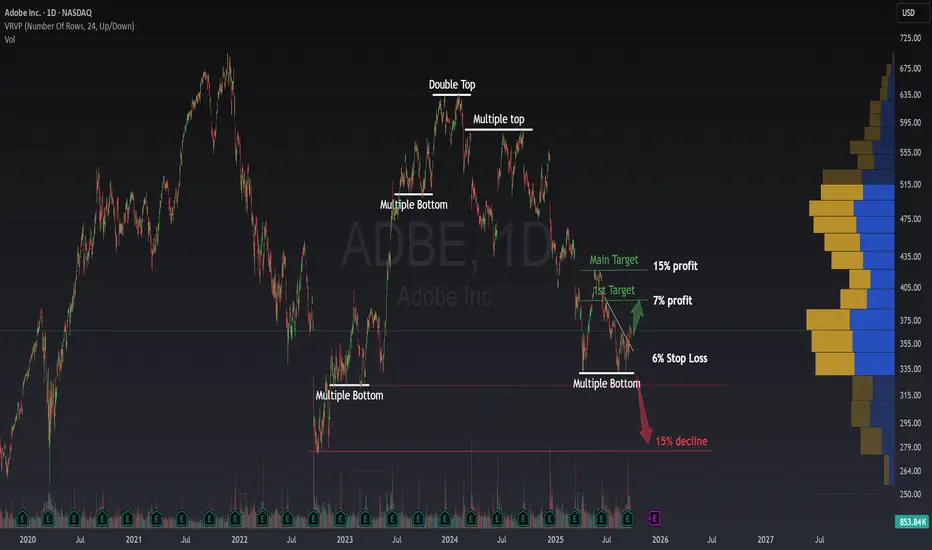

Adobe: Multiple Bottom Signals Potential Upside

ADBE has a clear history of respecting Multiple Bottoms and Tops. In other words, the stock tends to test the same price levels several times before moving decisively in the opposite direction. This repetitive behavior has been a reliable pattern in its price action.

ADBE has a clear history of respecting Multiple Bottoms and Tops. In other words, the stock tends to test the same price levels several times before moving decisively in the opposite direction. This repetitive behavior has been a reliable pattern in its price action.

Currently, we are seeing the same setup, a Multiple Bottom (Triple Bottom) forming around the $330–$340 area. The market has bounced strongly from this zone and is even breaking minor downtrends, suggesting that bullish momentum is gaining strength.

📈 Short-term Upside Potential

If the breakout holds, the first target sits around $393, offering a 7% profit from current levels.

Looking further, based on Fibonacci retracements of the entire decline, the stock could reach as high as $420, which would represent around a 15% profit.

Personally, I prefer locking in profits earlier around the first target and then reallocating to other opportunities.

📉 Downside Risk

We must also remain cautious. If the price fails to hold this Multiple Bottom zone and breaks lower:

A decline could extend toward $277, representing a 15% downside.

The $322 level may still act as support, which is why I don’t like the short setup until this level is broken convincingly.

🟢 For more ideas, hit the rocket & follow.

Currently, we are seeing the same setup, a Multiple Bottom (Triple Bottom) forming around the $330–$340 area. The market has bounced strongly from this zone and is even breaking minor downtrends, suggesting that bullish momentum is gaining strength.

📈 Short-term Upside Potential

If the breakout holds, the first target sits around $393, offering a 7% profit from current levels.

Looking further, based on Fibonacci retracements of the entire decline, the stock could reach as high as $420, which would represent around a 15% profit.

Personally, I prefer locking in profits earlier around the first target and then reallocating to other opportunities.

📉 Downside Risk

We must also remain cautious. If the price fails to hold this Multiple Bottom zone and breaks lower:

A decline could extend toward $277, representing a 15% downside.

The $322 level may still act as support, which is why I don’t like the short setup until this level is broken convincingly.

🟢 For more ideas, hit the rocket & follow.

⚡ Trading is not about luck or patience. Is about skills and knowledge. ⚡

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

⚡ Trading is not about luck or patience. Is about skills and knowledge. ⚡

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.