PROTECTED SOURCE SCRIPT

Consolidation and Breakout Strategy

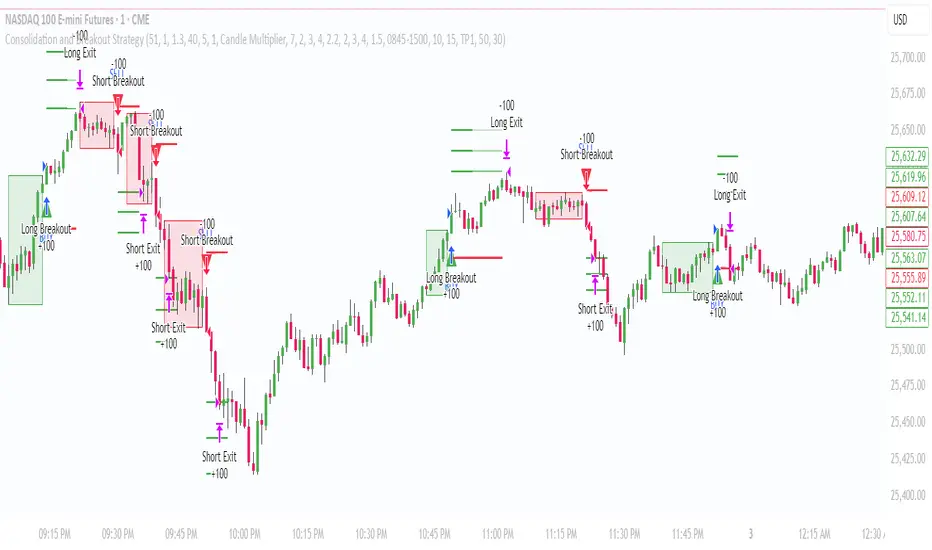

Consolidation and Breakout Strategy

This strategy is designed to detect tight consolidation zones followed by a strong breakout, allowing traders to capture explosive moves with high precision.

It works on every instrument (indices, stocks, crypto, futures, FX) and on every timeframe, as the consolidation logic is fully dynamic and adapts automatically based on volatility.

How It Works

The strategy finds periods of low volatility using a candle-body volatility filter.

When candles remain small for several bars, the script marks a consolidation box.

A valid breakout occurs only when:

The breakout candle is significantly larger (volatility expansion), and

Price closes outside the consolidation range with strong momentum.

A position is opened immediately on the breakout (on bar close).

Predefined TP/SL levels, with optional partial exits, manage the trade.

Default Performance (NQ 1-Minute Example)

With default parameters, using NASDAQ Futures (NQ) on the 1-minute chart, the strategy historically shows:

Win Rate: ~62.75%

Profit Factor: ~1.70

These numbers vary by provider and data source, but they highlight how well this structure performs in high-volatility markets.

Fully Customizable

Every key parameter is adjustable:

Consolidation detection sensitivity

Breakout strength threshold

TP/SL multipliers or percentages

Session filters

Partial exit logic

Visuals (boxes, colors, signals)

You can fine-tune the settings for your preferred instrument and timeframe.

Recommended Markets

This breakout structure works especially well on:

Index futures (NQ, ES, YM, DAX, FTSE)

Major crypto pairs

High-volume stocks

FX pairs with clean intraday movement

This strategy is designed to detect tight consolidation zones followed by a strong breakout, allowing traders to capture explosive moves with high precision.

It works on every instrument (indices, stocks, crypto, futures, FX) and on every timeframe, as the consolidation logic is fully dynamic and adapts automatically based on volatility.

How It Works

The strategy finds periods of low volatility using a candle-body volatility filter.

When candles remain small for several bars, the script marks a consolidation box.

A valid breakout occurs only when:

The breakout candle is significantly larger (volatility expansion), and

Price closes outside the consolidation range with strong momentum.

A position is opened immediately on the breakout (on bar close).

Predefined TP/SL levels, with optional partial exits, manage the trade.

Default Performance (NQ 1-Minute Example)

With default parameters, using NASDAQ Futures (NQ) on the 1-minute chart, the strategy historically shows:

Win Rate: ~62.75%

Profit Factor: ~1.70

These numbers vary by provider and data source, but they highlight how well this structure performs in high-volatility markets.

Fully Customizable

Every key parameter is adjustable:

Consolidation detection sensitivity

Breakout strength threshold

TP/SL multipliers or percentages

Session filters

Partial exit logic

Visuals (boxes, colors, signals)

You can fine-tune the settings for your preferred instrument and timeframe.

Recommended Markets

This breakout structure works especially well on:

Index futures (NQ, ES, YM, DAX, FTSE)

Major crypto pairs

High-volume stocks

FX pairs with clean intraday movement

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.