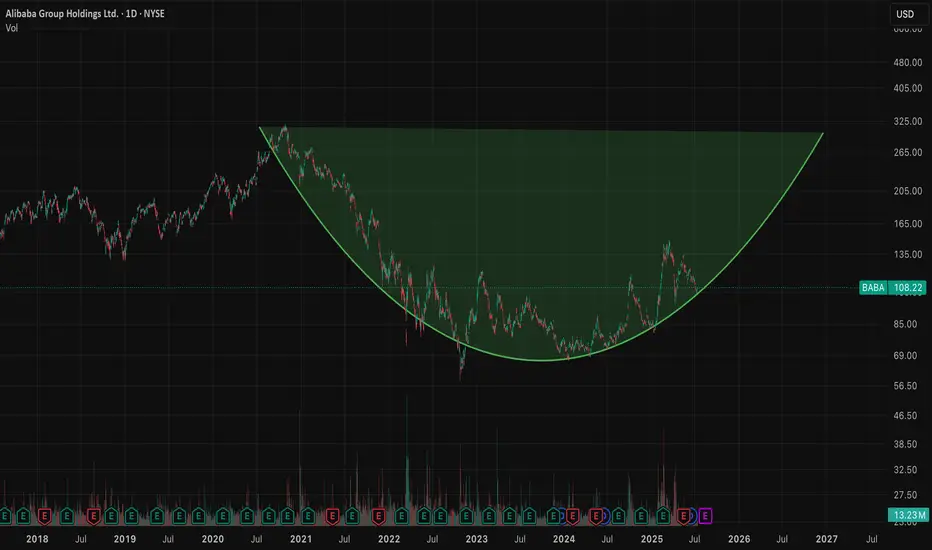

Price Target $160+ ; Ideally $180-200 range노트

Trade deal with China is bullish for 노트

- -

- Move 1: Started April 2024 when the trend reversal started. $68 -> $89 with around +30% then retraced $90 -> $72 ( -20% )

- Move 2: July 2024, $72 -> $116 (+61%) then retraced $116 -> $80 ( -31% )

- Move 3: Jan 2025, $80 -> $146 (+ 82.5%) then retraced $146 -> $108?? ( correction underway ) ~ -26% so far

- Move 4: Likely from $100-105 to $180-200

노트

Cross posting from my other post here:- If we cross $110 on BABA then that means the move #3 is over and the end of move #3 was around $103.83 and we have entered the Move #4 which will take

노트

- Reference:

cnbc.com/2025/07/27/us-china-trade-tariff-talks.html

노트

- - Move 4: Likely from $100-105 to $180-200 is in the play

노트

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.