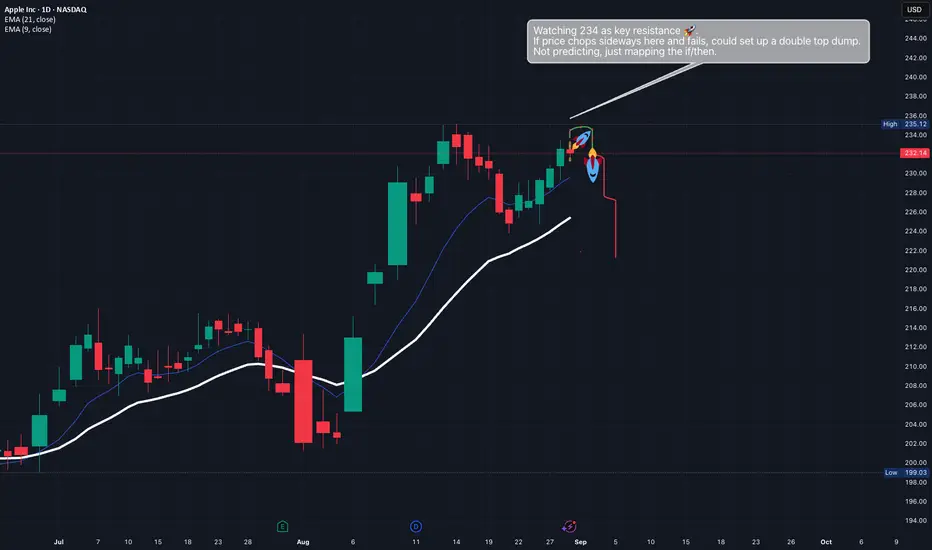

September hasn’t been Apple’s friend historically — average return is around –4.5% and over the last 5 years we’ve seen more red than green. Institutions usually use this month to rebalance into Q4, which can weigh on tech.

This year we’ve also got the Sept 9 “Awe Dropping” event (iPhone 17 lineup, Apple Watch updates, maybe AirPods). That’s a clear catalyst, but sometimes it’s “buy the rumor, sell the news.”

Here’s how I’m looking at it:

⬆Bull Scenario (Breakout)

If Apple clears 234 with volume and holds above, bulls could push it higher. Clean breakout = momentum continuation 🚀.

🔄 Sideways Scenario (Chop)

Apple tags 234, stalls, and just chops. No clear trend, just range trading while the market waits for a catalyst .

📉 Bear Scenario (Double Top / Puts)

Apple rejects at 234, goes sideways, then dumps. That would set up a **double top** and open downside risk back toward 219 .

For me → last week wasn’t great P\&L-wise, so I’m focusing on patience this month. Not trying to predict which path plays out, just mapping the if/then so I’m ready.

👉 What’s your bias going into September?

This year we’ve also got the Sept 9 “Awe Dropping” event (iPhone 17 lineup, Apple Watch updates, maybe AirPods). That’s a clear catalyst, but sometimes it’s “buy the rumor, sell the news.”

Here’s how I’m looking at it:

⬆Bull Scenario (Breakout)

If Apple clears 234 with volume and holds above, bulls could push it higher. Clean breakout = momentum continuation 🚀.

🔄 Sideways Scenario (Chop)

Apple tags 234, stalls, and just chops. No clear trend, just range trading while the market waits for a catalyst .

📉 Bear Scenario (Double Top / Puts)

Apple rejects at 234, goes sideways, then dumps. That would set up a **double top** and open downside risk back toward 219 .

For me → last week wasn’t great P\&L-wise, so I’m focusing on patience this month. Not trying to predict which path plays out, just mapping the if/then so I’m ready.

👉 What’s your bias going into September?

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.