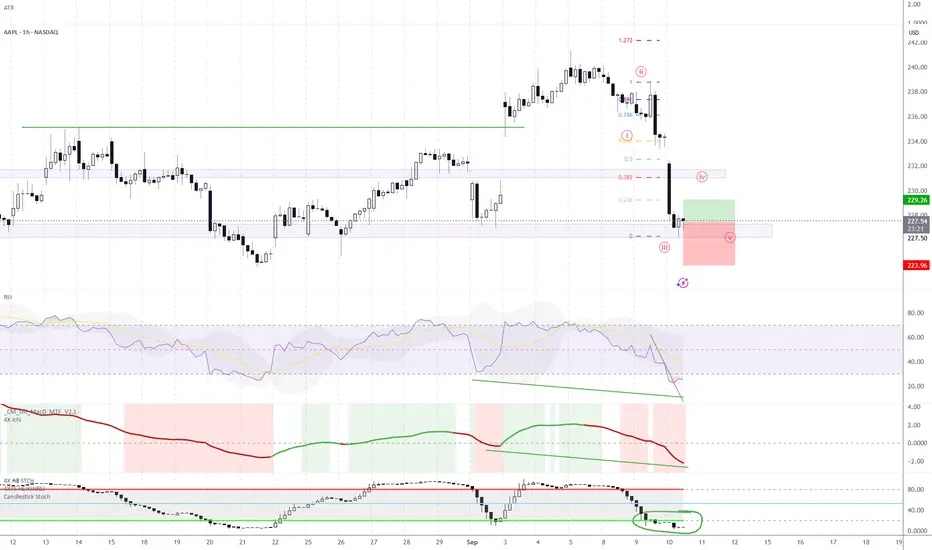

Apple’s stock dropped heavily after the recent iPhone 17 / iPhone Air keynote, landing on a key support level that previously aligned with an upside break of structure.

This sharp decline appears to have started an Elliott 5-wave move. Wave 3 has already completed, and I’m now speculating for Wave 4 to develop — which could complete a tight 0.5R setup.

Confluences:

• RSI and MACD both showing divergences at support

• Stochastic oversold, also printing divergence

• Structure remains intact, likely aiming for a retest of the above resistance area

For this setup, a 1 ATR target protected by a 2 ATR stop loss on the 1H timeframe should be enough.

Disclaimer: This idea is for educational purposes only. Please do not place trades solely based on this setup.

This sharp decline appears to have started an Elliott 5-wave move. Wave 3 has already completed, and I’m now speculating for Wave 4 to develop — which could complete a tight 0.5R setup.

Confluences:

• RSI and MACD both showing divergences at support

• Stochastic oversold, also printing divergence

• Structure remains intact, likely aiming for a retest of the above resistance area

For this setup, a 1 ATR target protected by a 2 ATR stop loss on the 1H timeframe should be enough.

Disclaimer: This idea is for educational purposes only. Please do not place trades solely based on this setup.

거래청산: 타겟 닿음

노트

This trade closed at 0.5R, and that’s exactly the point. I know many aim for 1:3R or higher, but the truth is those often don’t hit on the first attempt. With 0.5R it’s usually the opposite – most of them do hit first.The psychological side is huge:

- it’s not mentally exhausting,

- it gives quick wins and confidence,

- with an 80%+ winrate, a few quick wins are usually enough to cover the occasional loss and keep the account in balance.

I’m not saying everyone should trade like this, but if you love trading and still feel you’re fighting the market or yourself, this approach is worth thinking about.

And as this one reached target, so did others – for example:

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.