Arista Networks (ANET) is setting up for a potential breakout backed by strong fundamentals and AI momentum.

🔹 Technical Setup

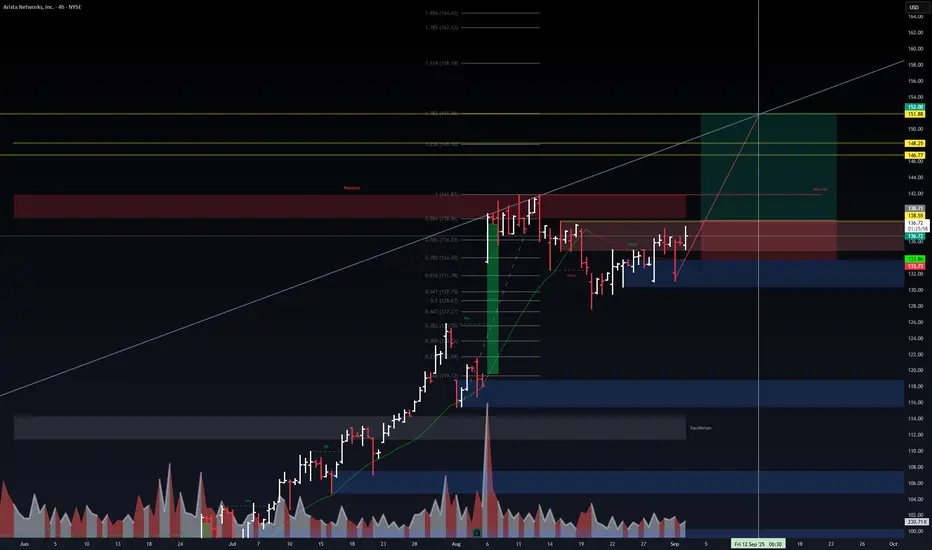

Price holding support at $133–136 zone.

Clear structure of higher lows; volume spikes confirm institutional activity.

Next resistance levels at $146.7 → $151.8.

Fibonacci extensions point toward $158+ medium-term.

🔹 Catalysts

Q2 Earnings Beat: Revenue +30% YoY, guidance raised to $8.75B FY25.

AI Growth: $1.5B AI revenue forecasted in 2025; accelerating hyperscaler demand.

Ethernet Leadership: Gaining share vs NVIDIA’s InfiniBand with Ultra Ethernet Consortium.

Expansion: VeloCloud acquisition strengthens enterprise & SD-WAN positioning.

Investor Day (Sept 11): Possible roadmap updates + new product pipeline.

📈 Trade Idea

Entry Zone: $134–136 support retest

Target 1: $146.7

Target 2: $151.8

Stretch Target: $158+ (Fibo extension)

Risk Management: Stop below $132

⚡ AI, hyperscaler spend, and enterprise expansion provide strong tailwinds. If momentum holds, ANET could be a leader in AI-driven networking into 2026.

액티브 트레이드

거래청산: 타겟 닿음

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.