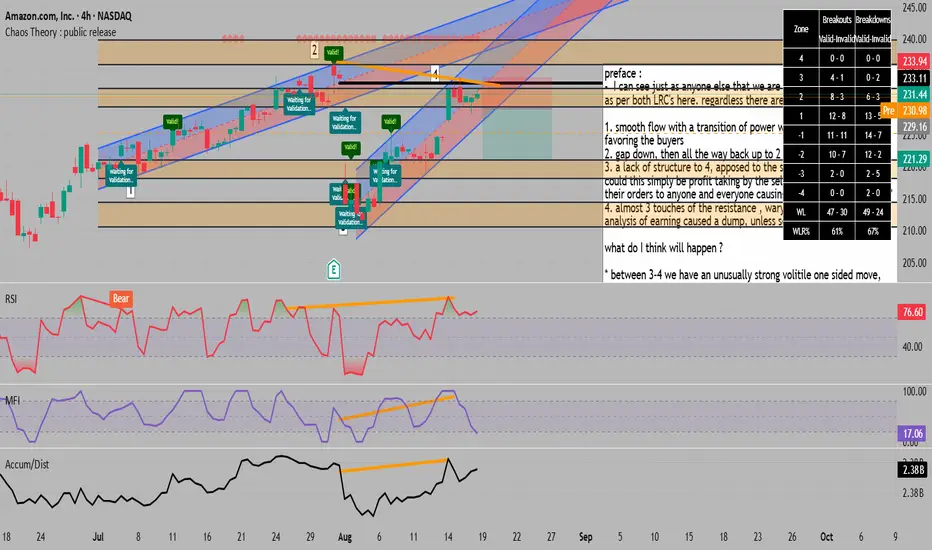

preface :

- I can see just as anyone else that we are angled upward ,

as per both LRC's here. regardless there are some points to note

1. smooth flow with a transition of power without much imbalance,

favoring the buyers

2. gap down, then all the way back up to 2

3. a lack of structure to 4, apposed to the smooth flow from 1-2,

could this simply be profit taking by the sellers at two, offloading

their orders to anyone and everyone causing massive spikes back to 4?

4. almost 3 touches of the resistance , wary buyers as per the

analysis of earning caused a dump, unless something changed?

what do I think will happen ?

* between 3-4 we have an unusually strong volitile one sided move,

normally these are followed by a smooth trend the opposing direction,

I could envision price coming back down to 3, or maybe at least 3-4

midpoint. it is taking too much libery to even hint at a turnaround ,

a pullback on the other hand.... possible, especially with this volitlity.

* RSI , MFI and Accumulation distribution all have hidden divergence,

as well as all being oversold, I dont care much about oversold, during

high volitility movements the overbought and sold are pretty much useless,

* over the past 2,500 bars, if price closes below a zone, we have a 67%

chance it follows through to the other end , you can manually verify

by reducing the lookback period. these are great odds!

- I can see just as anyone else that we are angled upward ,

as per both LRC's here. regardless there are some points to note

1. smooth flow with a transition of power without much imbalance,

favoring the buyers

2. gap down, then all the way back up to 2

3. a lack of structure to 4, apposed to the smooth flow from 1-2,

could this simply be profit taking by the sellers at two, offloading

their orders to anyone and everyone causing massive spikes back to 4?

4. almost 3 touches of the resistance , wary buyers as per the

analysis of earning caused a dump, unless something changed?

what do I think will happen ?

* between 3-4 we have an unusually strong volitile one sided move,

normally these are followed by a smooth trend the opposing direction,

I could envision price coming back down to 3, or maybe at least 3-4

midpoint. it is taking too much libery to even hint at a turnaround ,

a pullback on the other hand.... possible, especially with this volitlity.

* RSI , MFI and Accumulation distribution all have hidden divergence,

as well as all being oversold, I dont care much about oversold, during

high volitility movements the overbought and sold are pretty much useless,

* over the past 2,500 bars, if price closes below a zone, we have a 67%

chance it follows through to the other end , you can manually verify

by reducing the lookback period. these are great odds!

all my paid ( pro ) scripts can be obtained for a low price of 19.99 / month at : whop.com/sabr-pro-tools/access-to-all-pro-tools/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

all my paid ( pro ) scripts can be obtained for a low price of 19.99 / month at : whop.com/sabr-pro-tools/access-to-all-pro-tools/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.