█ OVERVIEW This plots the QQE (Quantitive Qualitative Estimation) with the addition of labels to show areas to watch out for and a colored cloud to show Green Upwards or Red Downwards Momentum The QQE indicator is based on Wilder's RSI, which is based on a smoothed RSI comparing the change (delta Δ) between between bars to compute the FastTL and SlowTL...

█ OVERVIEW This plots the Hull Moving Average Turning Points and Concavity with the addition of colored segments representing concavity and turning points: maxima, minima and inflection. a fast way to determine the trend direction and possible reversals based on concavity of the trend Dark Green: Concave Up but HMA decreasing. The 'mood' has changed and the...

THE INVERSE FISHER TRANSFORM STOCH RSI HOW IT WORKS This indicator uses the inverse fisher transform on the stoch RSI for clear buying and selling signals. The stoch rsi is used to limit it in the range of 0 and 100. We subtract 50 from this to get it into the range of -50 to +50 and multiply by .1 to get it in the range of -5 to +5. We then use the 9 period...

This very simple strategy is an implementation of PJ Sutherlands' Jaws Mean reversion algorithm. It simply buys when a small moving average period (e.g. 2) is below a longer moving average period (e.g. 5) by a certain percentage and closes when the small period average crosses over the longer moving average. If you are going to use this, you may wish to apply...

!!!! Note: Run this on the 15min timeframe (Important) !!!! Note the default settings on this indicator are best for BTC/USDT. For other pairs it might take some fiddling with variables to get a useful result (if a useful result is obtainable with the selected pair) Generally, select between the options (RSI/Stoch) and (15min/1hour) and (1hour/4hours) - to find a...

This script has been created to demonstrate the effectiveness of using market regime filters in your trading strategy, and how they can improve your returns and lower your drawdowns This strategy adds a simple filter (A historical volatility percentile filter, an implementation of which can be found on my trading profile) to a traditional buy and hold strategy of...

Fibodex Trap indicator this indicator designed by the Fibodex team you will receive dump and bump singles buy using this indicator also, you will receive buy and sell signals indeed by using our indicator you won't need many technical analyses The accuracy of the indicator with the correct settings is estimated to be more than 70% also, we are trying to improve...

Traders Dynamic Index + RSI Divergences + Buy/Sell Signals Credits to LazyBear (original code author) and JustUncleL (modifications).. I added some new features: 1- RSI Divergences (Original code from 'Divergence Indicator') 2- Buy/Sell Signals with alerts (Green label 'Buy' - Red label 'Sell') 3- Background colouring when RSI (Green line) crosses above MBL...

First of all the biggest thanks to @tista and @KivancOzbilgic for publishing their open source public indicators Bayesian BBSMA + nQQE Oscillator. And a mighty round of applause for @MarkBench for once again being my superhero pinescript guy that puts these awesome combination Ideas and ES stradegies in my head together. Now let me go ahead and explain what we...

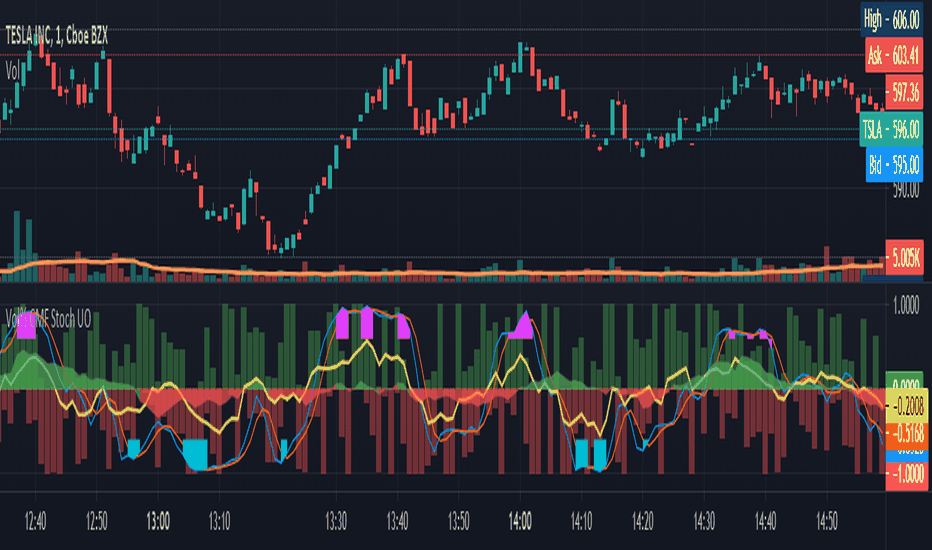

Plots % Buy / Sell Volume , Chaikin Money Flow , Stochastic Oscillator, and Ultimate Oscillator on same axis, bound -1 to 1. Show Volume Percentage, displaying buying as green and positive, selling as red and negative. Showing the CMF, with green / red fill for positive / negative values. Modified Stochastic Oscillator, converting bounds to -1 and 1, moving...

Showing the CMF, with green / red fill for positive / negative values, overlaid with Volume Percentage, displaying buying as green and positive, selling as red and negative.

Shading the area of positive CMF with green and negative with red.

This signal combines a portion of Chris Moody's 2014 SlingShot and my 2017 MTF Indicators. Both of our prior scripts over indicated Buy and Sell Points. This signal indicates a buy or sell point much less than our prior scripts did but with absolute precision. I would say it is 100% accurate, but that is because I am yet to find a timeframe and symbol where the...

Escaping of Rate from Average By Mustafa OZVER This code shows a location of a rate or price (or etc.) from the average, rated by the standard deviation. To show that, calculates the ema and standard deviation of our data then calculates the distance between ema and the current data by the standard deviation. In summary, we can say that this value is the current...

This is a Moving Average based indicator that is inspired by the MACD indicator. The indicator is intended to indicate trend reversals, and works best in hourly charts (1h-2h-3h-4h). The Seri Indicator is easy to interpret, which was one of the design goals. If the Fast Moving Average (Green Line) crosses ABOVE the Slow Moving Average (Red Line), it indicates a...

Firstly I'd like to state that this script's ATR buy/sell source is from the public script library here: Additionally with the buy/sell signals from the original script, two more buy/sell conditions were added to give more entries/scaling in or out options. On top of that, two SMA lines were added, a 1 day moving average and a 5 day moving average. This script...

This strategy trial is let you to giving sell and buy orders with ATR (average true range) and an coefficent for them. it is my first strategy work, needs to be upgraded. USE IT WITH YOUR OWN RISK. IT IS NOT EVEN GUARANTEED TO WORK.

This indicator is elaborated following the 3 window strategy described by Elder. The fast, slow averages and MACD histogram are taken from a time frame 5 times higher than the active time frame and indicate bullish / bearish trends as well as divergences (bottom) of the hostogram with the price.

![[GJ]IFRSI QCOM: [GJ]IFRSI](https://s3.tradingview.com/i/IonBACU2_mid.png)

![Jaws Mean Reversion [Strategy] NQ1!: Jaws Mean Reversion [Strategy]](https://s3.tradingview.com/r/RZ1GZGP3_mid.png)

![Simple way to BEAT the market [STRATEGY] SPY: Simple way to BEAT the market [STRATEGY]](https://s3.tradingview.com/v/vrFq8cGn_mid.png)