PROTECTED SOURCE SCRIPT

VWAP and EMA Crossover

VWAP & EMA-21 Crossover Indicator

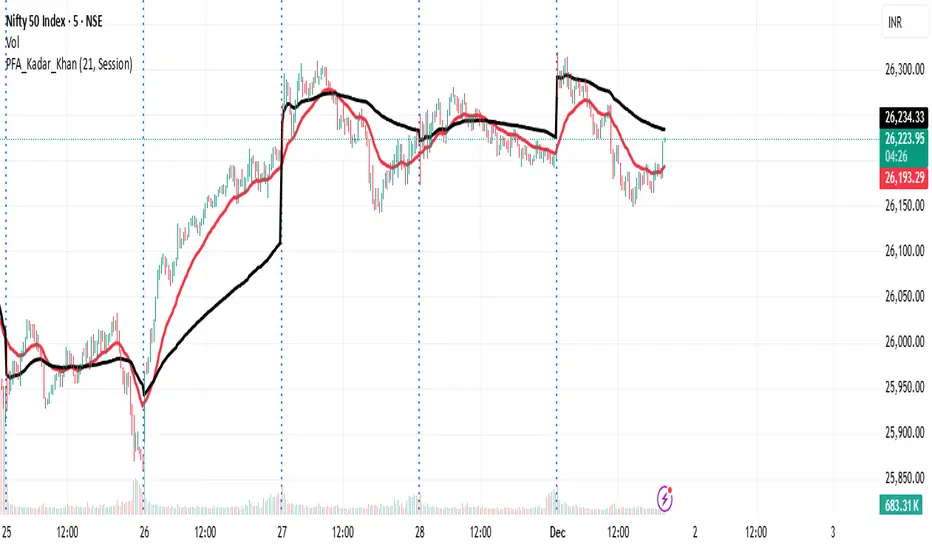

The VWAP & EMA-21 Crossover Indicator is a momentum-based trend tool that combines the institutional strength of VWAP with the responsiveness of the 21-period Exponential Moving Average. It is designed for intraday traders who rely on clean and high-probability trend confirmation.

Key Features

How Signals Work

Best Use-Cases

Why this Indicator Works

VWAP identifies where institutional traders see fair value, while EMA-21 captures short-term trend direction. When both align, the indicator highlights clean, high-probability trading opportunities and filters out low-quality setups.

Conclusion

The VWAP & EMA-21 Crossover Indicator is ideal for traders seeking a simple yet powerful signal system that blends institutional volume logic with fast trend confirmation. Perfect for day traders, scalpers, and momentum-based strategies.

The VWAP & EMA-21 Crossover Indicator is a momentum-based trend tool that combines the institutional strength of VWAP with the responsiveness of the 21-period Exponential Moving Average. It is designed for intraday traders who rely on clean and high-probability trend confirmation.

Key Features

- Plots real-time VWAP as the institutional fair-value benchmark

- Plots EMA-21 for fast trend detection

- Generates Buy & Sell signals based on VWAP and EMA-21 alignment

- Alerts for bullish and bearish crossovers

- Suitable for stocks, indices, crypto, forex, and futures

How Signals Work

- Buy Signal: Triggered when price moves above VWAP and crosses above EMA-21, indicating bullish momentum.

- Sell Signal: Triggered when price moves below VWAP and crosses below EMA-21, confirming bearish momentum.

Best Use-Cases

- Scalping and intraday trading (1m–30m charts)

- Trend continuation and breakout confirmation

- Filtering trades using VWAP’s institutional bias

- Spotting early momentum shifts with EMA-21

Why this Indicator Works

VWAP identifies where institutional traders see fair value, while EMA-21 captures short-term trend direction. When both align, the indicator highlights clean, high-probability trading opportunities and filters out low-quality setups.

Conclusion

The VWAP & EMA-21 Crossover Indicator is ideal for traders seeking a simple yet powerful signal system that blends institutional volume logic with fast trend confirmation. Perfect for day traders, scalpers, and momentum-based strategies.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.